Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I wanted to know how did that Asset investment answers appear as $200,000. $500,000. $200,000..... can you make clear the format? Company A is a

I wanted to know how did that Asset investment answers appear as $200,000. $500,000. $200,000..... can you make clear the format?

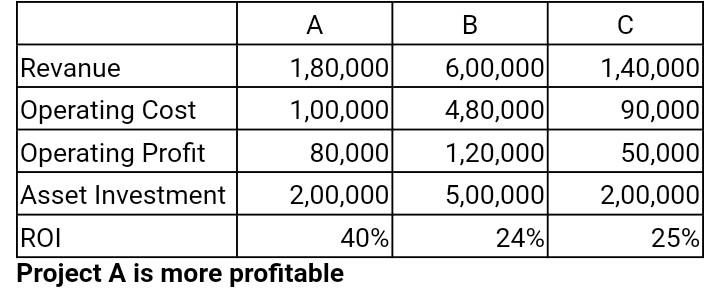

Company A is a divisionalized organization, where all its division managers are responsible for making all division decisions and the manager is responsible for those decisions made. Division X current return of investment (ROI) is 28%. Division X is presented with the following investment opportunities: Projects A B C Revenue $180,000$600,000$140,000 Operating costs $100,000$480,000$90,000 Asset Investment $200,000$500,000$200,000 Company A minimum required rate of return is 18% which is equal to the Company A average cost of capital. 8 . If you were the division manager and you were evaluated based on ROI, which projects would you accept? If you were the corporate finance director which projects would you accept? Project A is more protitableStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started