i want you to please find the following:

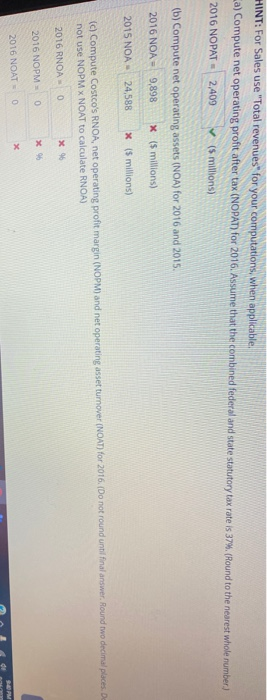

b) 2016 NOA , 2015 NOA

c) 2016 RNOA, 2016 NOPM, 2016 NOAT

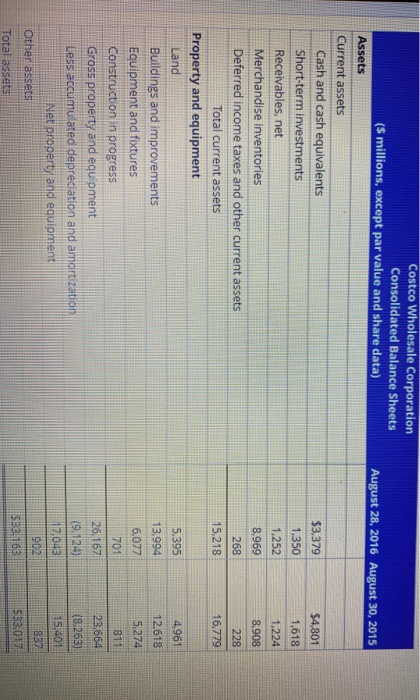

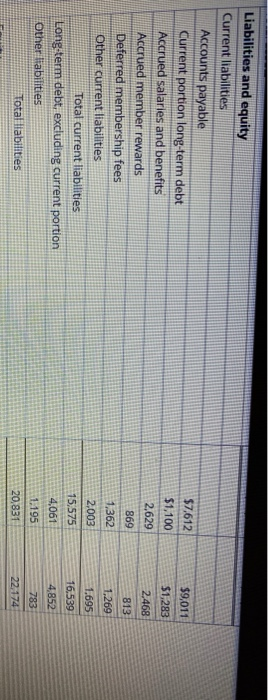

Costco Wholesale Corporation Consolidated Balance Sheets ($ millions, except par value and share data) August 28, 2016 August 30, 2015 Assets $3,379 $4,801 1,350 1,618 1,224 1.252 8,969 8.908 268 228 15,218 16,779 Current assets Cash and cash equivalents Short-term investments Receivables, net Merchandise inventories Deferred income taxes and other current assets Total current assets Property and equipment Land Buildings and improvements Equipment and fixtures Construction in progress Gross property and equipment Less accumulated depreciation and amortization Net property and equipment Other assets 4,961 5,395 13,994 12.618 6,077 5,274 701 811 26, 167 23,664 (8:263) (9.124) 17,043 902 15,401 837 $33.168 SB3.017 Total assets $7.612 $1,100 $9,011 $1,283 2,629 2,468 Liabilities and equity Current liabilities Accounts payable Current portion long-term debt Accrued salaries and benefits Accrued member rewards Deferred membership fees Other current liabilities Total current liabilities Long-term debt, excluding current portion Other liabilities Total liabilities 869 813 1,269 1,362 2,003 1.695 15,575 4,061 1,195 20,831 16,539 4,852 783 22,174 HINT: For Sales use "Total revenues for your computations, when applicable. a) Compute net operating profit after tax (NOPAT) for 2016. Assume that the combined federal and state statutory tax rate is 37%. (Round to the nearest whole number) 2016 NOPAT 2,409 (5 millions) (b) Compute net operating assets (NOA) for 2016 and 2015. 2016 NOA = 9,898 X (5 millions) 2015 NOA 24,588 X (5 millions) (c) Compute Costco's RNOA, net operating profit margin (NOPM) and net operating asset turnover (NOAT) for 2016. (Do not round until final answer. Round two decimal places. De not use NOPMX NOAT to calculate RNOA) 2016 RNOA O X 2016 NOPMO x06 x 2016 NOAT = 0 Costco Wholesale Corporation Consolidated Balance Sheets ($ millions, except par value and share data) August 28, 2016 August 30, 2015 Assets $3,379 $4,801 1,350 1,618 1,224 1.252 8,969 8.908 268 228 15,218 16.779 Current assets Cash and cash equivalents Short-term investments Receivables, net Merchandise inventories Deferred income taxes and other current assets Total current assets Property and equipment Land Buildings and improvements Equipment and fixtures Construction in progress Gross property and equipment Less accumulated depreciation and amortization Net property and equipment Other assets 4,961 5,395 13.994 12.618 6,077 5,274 701 811 26, 167 23,664 (8:263) (9.124) 17,043 902 15,401 837 $33.163 503.017 Total assets $7,612 $9,011 $1,283 Liabilities and equity Current liabilities Accounts payable Current portion long-term debt Accrued salaries and benefits Accrued member rewards Deferred membership fees Other current liabilities Total current liabilities Long-term debt, excluding current portion Other liabilities Total liabilities $1,100 2,629 869 2,468 813 1,269 1,362 1.695 2,003 15,575 4,061 1.195 20,831 16,539 4,852 783 22. 