Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I wonder how to calculate these and what's the result... Thank u sooo much!!! 1) Gas Diggers United Ltd. Co. is planning the acquisition of

I wonder how to calculate these and what's the result...

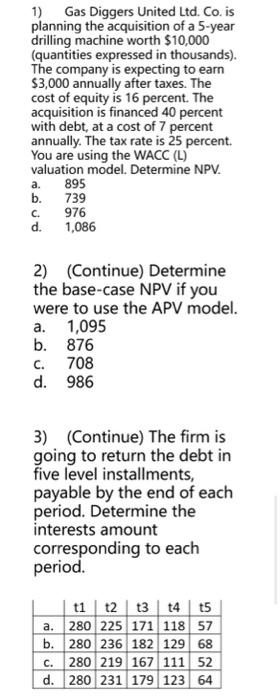

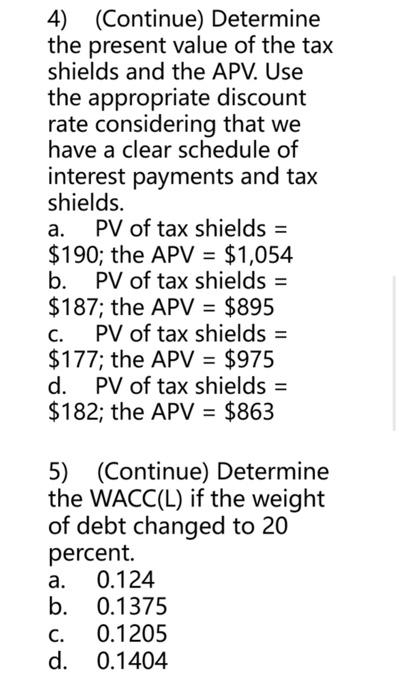

1) Gas Diggers United Ltd. Co. is planning the acquisition of a 5-year drilling machine worth $10,000 (quantities expressed in thousands). The company is expecting to earn $3,000 annually after taxes. The cost of equity is 16 percent. The acquisition is financed 40 percent with debt, at a cost of 7 percent annually. The tax rate is 25 percent. You are using the WACC (L) valuation model. Determine NPV. a. 895 b. 739 c.d.9761,086 2) (Continue) Determine the base-case NPV if you were to use the APV model. a. 1,095 b. 876 c. 708 d. 986 3) (Continue) The firm is going to return the debt in five level installments, payable by the end of each period. Determine the interests amount corresponding to each period. 4) (Continue) Determine the present value of the tax shields and the APV. Use the appropriate discount rate considering that we have a clear schedule of interest payments and tax shields. a. PV of tax shields = $190; the APV =$1,054 b. PV of tax shields = $187; the APV =$895 c. PV of tax shields = $177; the APV =$975 d. PV of tax shields = $182; the APV =$863 5) (Continue) Determine the WACC (L) if the weight of debt changed to 20 percent. a. 0.124 b. 0.1375 c. 0.1205 d. 0.1404 Thank u sooo much!!!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started