Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I will upvote, whoever helps me complete it please! I need help for sure. Assessing Martin Manufacturing's Current Financial Position Terri Spiro, an experienced budget

I will upvote, whoever helps me complete it please! I need help for sure.

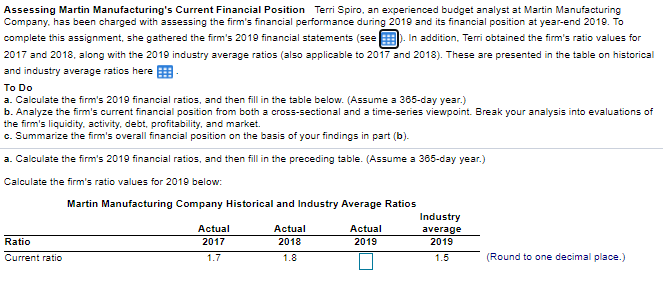

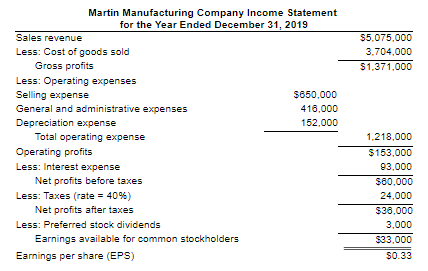

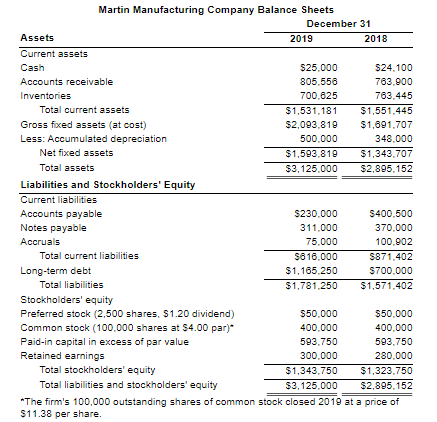

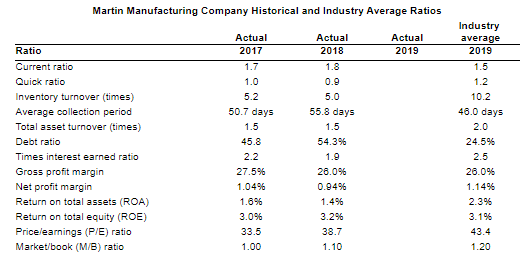

Assessing Martin Manufacturing's Current Financial Position Terri Spiro, an experienced budget analyst at Martin Manufacturing Company has been charged with assessing the firm's financial performance during 2019 and its financial position at year-end 2019. To complete this assignment, she gathered the firm's 2019 financial statements (see B). In addition, Terri obtained the firm's ratio values for 2017 and 2018, along with the 2019 industry average ratios (also applicable to 2017 and 2018). These are presented in the table on historical and industry average ratios here To Do a. Calculate the firm's 2019 financial ratios, and then fill in the table below. (Assume a 365-day year.) b. Analyze the firm's current financial position from both a cross-sectional and a time-series viewpoint. Break your analysis into evaluations of the firm's liquidity, activity, debt, profitability, and market. c. Summarize the firm's overall financial position on the basis of your findings in part (b). a. Calculate the firm's 2019 financial ratios, and then fill in the preceding table. (Assume a 365-day year.) Calculate the firm's ratio values for 2018 below: Martin Manufacturing Company Historical and Industry Average Ratios Industry Actual Actual Actual 2018 2019 2019 Current ratio 1.7 (Round to one decimal place.) average Ratio 2017 1.8 1.5 $5.075,000 3.704,000 $1.371.000 Martin Manufacturing Company Income Statement for the Year Ended December 31, 2019 Sales revenue Less: Cost of goods sold Gross profits Less: Operating expenses Selling expense $650,000 General and administrative expenses 416,000 Depreciation expense 152.000 Total operating expense Operating profits Less: Interest expense Net profits before taxes Less: Taxes (rate = 40%) Net profits after taxes Less: Preferred stock dividends Earnings available for common stockholders Earnings per share (EPS) 1.218.000 $153,000 93.000 $80.000 24,000 $36.000 $ 3.000 $33.000 $0.33 Martin Manufacturing Company Balance Sheets December 31 Assets 2019 2018 Current assets Cash $25.000 $24.100 Accounts receivable 805,556 763.900 Inventories 700.625 763,445 Total current assets $1,531.181 $1,551,445 Gross foced assets (at cost) $2,093.819 $1,691.707 Less: Accumulated depreciation 500.000 348.000 Net fixed assets $1,593,819 $1,343.707 Total assets $3,125.000 $2,895.152 Liabilities and Stockholders' Equity Current liabilities Accounts payable S230.000 $400.500 Notes payable 311.000 370.000 Accruals 75.000 100.902 Total current liabilities $816.000 $871,402 Long-term debt $1,165.250 $700.000 Total liabilities $1,781.250 $1,571.402 Stockholders' equity Preferred stock (2,500 shares, $1.20 dividend) $50.000 $50.000 Common stock (100.000 shares at $4.00 par)* 400.000 400.000 Paid-in capital in excess of par value 593.750 593.750 Retained earnings 300.000 280.000 Total stockholders' equity $1,343.750 $1,323.750 Total liabilities and stockholders' equity $3,125.000 $2,895.152 *The firm's 100,000 outstanding shares of common stock closed 2019 at a price of $11.38 per share. Martin Manufacturing Company Historical and Industry Average Ratios Actual 2019 Actual 2017 1.7 1.0 5.2 Actual 2018 1.8 0.9 5.0 55.8 days 1.5 54.3% 50.7 days Ratio Current ratio Quick ratio Inventory turnover (times) Average collection period Total asset turnover (times) Debt ratio Times interest earned ratio Gross profit margin Net profit margin Return on total assets (ROA) Return on total equity (ROE) Pricelearnings (P/E) ratio