I was confused by the ratio part, could you be specific in steps? Thank you very much

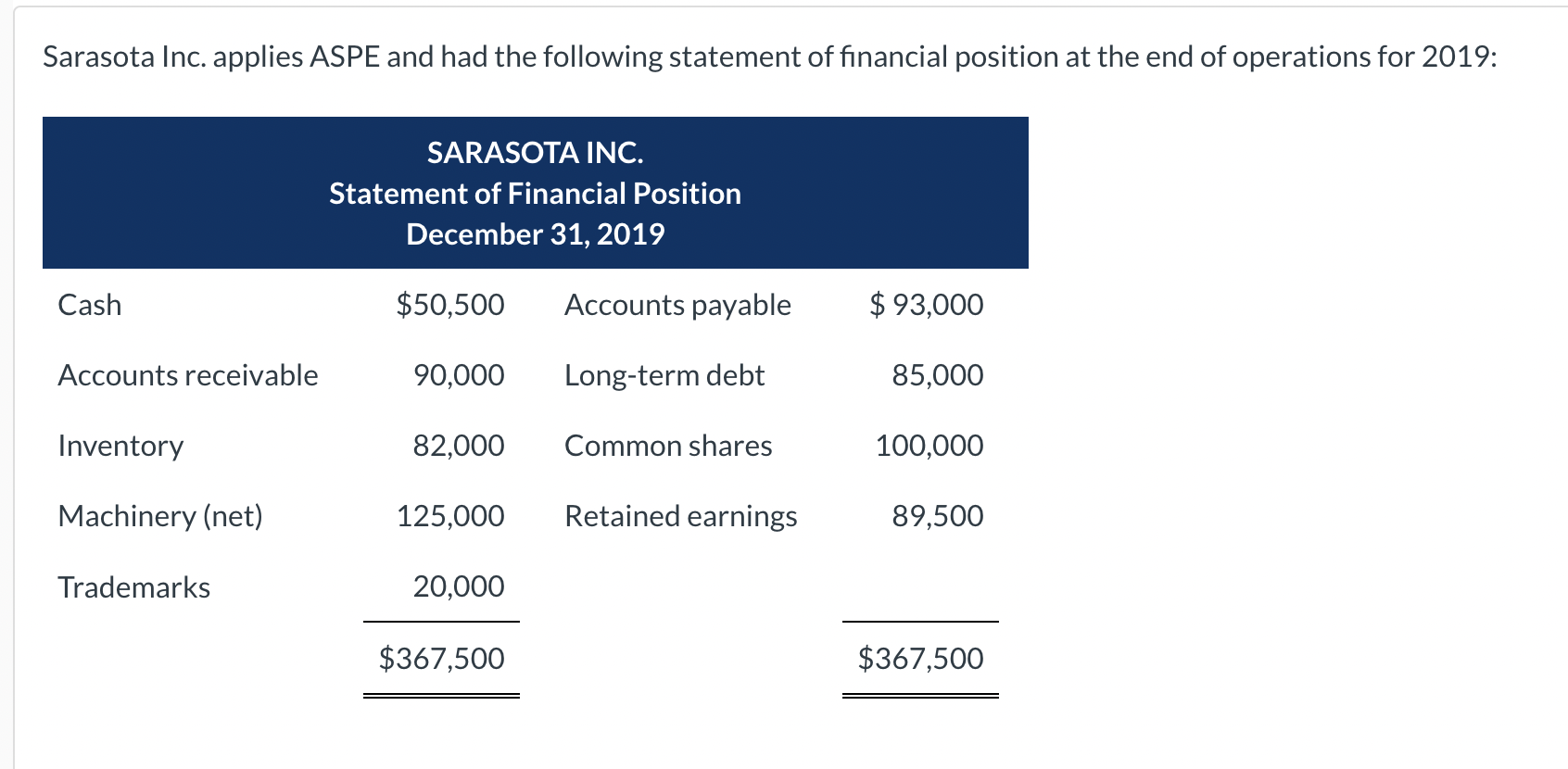

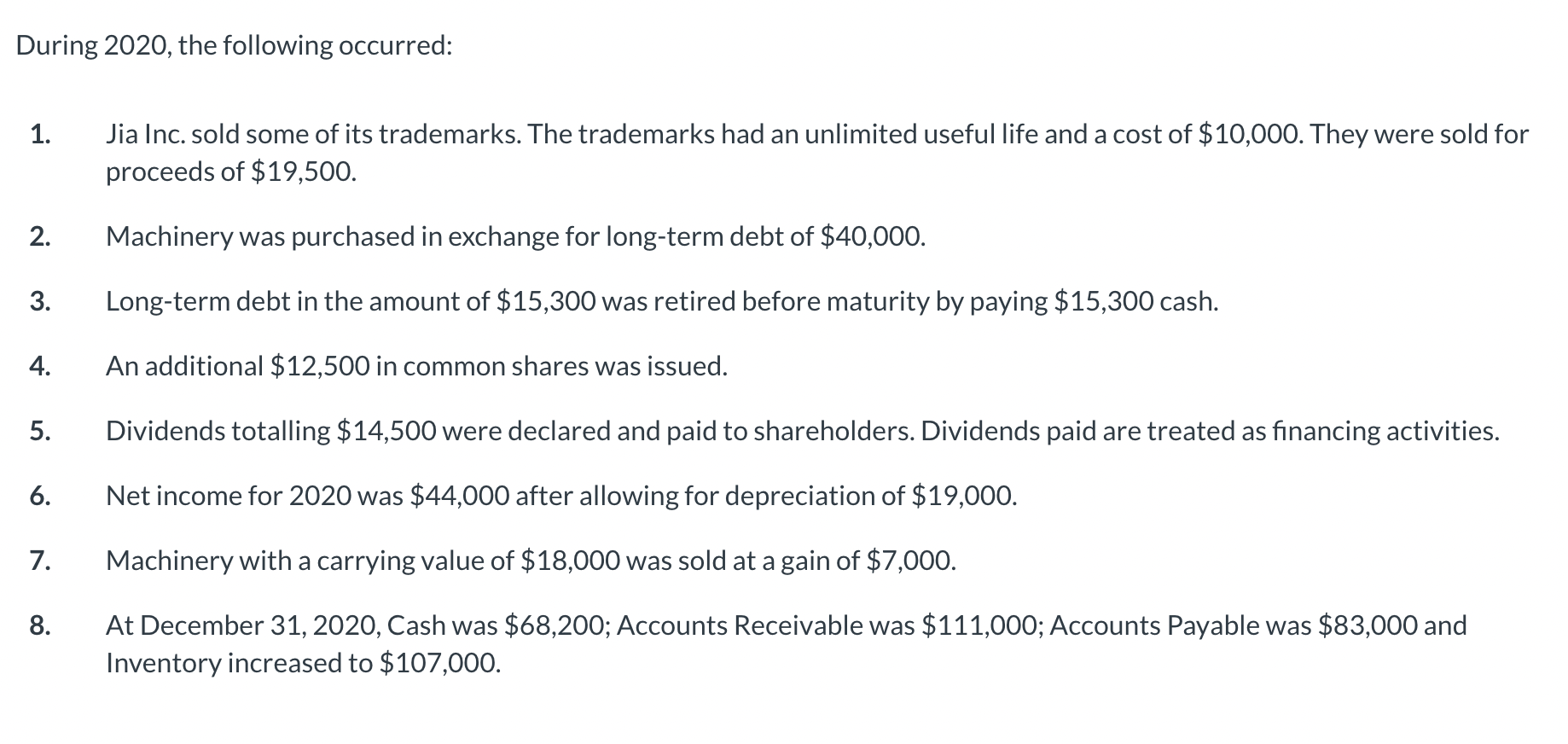

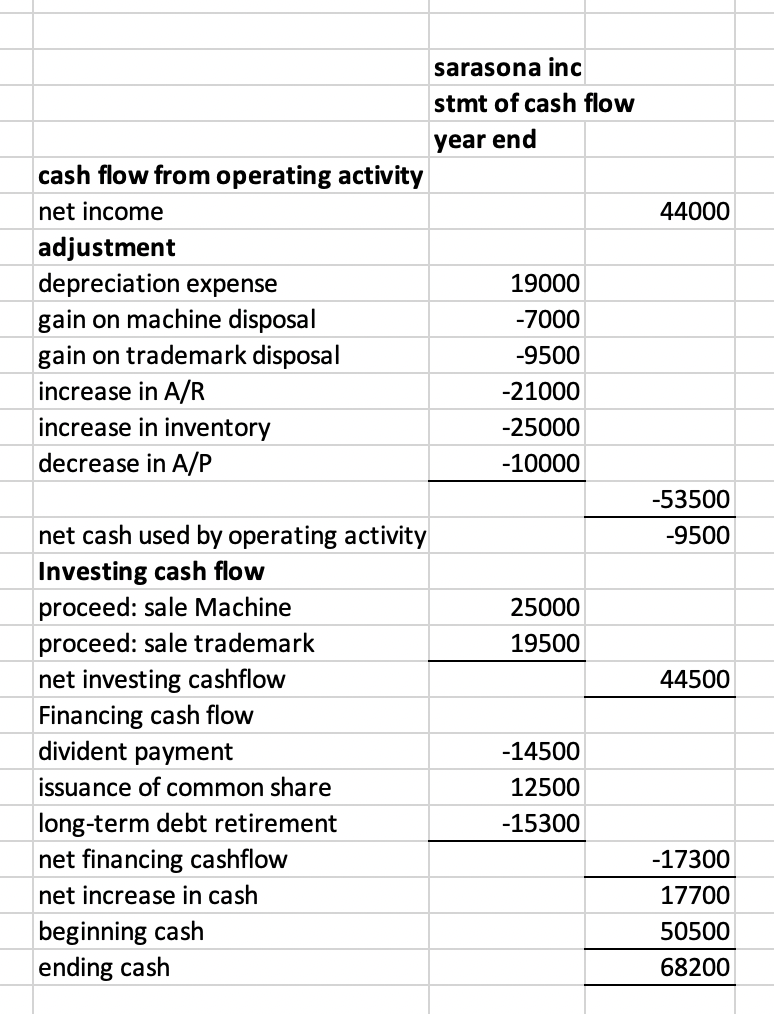

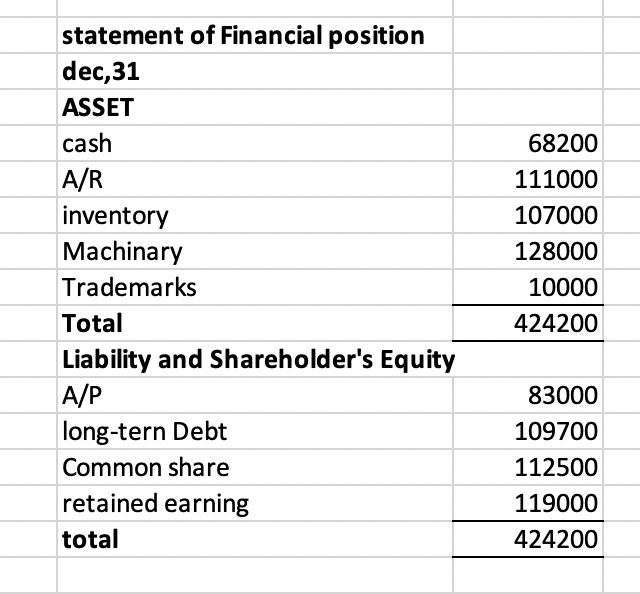

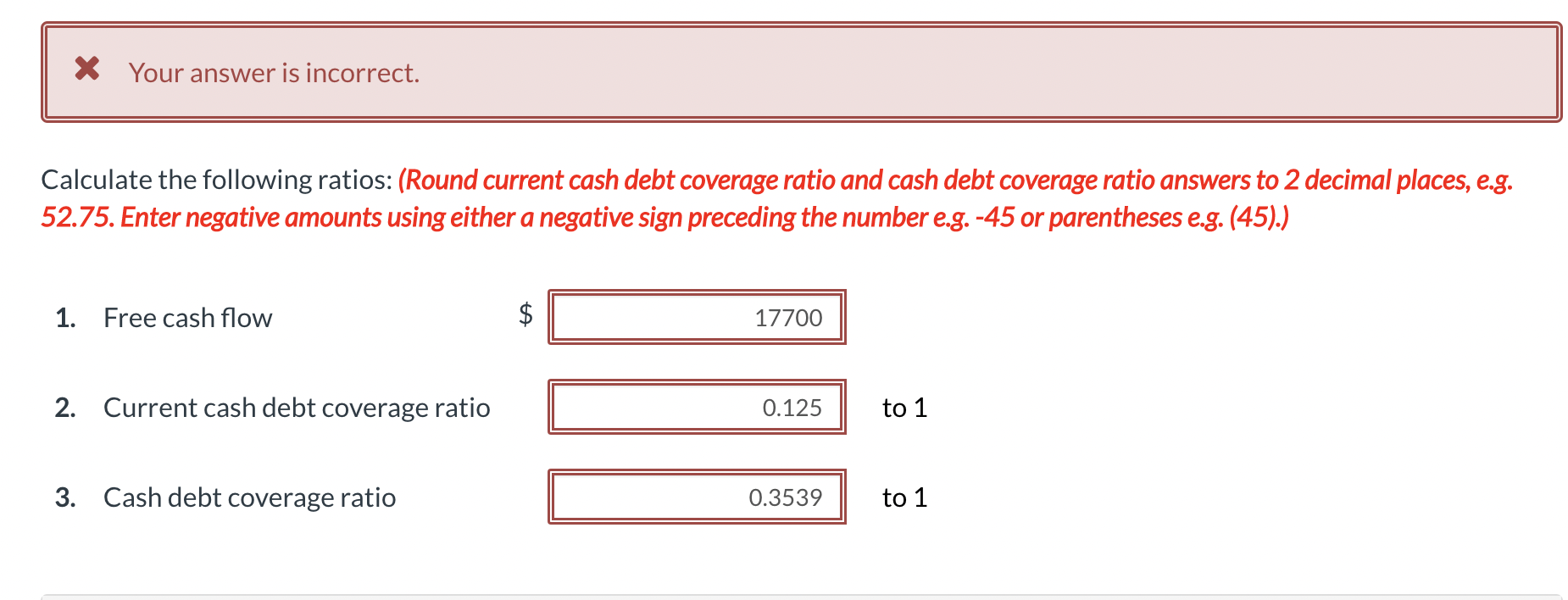

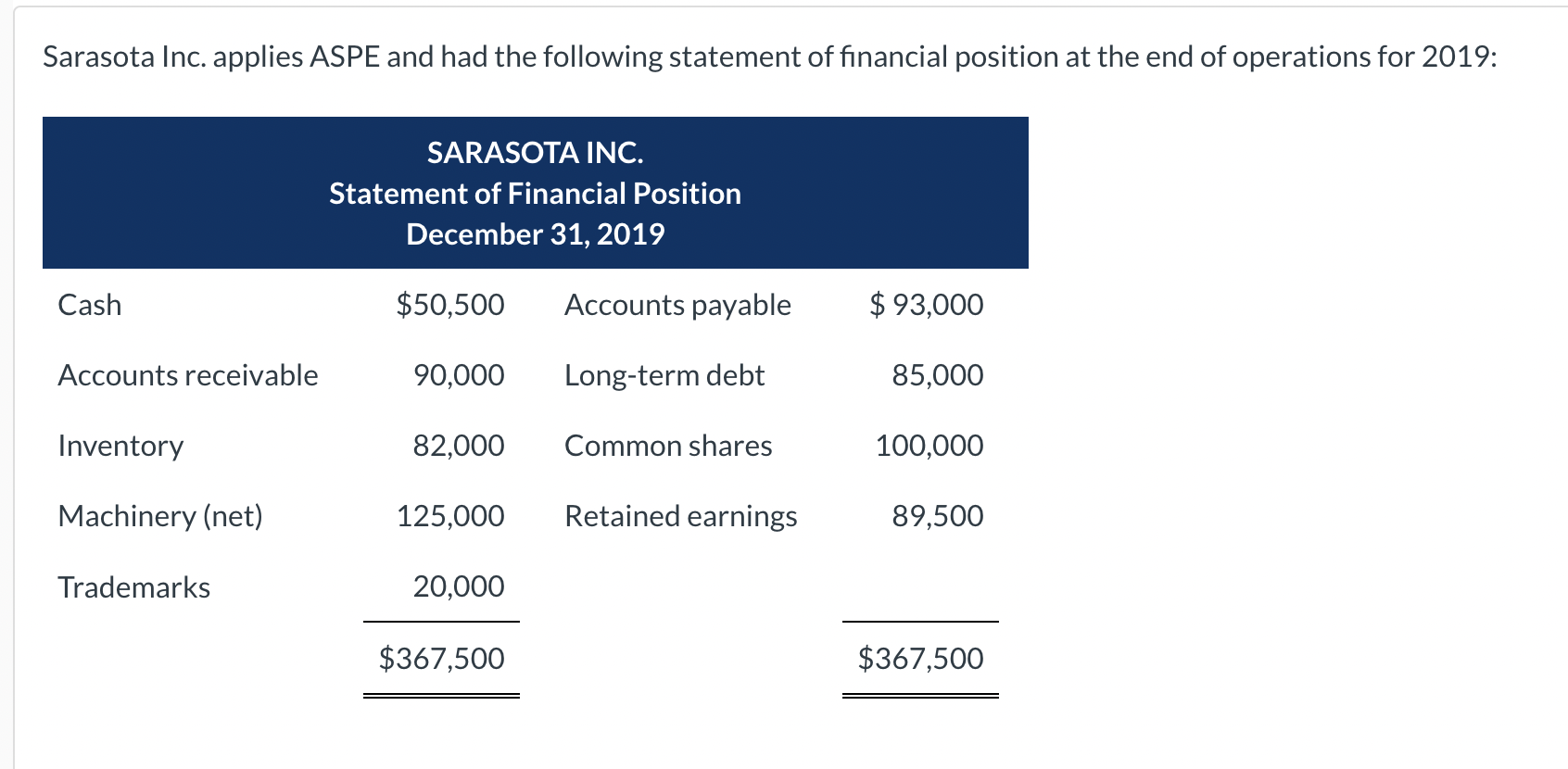

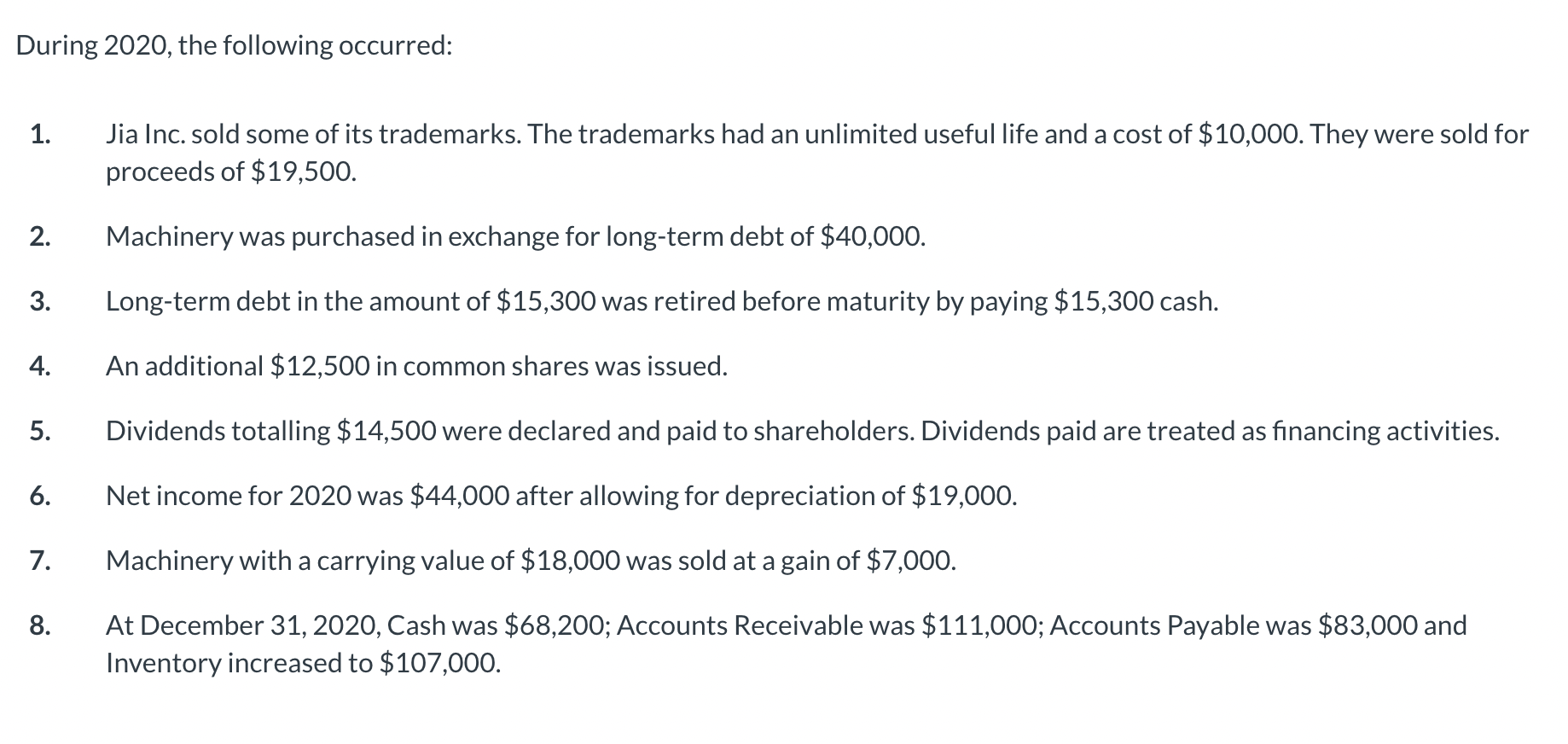

