Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I will upvote (Time recommended: 13 minutes) On 30 June 2021, MU Ltd decides to sell its delivery van and replace it by purchasing a

I will upvote

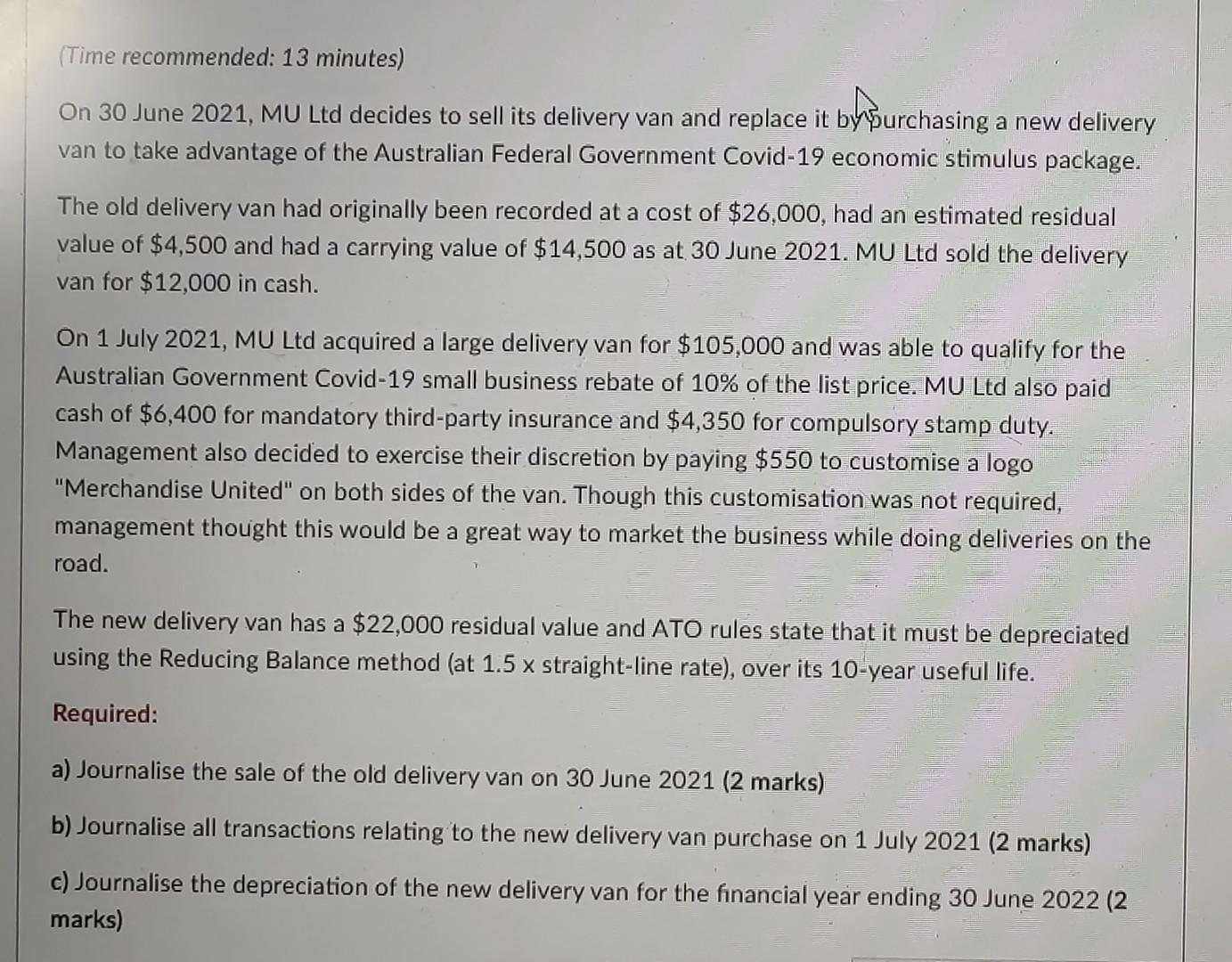

(Time recommended: 13 minutes) On 30 June 2021, MU Ltd decides to sell its delivery van and replace it by purchasing a new delivery by burch van to take advantage of the Australian Federal Government Covid-19 economic stimulus package. The old delivery van had originally been recorded at a cost of $26,000, had an estimated residual value of $4,500 and had a carrying value of $14,500 as at 30 June 2021. MU Ltd sold the delivery van for $12,000 in cash. On 1 July 2021, MU Ltd acquired a large delivery van for $105,000 and was able to qualify for the Australian Government Covid-19 small business rebate of 10% of the list price. MU Ltd also paid cash of $6,400 for mandatory third-party insurance and $4,350 for compulsory stamp duty. Management also decided to exercise their discretion by paying $550 to customise a logo "Merchandise United" on both sides of the van. Though this customisation was not required, management thought this would be a great way to market the business while doing deliveries on the road. The new delivery van has a $22,000 residual value and ATO rules state that it must be depreciated using the Reducing Balance method (at 1.5 x straight-line rate), over its 10-year useful life. Required: a) Journalise the sale of the old delivery van on 30 June 2021 (2 marks) b) Journalise all transactions relating to the new delivery van purchase on 1 July 2021 (2 marks) c) Journalise the depreciation of the new delivery van for the financial year ending 30 June 2022 (2 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started