Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i will give good rate in answering that questions. Also i will comment. 2 points RST Limited purchased some plant in January 2020 costing P

i will give good rate in answering that questions. Also i will comment.

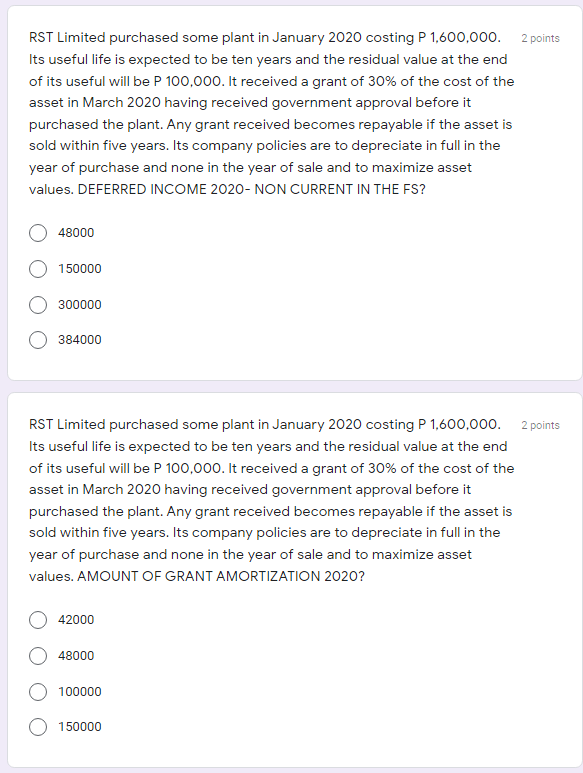

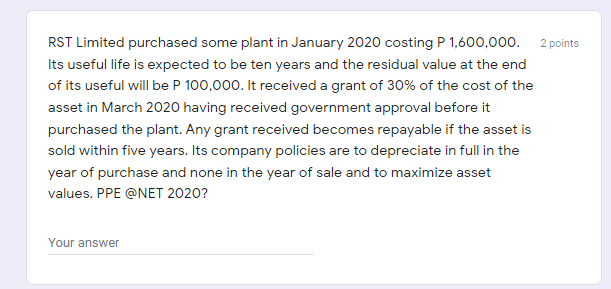

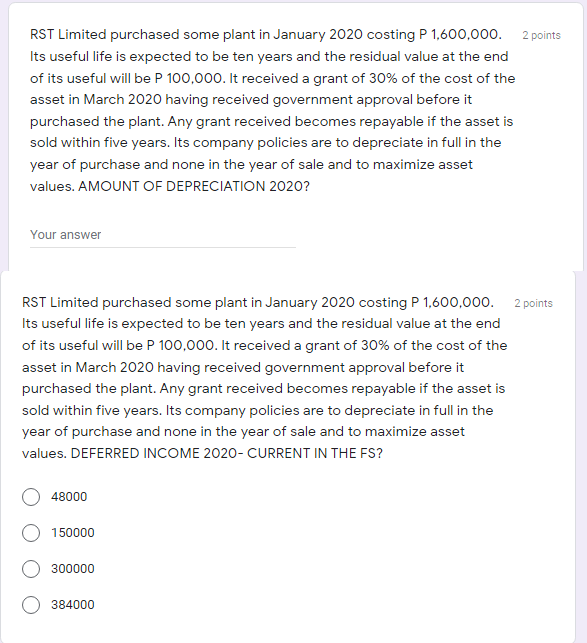

2 points RST Limited purchased some plant in January 2020 costing P 1,600,000. Its useful life is expected to be ten years and the residual value at the end of its useful will be P 100,000. It received a grant of 30% of the cost of the asset in March 2020 having received government approval before it purchased the plant. Any grant received becomes repayable if the asset is sold within five years. Its company policies are to depreciate in full in the year of purchase and none in the year of sale and to maximize asset values. DEFERRED INCOME 2020-NON CURRENT IN THE FS? 48000 150000 300000 384000 2 points RST Limited purchased some plant in January 2020 costing P 1,600,000. Its useful life is expected to be ten years and the residual value at the end of its useful will be P 100,000. It received a grant of 30% of the cost of the asset in March 2020 having received government approval before it purchased the plant. Any grant received becomes repayable if the asset is sold within five years. Its company policies are to depreciate in full in the year of purchase and none in the year of sale and to maximize asset values. AMOUNT OF GRANT AMORTIZATION 2020? 42000 48000 100000 150000 2 points RST Limited purchased some plant in January 2020 costing P 1,600,000. Its useful life is expected to be ten years and the residual value at the end of its useful will be P 100,000. It received a grant of 30% of the cost of the asset in March 2020 having received government approval before it purchased the plant. Any grant received becomes repayable if the asset is sold within five years. Its company policies are to depreciate in full in the year of purchase and none in the year of sale and to maximize asset values. PPE @NET 2020? Your answer RST Limited purchased some plant in January 2020 costing P 1,600,000. 2 points Its useful life is expected to be ten years and the residual value at the end of its useful will be P 100,000. It received a grant of 30% of the cost of the asset in March 2020 having received government approval before it purchased the plant. Any grant received becomes repayable if the asset is sold within five years. Its company policies are to depreciate in full in the year of purchase and none in the year of sale and to maximize asset values. AMOUNT OF DEPRECIATION 2020? Your answer RST Limited purchased some plant in January 2020 costing P 1,600,000. 2 points Its useful life is expected to be ten years and the residual value at the end of its useful will be P 100,000. It received a grant of 30% of the cost of the asset in March 2020 having received government approval before it purchased the plant. Any grant received becomes repayable if the asset is sold within five years. Its company policies are to depreciate in full in the year of purchase and none in the year of sale and to maximize asset values. DEFERRED INCOME 2020-CURRENT IN THE FS? 48000 150000 300000 384000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started