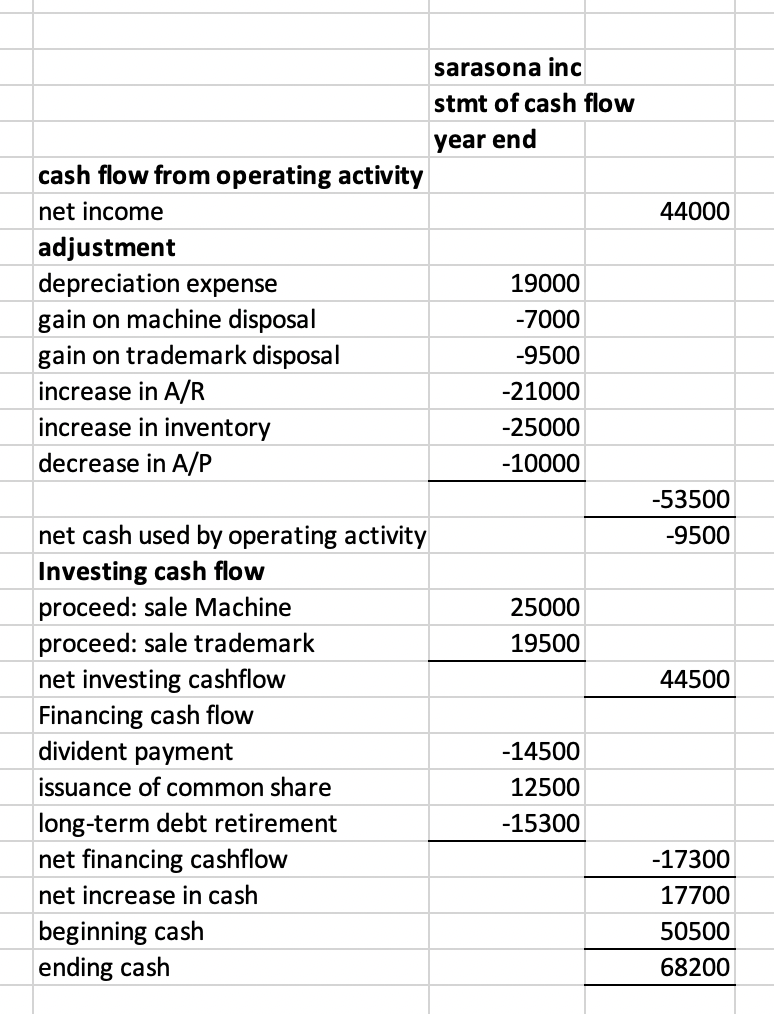

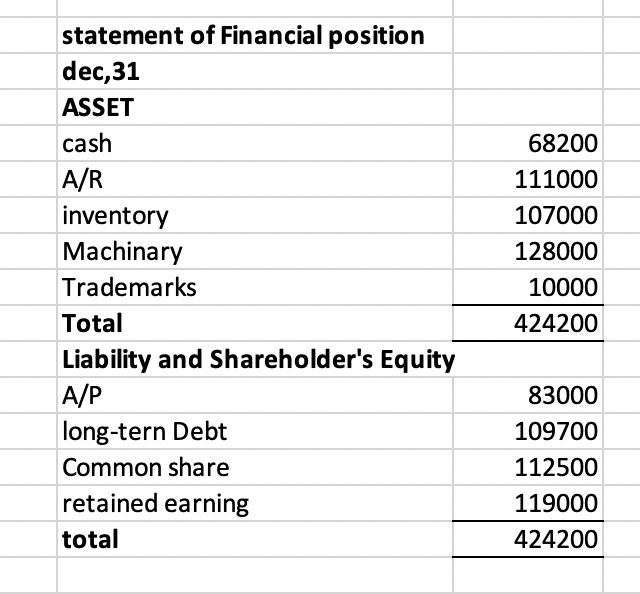

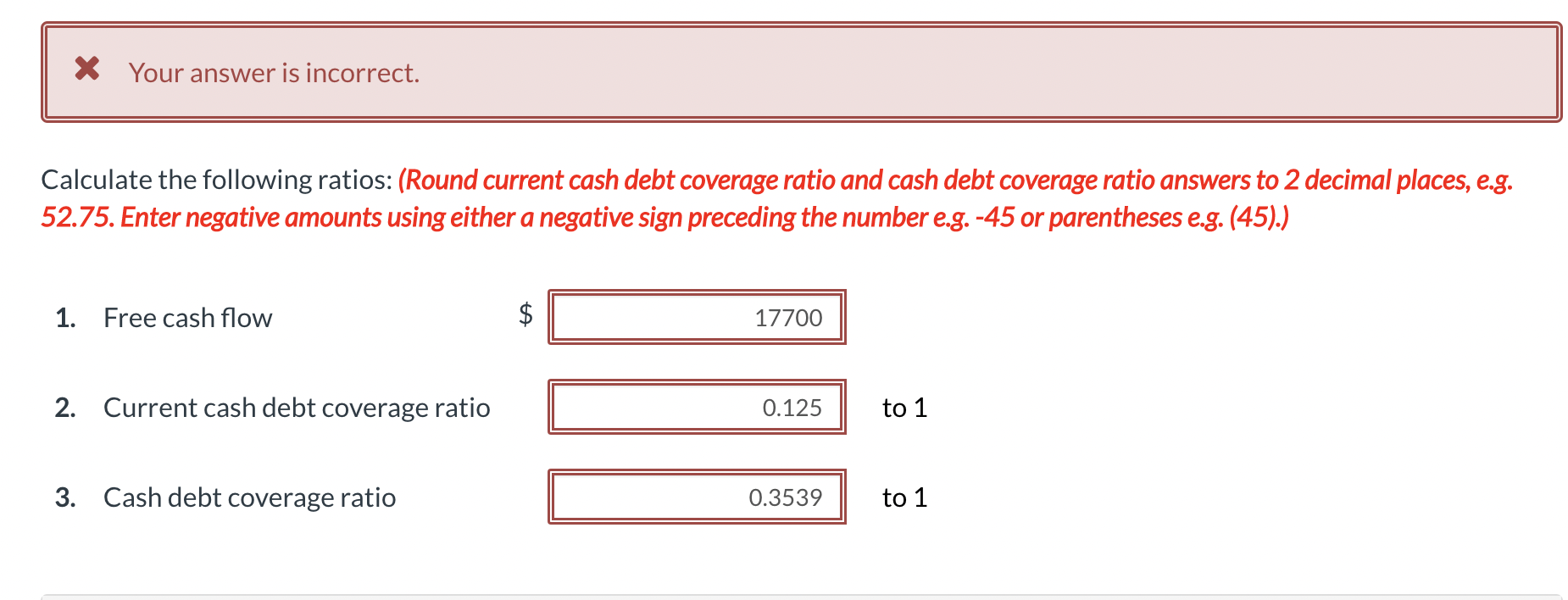

Sarasota Inc. applies ASPE and had the following statement of financial position at the end of operations for 2019: SARASOTA INC. Statement of Financial Position December 31, 2019 Cash $93,000 Accounts receivable 85,000 Inventory 