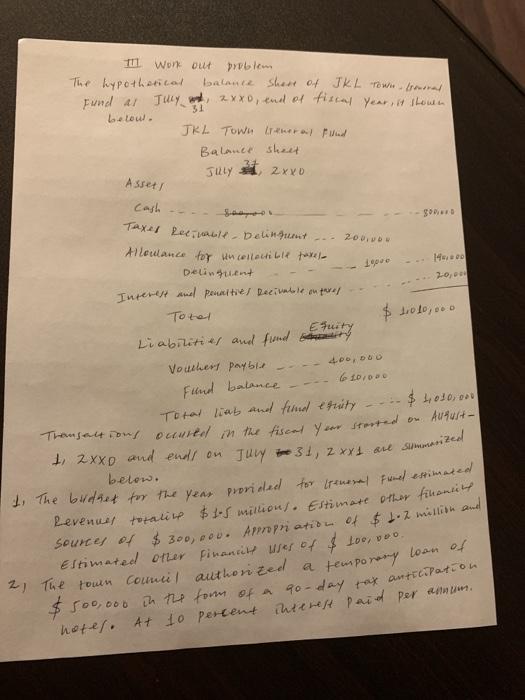

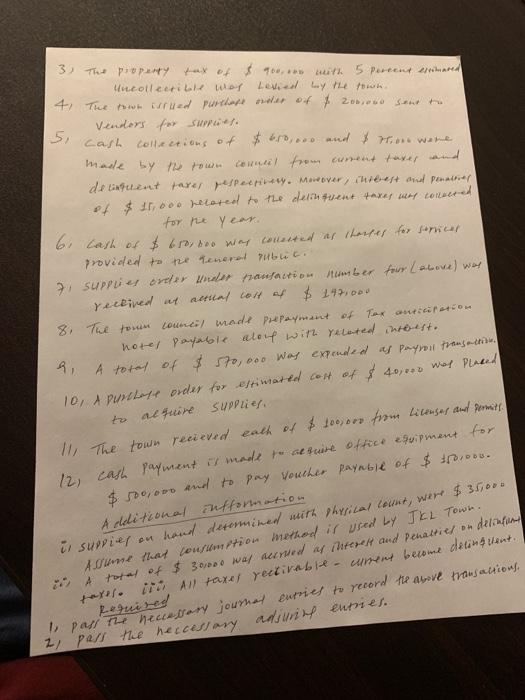

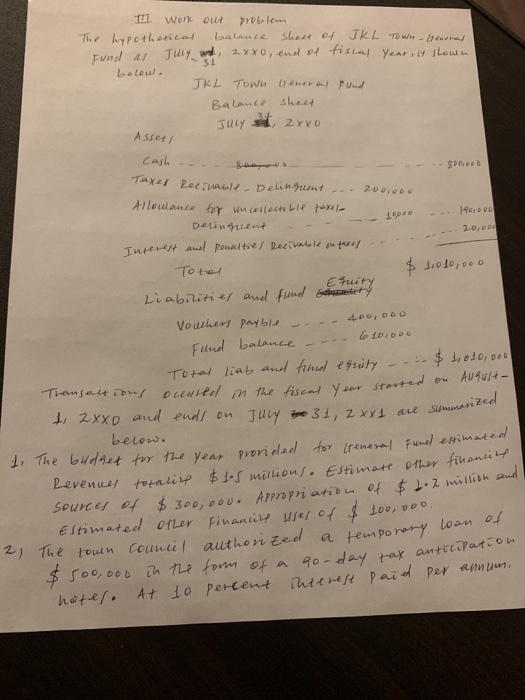

I work out problem The hypothetical balance share of JKL Town, trommal Fund as July 2xx, and of fiscal year, it shown. Lalou. JKL Town treneral Fund Balance sheet July 1, 2xxo Asset Cash Taxes Receivable - Delinquent --- 200, Allowance for uncellei LH til Delinquent Interest and penalties Recivable on pares Total Liabilities and fund Equity Vouchers payble 10/0 H00 2.0, $ 10060,.. ---- 400, DOO Fund balance Total liab and find etunity Transactions suured in the fiscal your started on August + 2xXD and ends on Jury to 31, 2 xx1 are summarized below. 100, 0oo. I. The budget for the year provided for treneral fand estimated Revenues torative $1.5 millions. Estimare other finansine sources of $300,000. Apropriation of $1.2 million and Estimated other financite uses of $ 2 The town council authorized a $500,000 in the form of a 90-day tax anticipation hoter. At to percent interest paid per annum. temporary loan of 3) The property tax of $ 900...0 with 5 percent encomated Heoil cerill LLY V toon 4 The town isrued purchase order of & 2000 sent to Valors fa suma. 5 cash collections of $600,... and & ton were made by the town council from current taxes and de buut are respectiv. Muover, chibet med pennine!! of $ 11,000 pelated to the delinquent taxes was consered for the year. 6. Cash of $ 650,000 was conessed as therkes for sornicar provided to the general public. 7: supplie order meer paulatimber four Labove) wey received as actual cost of $ 147,000 8. The town council made prepayment of Tax anticipation notes payable aloue with related interest. a A total of $ 500,000 was expended as payroll transaction. 12) 10, A Purchase order for estimated cost of $40,000 was placed to acquire supplies 11 The town recieved each of $ 100,000 from Litenses and Permits. cash payment is made to atsuite office equipment for $ 500,000 and to pay voucher payable of $ $50.000. Additional infformation i suppies on hand determined with shrsical count, were $35,000 Awne that coustion method is used by JKL Town A r/ of $ 3000 wa/ Auwed af lifevent and Penaltie/ detonun 1. 78 A taxes rectivabitumen become decent. pasi the necessary joumat euries to record the above transactions, 2) Pell the heccessary adjuring envies. TH1 Work O problem The hypothetical balance Shest of J K L Town General Fund as July 2xxo, end of fiscal year, it shown. 31 below. JKL Town Cera Full Balance sheet July it, axxo SPEED Assets Cash Taxes Recinable Delinquent . 200.000 Hloulance for ucilati LH VI Detinguent BODO 20, Interest and penaltie/ Recivatle on trores Total $ 1.010,000 Liabilities and fund antity Etuity Vouchers payble DO;DDD Fund balance 6 10. Total liab and find equity $ 2,010,oo Transactions ocurred in the fiscal year started on August & ZXXO and ends on July 31, 2 xx1 are summanized below. t. The budget for the year provided for Heneral Funed estimated Revenues torative $1.5 millions. Estimate other finansine sources of $300,000. Appropriation of $ 2.7 million and Estimated other financils uses of $ 100,000 2) The town Council authorized a temporary toan of $ 500,000 in the form of a go-day