i want to know the answer of those questions please

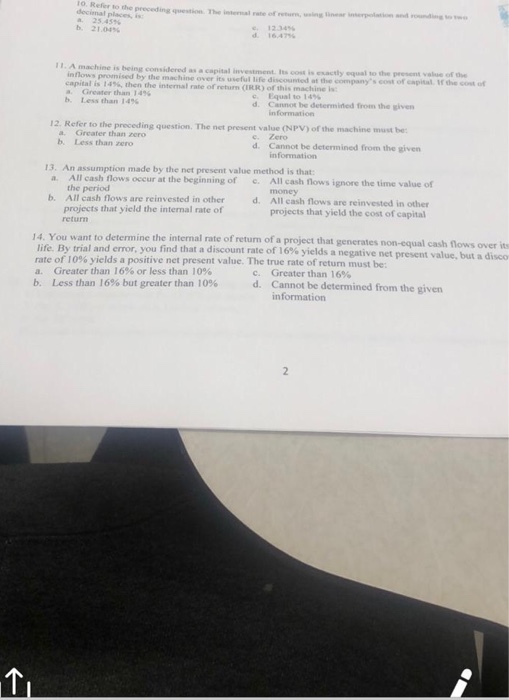

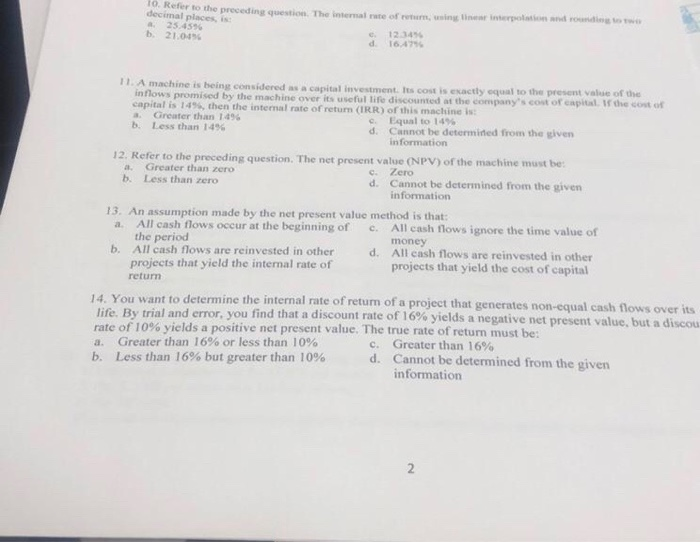

Refer to the preceding question. The internal rate of retum, singles interation and ratings 1234 2100 11. A machine is being considered as a capital investment. It cost is exactly equal to the present of the inflows promised by the machine over its useful life discounted at the company's cost of capital the cost of capital is 1496, then the internal rate of return (IRR) of this machines Greater than 1496 Equal to 145 Less than 14% d Cannot be determined from the given information 12. Refer to the preceding question. The net present value (NPV) of the machine must be Greater than zero Zero Less than zero d. Cannot be determined from the given information 13. An assumption made by the net present value method is that: All cash flows occur at the beginning of c. All cash rows ignore the time value of the period money b All cash flows are reinvested in other d. All cash flows are reinvested in other projects that yield the internal rate of projects that yield the cost of capital retum 14. You want to determine the internal rate of retum of a project that generates non-equal cash flows over its life. By trial and error, you find that a discount rate of 16% yields a negative net present value, but a disco rate of 10% yields a positive net present value. The true rate of retum must be: Greater than 16% or less than 10% c. Greater than 16% b. Less than 16% but greater than 10% d. Cannot be determined from the given information 2 Refer to the preceding question. The internal rate of return, sing tar interpolation and round decimal places 25.4594 123456 b21.0496 16.4796 d 11. A machine is being considered as a capital investment. Its cost is exactly equal to the present value of the inflows promised by the machine over its useful life discounted at the company's cost of capital the cost of capital is 1496, then the internal rate of return (IRR) of this machine is Greater than 1696 Equal to 14% Less than 1496 & cannot be determined from the given Information 12. Refer to the preceding question. The net present value (NPV) of the machine must be a Greater than zero b. Less than zero d. Cannot be determined from the given information 13. An assumption made by the net present value method is that: All cash flows occur at the beginning of c. All cash flows ignore the time value of the period money b. All cash flows are reinvested in other d. All cash flows are reinvested in other projects that yield the internal rate of projects that yield the cost of capital retum 14. You want to determine the internal rate of retum of a project that generates non-equal cash flows over its life. By trial and error, you find that a discount rate of 16% yields a negative net present value, but a discou rate of 10% yields a positive net present value. The true rate of return must be: a Greater than 16% or less than 10% c. Greater than 16% b. Less than 16% but greater than 10% d. Cannot be determined from the given information 2