174 HINT: For Sales use "Total revenues for your computations, when applicable. a) Compute net operating profit after tax (NOPAT) for 2016. Assume that the combined federal and state statutory tax rate is 37%. (Round to the nearest whole number) 2016 NOPAT 2,409 (5 millions) (b) Compute net operating assets (NOA) for 2016 and 2015 2016 NOA - 9,898 X (5 millions) 2015 NOA 24,588 X (5 millions) (c) Compute Costco's RNOA, net operating profit margin (NOPM) and net operating asset turnover (NOAT) for 2016. (Do not round until final answer. Round two decimal places. De not use NOPMX NOAT to calculate RNCA) 2016 RNOA 0 X 2016 NOPMO x96 2016 NOAT = 0 Costco Wholesale Corporation Consolidated Balance Sheets ($ millions, except par value and share data) August 28, 2016 August 30, 2015 Assets $3,379 $4,801 1,350 1,618 1,224 1.252 8,969 8.908 268 228 15,218 16,779 Current assets Cash and cash equivalents Short-term investments Receivables, net Merchandise inventories Deferred income taxes and other current assets Total current assets Property and equipment Land Buildings and improvements Equipment and fixtures Construction in progress Gross property and equipment Less accumulated depreciation and amortization Net property and equipment Other assets 4,961 5,395 13,994 12.618 6,077 5,274 701 811 26, 167 23,664 (8:263) (9.124) 17,043 902 15,401 837 $33.168 SB3.017 Total assets $7.612 $1,100 $9,011 $1,283 2,629 2,468 Liabilities and equity Current liabilities Accounts payable Current portion long-term debt Accrued salaries and benefits Accrued member rewards Deferred membership fees Other current liabilities Total current liabilities Long-term debt, excluding current portion Other liabilities Total liabilities 869 813 1,269 1,362 2,003 1.695 15,575 4,061 1,195 20,831 16,539 4,852 783 22,174 HINT: For Sales use "Total revenues for your computations, when applicable. a) Compute net operating profit after tax (NOPAT) for 2016. Assume that the combined federal and state statutory tax rate is 37%. (Round to the nearest whole number) 2016 NOPAT 2,409 (5 millions) (b) Compute net operating assets (NOA) for 2016 and 2015. 2016 NOA = 9,898 X (5 millions) 2015 NOA 24,588 X (5 millions) (c) Compute Costco's RNOA, net operating profit margin (NOPM) and net operating asset turnover (NOAT) for 2016. (Do not round until final answer. Round two decimal places. De not use NOPMX NOAT to calculate RNOA) 2016 RNOA O X 2016 NOPMO x06 x 2016 NOAT = 0 Costco Wholesale Corporation Consolidated Balance Sheets ($ millions, except par value and share data) August 28, 2016 August 30, 2015 Assets $3,379 $4,801 1,350 1,618 1,224 1.252 8,969 8.908 268 228 15,218 16.779 Current assets Cash and cash equivalents Short-term investments Receivables, net Merchandise inventories Deferred income taxes and other current assets Total current assets Property and equipment Land Buildings and improvements Equipment and fixtures Construction in progress Gross property and equipment Less accumulated depreciation and amortization Net property and equipment Other assets 4,961 5,395 13.994 12.618 6,077 5,274 701 811 26, 167 23,664 (8:263) (9.124) 17,043 902 15,401 837 $33.163 503.017 Total assets $7,612 $9,011 $1,283 Liabilities and equity Current liabilities Accounts payable Current portion long-term debt Accrued salaries and benefits Accrued member rewards Deferred membership fees Other current liabilities Total current liabilities Long-term debt, excluding current portion Other liabilities Total liabilities $1,100 2,629 869 2,468 813 1,269 1,362 1.695 2,003 15,575 4,061 1.195 20,831 16,539 4,852 783 22. 174 HINT: For Sales use "Total revenues for your computations, when applicable. a) Compute net operating profit after tax (NOPAT) for 2016. Assume that the combined federal and state statutory tax rate is 37%. (Round to the nearest whole number) 2016 NOPAT 2,409 (5 millions) (b) Compute net operating assets (NOA) for 2016 and 2015 2016 NOA - 9,898 X (5 millions) 2015 NOA 24,588 X (5 millions) (c) Compute Costco's RNOA, net operating profit margin (NOPM) and net operating asset turnover (NOAT) for 2016. (Do not round until final answer. Round two decimal places. De not use NOPMX NOAT to calculate RNCA) 2016 RNOA 0 X 2016 NOPMO x96 2016 NOAT = 0