tax anticipation hotes. At 10 percent interest paid per annum, I work out problem The hypothetical balance share of JKL Town, trommal Fund as July 2xx, and of fiscal year, it shown. Lalou. JKL Town treneral Fund Balance sheet July 1, 2xxo Asset Cash Taxes Receivable - Delinquent --- 200, Allowance for uncellei LH til Delinquent Interest and penalties Recivable on pares Total Liabilities and fund Equity Vouchers payble 10/0 H00 2.0, $ 10060,.. ---- 400, DOO Fund balance Total liab and find etunity Transactions suured in the fiscal your started on August + 2xXD and ends on Jury to 31, 2 xx1 are summarized below. 100, 0oo. I. The budget for the year provided for treneral fand estimated Revenues torative $1.5 millions. Estimare other finansine sources of $300,000. Apropriation of $1.2 million and Estimated other financite uses of $ 2 The town council authorized a $500,000 in the form of a 90-day tax anticipation hoter. At to percent interest paid per annum. temporary loan of 3) The property tax of $ 900...0 with 5 percent encomated Heoil cerill LLY V toon 4 The town isrued purchase order of & 2000 sent to Valors fa suma. 5 cash collections of $600,... and & ton were made by the town council from current taxes and de buut are respectiv. Muover, chibet med pennine!! of $ 11,000 pelated to the delinquent taxes was consered for the year. 6. Cash of $ 650,000 was conessed as therkes for sornicar provided to the general public. 7: supplie order meer paulatimber four Labove) wey received as actual cost of $ 147,000 8. The town council made prepayment of Tax anticipation notes payable aloue with related interest. a A total of $ 500,000 was expended as payroll transaction. 12) 10, A Purchase order for estimated cost of $40,000 was placed to acquire supplies 11 The town recieved each of $ 100,000 from Litenses and Permits. cash payment is made to atsuite office equipment for $ 500,000 and to pay voucher payable of $ $50.000. Additional infformation i suppies on hand determined with shrsical count, were $35,000 Awne that coustion method is used by JKL Town A r/ of $ 3000 wa/ Auwed af lifevent and Penaltie/ detonun 1. 78 A taxes rectivabitumen become decent. pasi the necessary joumat euries to record the above transactions, 2) Pell the heccessary adjuring envies. TH1 Work O problem The hypothetical balance Shest of J K L Town General Fund as July 2xxo, end of fiscal year, it shown. 31 below. JKL Town Cera Full Balance sheet July it, axxo SPEED Assets Cash Taxes Recinable Delinquent . 200.000 Hloulance for ucilati LH VI Detinguent BODO 20, Interest and penaltie/ Recivatle on trores Total $ 1.010,000 Liabilities and fund antity Etuity Vouchers payble DO;DDD Fund balance 6 10. Total liab and find equity $ 2,010,oo Transactions ocurred in the fiscal year started on August & ZXXO and ends on July 31, 2 xx1 are summanized below. t. The budget for the year provided for Heneral Funed estimated Revenues torative $1.5 millions. Estimate other finansine sources of $300,000. Appropriation of $ 2.7 million and Estimated other financils uses of $ 100,000 2) The town Council authorized a temporary toan of $ 500,000 in the form of a go-day tax anticipation hotes. At 10 percent interest paid per annum