Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I will give thumbs up for correct answers ASAP! Thank you!! Rantzow-Lear Company buys and sells debt securities expecting to earn profits on short-term differences

I will give thumbs up for correct answers ASAP! Thank you!!

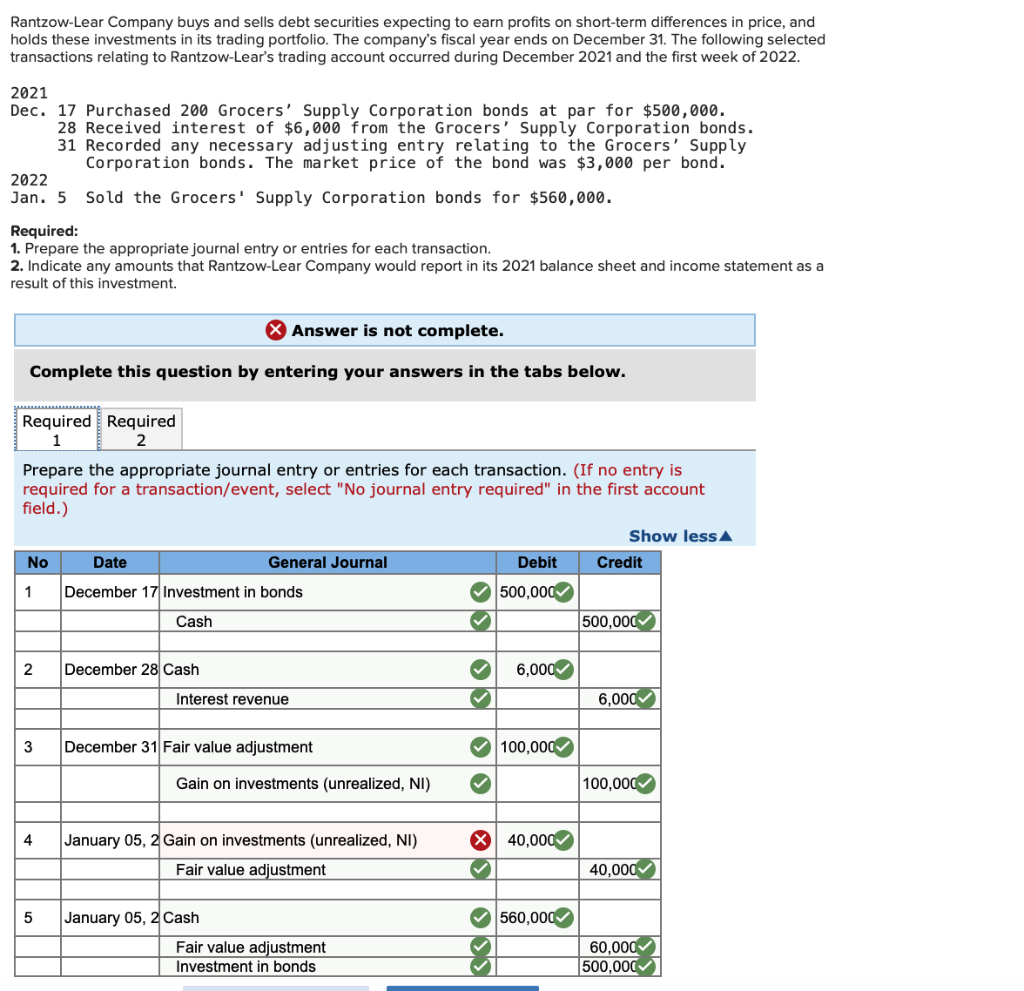

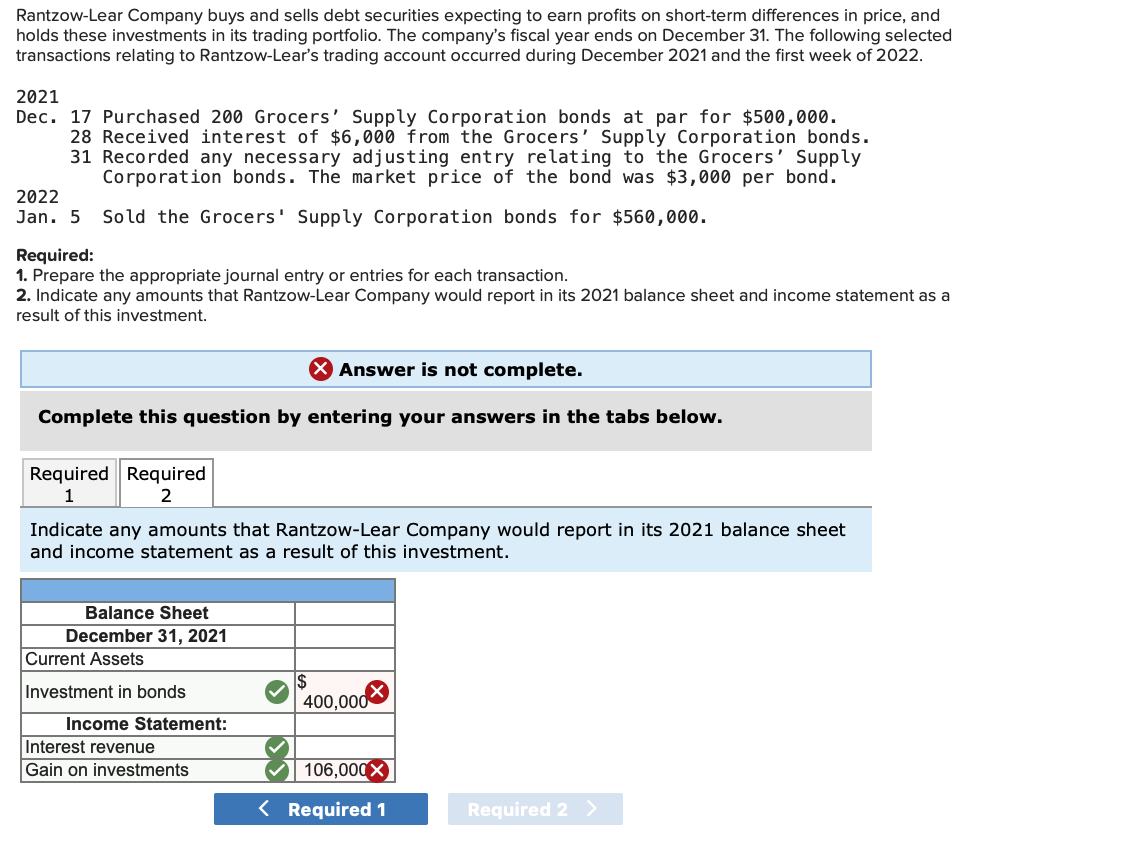

Rantzow-Lear Company buys and sells debt securities expecting to earn profits on short-term differences in price, and holds these investments in its trading portfolio. The company's fiscal year ends on December 31. The following selected transactions relating to Rantzow-Lear's trading account occurred during December 2021 and the first week of 2022. 2021 Dec. 17 Purchased 200 Grocers' Supply Corporation bonds at par for $500,000. 28 Received interest of $6,000 from the Grocers' Supply Corporation bonds. 31 Recorded any necessary adjusting entry relating to the Grocers' Supply Corporation bonds. The market price of the bond was $3,000 per bond. 2022 Jan. 5 Sold the Grocers' Supply Corporation bonds for $560,000. Required: 1. Prepare the appropriate journal entry or entries for each transaction. 2. Indicate any amounts that Rantzow-Lear Company would report in its 2021 balance sheet and income statement as a result of this investment. X Answer is not complete. Complete this question by entering your answers in the tabs below. Required Required 2 Prepare the appropriate journal entry or entries for each transaction. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Show lessA No Date General Journal Debit Credit 1 December 17 Investment in bonds O 500,000 Cash 500,000 December 28 Cash 6,000 Interest revenue 6,000 3 December 31 Fair value adjustment O 100,000 Gain on investments (unrealized, NI) 100,000 4 January 05, 2 Gain on investments (unrealized, NI) O 40,000 Fair value adjustment 40,000 January 05, 2 Cash O 560,000 Fair value adjustment Investment in bonds 60,000 500,000

Step by Step Solution

★★★★★

3.53 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

RantzowLear Company Requirement 1 Requirement 2 Journal Enteries Ba...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started