Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i will rate every correct answer given immediately A company sold merchandise with a cost of $500 for $3,000 on account. The seller uses the

i will rate every correct answer given immediately

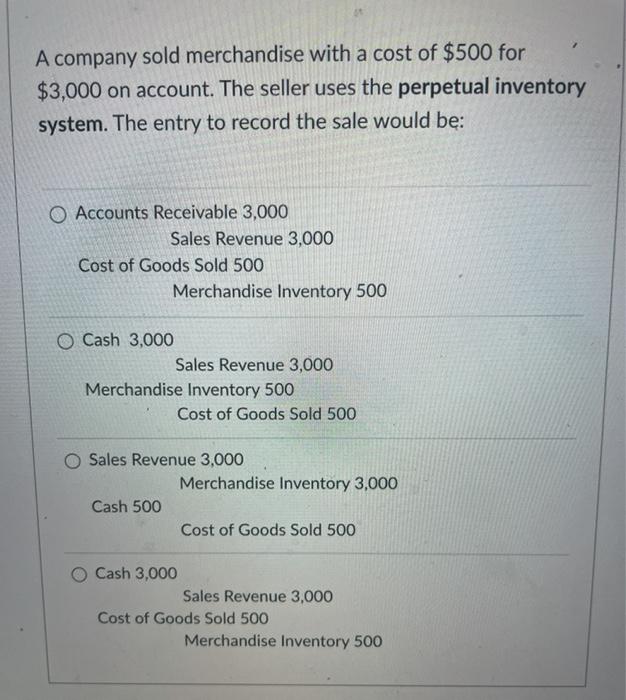

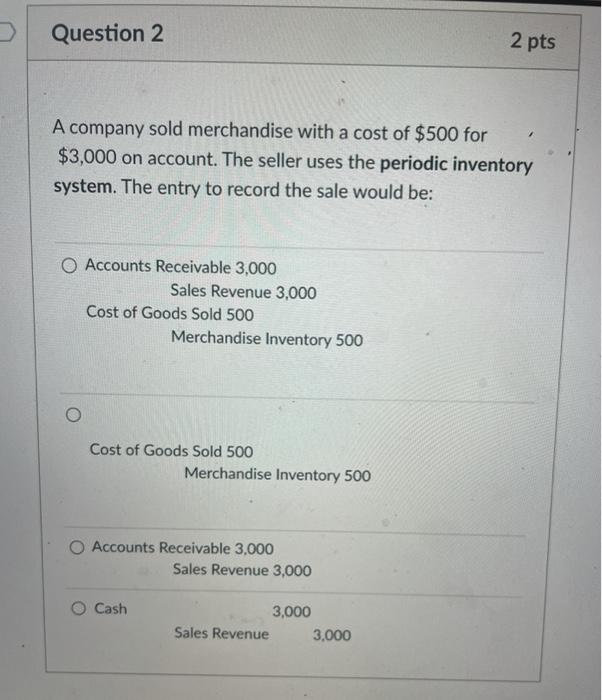

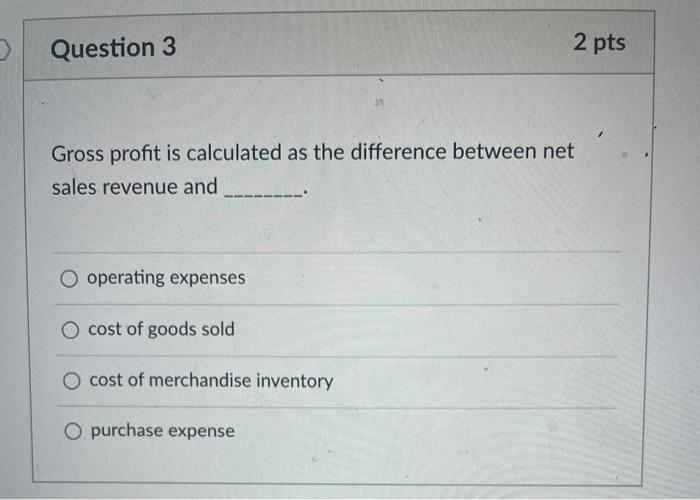

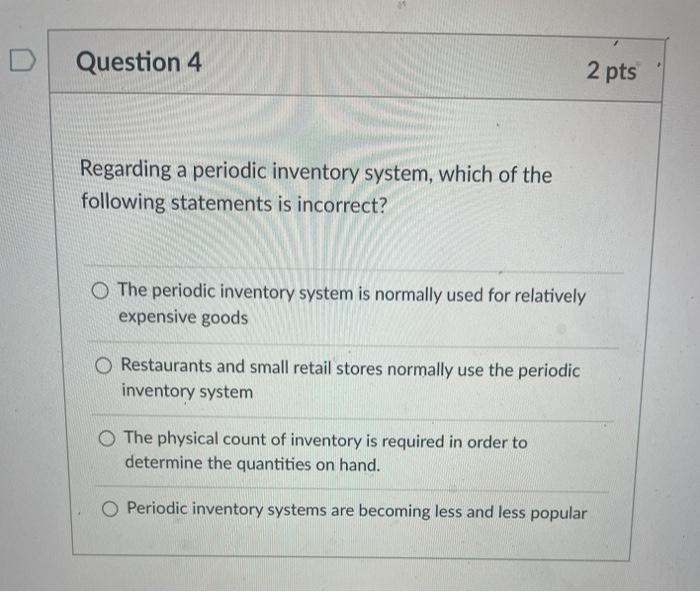

A company sold merchandise with a cost of $500 for $3,000 on account. The seller uses the perpetual inventory system. The entry to record the sale would be: Accounts Receivable 3,000 Sales Revenue 3,000 Cost of Goods Sold 500 Merchandise Inventory 500 O Cash 3,000 Sales Revenue 3,000 Merchandise Inventory 500 Cost of Goods Sold 500 O Sales Revenue 3,000 Merchandise Inventory 3,000 Cash 500 Cost of Goods Sold 500 Cash 3,000 Sales Revenue 3,000 Cost of Goods Sold 500 Merchandise Inventory 500 Question 2 2 pts A company sold merchandise with a cost of $500 for $3,000 on account. The seller uses the periodic inventory system. The entry to record the sale would be: O Accounts Receivable 3,000 Sales Revenue 3,000 Cost of Goods Sold 500 Merchandise Inventory 500 Cost of Goods Sold 500 Merchandise Inventory 500 O Accounts Receivable 3,000 Sales Revenue 3,000 Cash 3,000 Sales Revenue 3.000 > Question 3 2 pts Gross profit is calculated as the difference between net sales revenue and O operating expenses O cost of goods sold O cost of merchandise inventory O purchase expense Question 4 2 pts Regarding a periodic inventory system, which of the following statements is incorrect? O The periodic inventory system is normally used for relatively expensive goods Restaurants and small retail stores normally use the periodic inventory system O The physical count of inventory is required in order to determine the quantities on hand. Periodic inventory systems are becoming less and less popular Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started