100,000 Machinery (net) 89,500 Trademarks $367,500 $50,500 Accounts payable 90,000 Long-term debt 82,000 Common shares 125,000 Retained earnings 20,000 $367,500 During 2020, the following occurred: 1. Jia Inc. sold some of its trademarks. The trademarks had an unlimited useful life and a cost of $10,000. They were sold for proceeds of $19,500. 2. Machinery was purchased in exchange for long-term debt of $40,000. 3. Long-term debt in the amount of $15,300 was retired before maturity by paying $15,300 cash. 4. An additional $12,500 in common shares was issued. 5. Dividends totalling $14,500 were declared and paid to shareholders. Dividends paid are treated as financing activities. Net income for 2020 was $44,000 after allowing for depreciation of $19,000. 6. 7. Machinery with a carrying value of $18,000 was sold at a gain of $7,000. 8. At December 31, 2020, Cash was $68,200; Accounts Receivable was $111,000; Accounts Payable was $83,000 and Inventory increased to $107,000. cash flow from operating activity net income adjustment depreciation expense gain on machine disposal gain on trademark disposal increase in A/R increase in inventory decrease in A/P net cash used by operating activity Investing cash flow proceed: sale Machine proceed: sale trademark net investing cashflow Financing cash flow divident payment issuance of common share long-term debt retirement net financing cashflow net increase in cash beginning cash ending cash sarasona inc stmt of cash flow year end 19000 -7000 -9500 -21000 -25000 -10000 25000 19500 -14500 12500 -15300 44000 -53500 -9500 44500 -17300 17700 50500 68200 statement of Financial position dec, 31 ASSET cash A/R inventory Machinary Trademarks Total Liability and Shareholder's Equity A/P long-tern Debt Common share retained earning total 68200 111000 107000 128000 10000 424200 83000 109700 112500 119000 424200 X Your answer is incorrect. Calculate the following ratios: (Round current cash debt coverage ratio and cash debt coverage ratio answers to 2 decimal places, e.g. 52.75. Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) 1. Free cash flow 17700 2. Current cash debt coverage ratio 0.125 to 1 3. Cash debt coverage ratio 0.3539 to 1