Market/book (M/B) ratio Industry average 2019 1.5 1.2 10.2 46.0 days 2.0 24.5% 2.5 26.096 1.14% 2.3% 3.1% 43.4 1.20 1.5 45.8 2.2 27.5% 1.0496 1.696 3.0% 33.5 1.00 1.9 26.0% 0.9496 1.496 3.29% 38.7 1.10 Assessing Martin Manufacturing's Current Financial Position Terri Spiro, an experienced budget analyst at Martin Manufacturing Company has been charged with assessing the firm's financial performance during 2019 and its financial position at year-end 2019. To complete this assignment, she gathered the firm's 2019 financial statements (see B). In addition, Terri obtained the firm's ratio values for 2017 and 2018, along with the 2019 industry average ratios (also applicable to 2017 and 2018). These are presented in the table on historical and industry average ratios here To Do a. Calculate the firm's 2019 financial ratios, and then fill in the table below. (Assume a 365-day year.) b. Analyze the firm's current financial position from both a cross-sectional and a time-series viewpoint. Break your analysis into evaluations of the firm's liquidity, activity, debt, profitability, and market. c. Summarize the firm's overall financial position on the basis of your findings in part (b). a. Calculate the firm's 2019 financial ratios, and then fill in the preceding table. (Assume a 365-day year.) Calculate the firm's ratio values for 2018 below: Martin Manufacturing Company Historical and Industry Average Ratios Industry Actual Actual Actual 2018 2019 2019 Current ratio 1.7 (Round to one decimal place.) average Ratio 2017 1.8 1.5 $5.075,000 3.704,000 $1.371.000 Martin Manufacturing Company Income Statement for the Year Ended December 31, 2019 Sales revenue Less: Cost of goods sold Gross profits Less: Operating expenses Selling expense $650,000 General and administrative expenses 416,000 Depreciation expense 152.000 Total operating expense Operating profits Less: Interest expense Net profits before taxes Less: Taxes (rate = 40%) Net profits after taxes Less: Preferred stock dividends Earnings available for common stockholders Earnings per share (EPS) 1.218.000 $153,000 93.000 $80.000 24,000 $36.000 $ 3.000 $33.000 $0.33 Martin Manufacturing Company Balance Sheets December 31 Assets 2019 2018 Current assets Cash $25.000 $24.100 Accounts receivable 805,556 763.900 Inventories 700.625 763,445 Total current assets $1,531.181 $1,551,445 Gross foced assets (at cost) $2,093.819 $1,691.707 Less: Accumulated depreciation 500.000 348.000 Net fixed assets $1,593,819 $1,343.707 Total assets $3,125.000 $2,895.152 Liabilities and Stockholders' Equity Current liabilities Accounts payable S230.000 $400.500 Notes payable 311.000 370.000 Accruals 75.000 100.902 Total current liabilities $816.000 $871,402 Long-term debt $1,165.250 $700.000 Total liabilities $1,781.250 $1,571.402 Stockholders' equity Preferred stock (2,500 shares, $1.20 dividend) $50.000 $50.000 Common stock (100.000 shares at $4.00 par)* 400.000 400.000 Paid-in capital in excess of par value 593.750 593.750 Retained earnings 300.000 280.000 Total stockholders' equity $1,343.750 $1,323.750 Total liabilities and stockholders' equity $3,125.000 $2,895.152 *The firm's 100,000 outstanding shares of common stock closed 2019 at a price of $11.38 per share. Martin Manufacturing Company Historical and Industry Average Ratios Actual 2019 Actual 2017 1.7 1.0 5.2 Actual 2018 1.8 0.9 5.0 55.8 days 1.5 54.3% 50.7 days Ratio Current ratio Quick ratio Inventory turnover (times) Average collection period Total asset turnover (times) Debt ratio Times interest earned ratio Gross profit margin Net profit margin Return on total assets (ROA) Return on total equity (ROE) Pricelearnings (P/E) ratio Market/book (M/B) ratio Industry average 2019 1.5 1.2 10.2 46.0 days 2.0 24.5% 2.5 26.096 1.14% 2.3% 3.1% 43.4 1.20 1.5 45.8 2.2 27.5% 1.0496 1.696 3.0% 33.5 1.00 1.9 26.0% 0.9496 1.496 3.29% 38.7 1.10Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started