Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I will vote your answer don't give Wrong Answer thank you Cost apportionment is the allotment of proportions of cost to cost centres or cost

I will vote your answer don't give Wrong Answer thank you

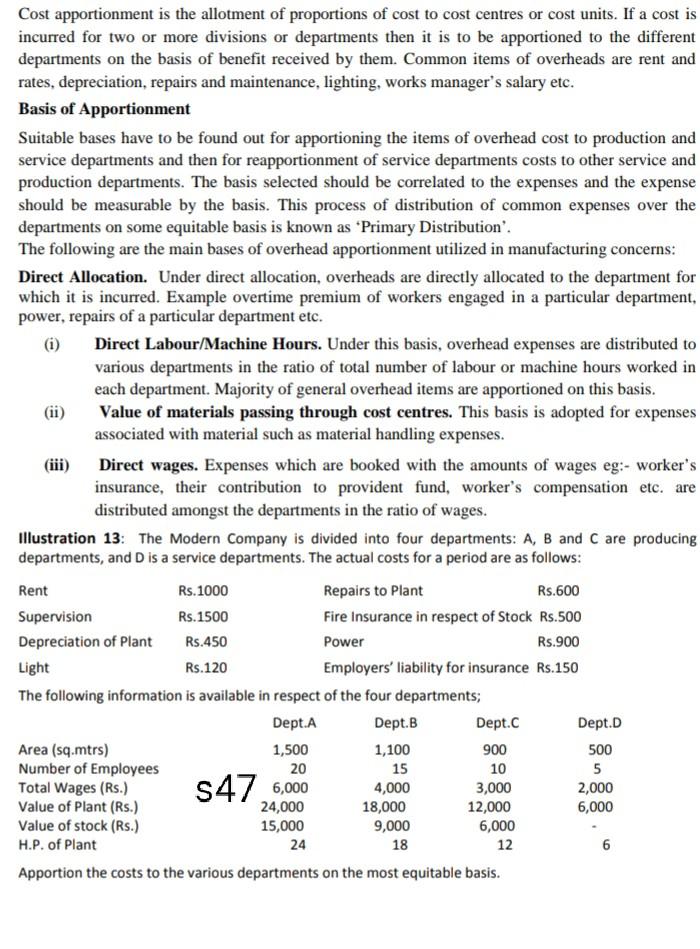

Cost apportionment is the allotment of proportions of cost to cost centres or cost units. If a cost is incurred for two or more divisions or departments then it is to be apportioned to the different departments on the basis of benefit received by them. Common items of overheads are rent and rates, depreciation, repairs and maintenance, lighting, works manager's salary etc. Basis of Apportionment Suitable bases have to be found out for apportioning the items of overhead cost to production and service departments and then for reapportionment of service departments costs to other service and production departments. The basis selected should be correlated to the expenses and the expense should be measurable by the basis. This process of distribution of common expenses over the departments on some equitable basis is known as Primary Distribution'. The following are the main bases of overhead apportionment utilized in manufacturing concerns: Direct Allocation. Under direct allocation, overheads are directly allocated to the department for which it is incurred. Example overtime premium of workers engaged in a particular department, power, repairs of a particular department etc. (i) Direct Labour/Machine Hours. Under this basis, overhead expenses are distributed to various departments in the ratio of total number of labour or machine hours worked in each department. Majority of general overhead items are apportioned on this basis. (ii) Value of materials passing through cost centres. This basis is adopted for expenses associated with material such as material handling expenses. (iii) Direct wages. Expenses which are booked with the amounts of wages eg:- worker's insurance, their contribution to provident fund, worker's compensation etc. are distributed amongst the departments in the ratio of wages. Illustration 13: The Modern Company is divided into four departments: A, B and C are producing departments, and D is a service departments. The actual costs for a period are as follows: Rent Rs. 1000 Repairs to Plant Rs.600 Supervision Rs. 1500 Fire Insurance in respect of Stock Rs.500 Depreciation of Plant Rs.450 Power Rs.900 Light Rs.120 Employers' liability for insurance Rs.150 The following information is available in respect of the four departments; Dept.A Dept.B Dept.C Dept.D Area (sq.mtrs) 1,500 1,100 900 500 Number of Employees 20 15 10 5 Total Wages (Rs.) 547 6,000 4,000 3,000 2,000 Value of Plant (Rs.) 24,000 18,000 12,000 6,000 Value of stock (Rs.) 15,000 9,000 6,000 H.P. of Plant 24 18 12 Apportion the costs to the various departments on the most equitable basis. 6Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started