Answered step by step

Verified Expert Solution

Question

1 Approved Answer

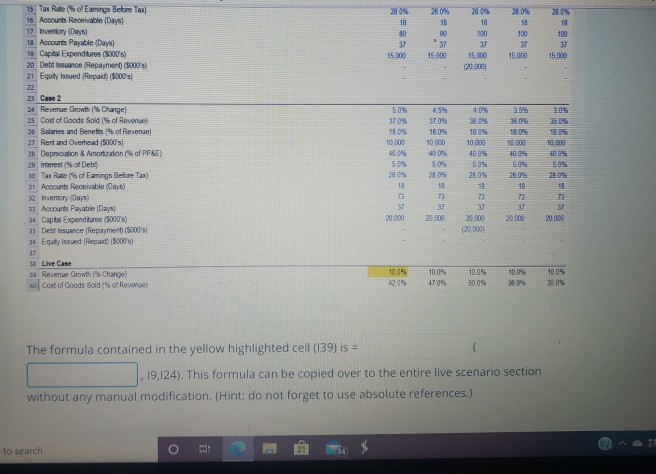

i was wondering how to get the formula how do I find the formula? 2804 18 280% 18 90 37 15 000 2804 18 100

i was wondering how to get the formula

how do I find the formula?

2804 18 280% 18 90 37 15 000 2804 18 100 280 18 100 37 15 000 280 18 100 37 15 000 37 15.000 15.000 20.000 5:05 37.09 4.54 27.0% 38.09 35.0% 10.000 10.000 15 Tax Rate (of Eamings Before Tax 16 Accounts Receivable Days) 17 Inventory Days 18 Accounts Payable (Daya) Capital Expenditures (3000's) 20 Debt Issuance (Repaymer (5000) 21 Equity Issued (Repaid (9000's 22 23 Case 2 24 Revenue Growth Changel 25 Cost of Goods Sold ($6 of Revenue 25 Salaries and Benefits of Revenue 27 Rent and Overhead S000 28 Depreciation & Amortization of PP&E) 29 Interest of Debt 10 Tax Rate(% of Eamings Before Taxi 31 Accounts Receivable (Cars) 22 Invemory Days 33 Accounts Payable (Days) 34 Capital Expenditures (5000) 35 Debt issuance Repaymer (5000 36 Equity issued Repaid 15000 37 38 Live Case 30 Revenue Growth Chano) 40 Cost of Goods Sold of Revon 30.0% 18.08 10 000 400% SON 10.800 10 000 0096 50% 28.046 18 Ta 37 20.000 18 7 37 20.000 13 28.01. 18 13 32 20.000 20.0% 18 T3 37 20.000 20.000 (20,000 10.06 100% 420 10.0% 4T0N 10.0% 500% 100% 350% The formula contained in the yellow highlighted cell (139) is = 19,124). This formula can be copied over to the entire live scenario section without any manual modification. (Hint: do not forget to use absolute references.) to search oStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started