I would appreciate if if you could type the answer and explain fully whats happening in each stage/ equations used for revisions purposes.

Past paper:

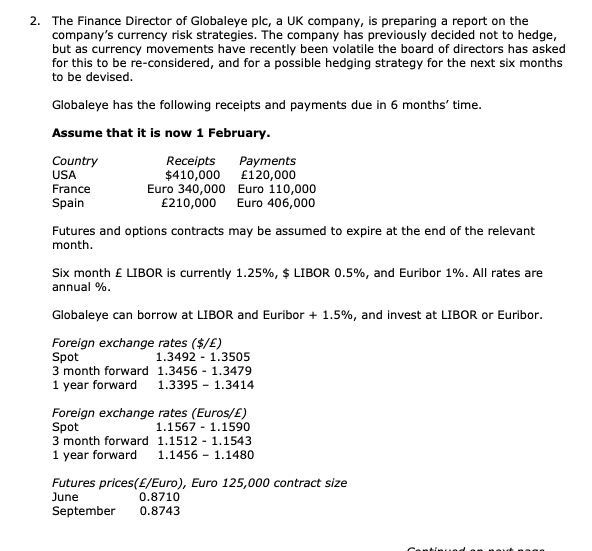

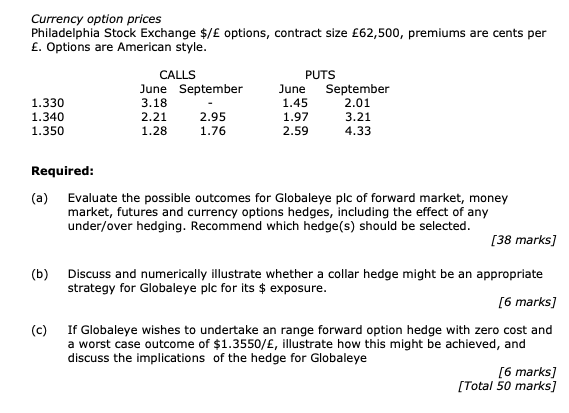

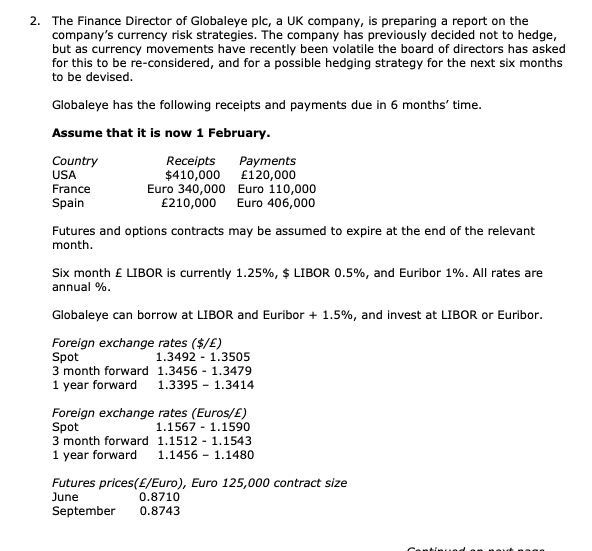

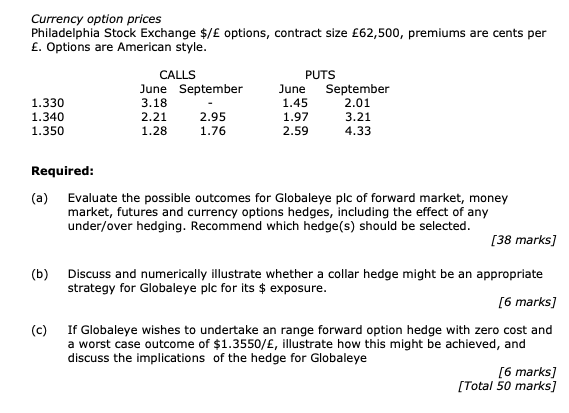

2. The Finance Director of Globaleye plc, a UK company, is preparing a report on the company's currency risk strategies. The company has previously decided not to hedge, but as currency movements have recently been volatile the board of directors has asked for this to be re-considered, and for a possible hedging strategy for the next six months to be devised. Globaleye has the following receipts and payments due in 6 months' time. Assume that it is now 1 February. Country Receipts Payments USA $410,000 120,000 France Euro 340,000 Euro 110,000 Spain 210,000 Euro 406,000 Futures and options contracts may be assumed to expire at the end of the relevant month. Six month LIBOR is currently 1.25%, $ LIBOR 0.5%, and Euribor 1%. All rates are annual %. Globaleye can borrow at LIBOR and Euribor + 1.5%, and invest at LIBOR or Euribor. Foreign exchange rates ($/) Spot 1.3492 - 1.3505 3 month forward 1.3456 - 1.3479 1 year forward 1.3395 - 1.3414 Foreign exchange rates (Euros/L) Spot 1.1567 - 1.1590 3 month forward 1.1512 - 1.1543 1 year forward 1.1456 - 1.1480 Futures prices(E/Euro), Euro 125,000 contract size June 0.8710 September 0.8743 - canti Currency option prices Philadelphia Stock Exchange $/ options, contract size 62,500, premiums are cents per . Options are American style. CALLS PUTS June September June September 1.330 3.18 1.45 2.01 1.340 2.21 2.95 1.97 3.21 1.350 1.28 1.76 2.59 4.33 Required: (a) Evaluate the possible outcomes for Globaleye plc of forward market, money market, futures and currency options hedges, including the effect of any under/over hedging. Recommend which hedge(s) should be selected. [38 marks) (b) Discuss and numerically illustrate whether a collar hedge might be an appropriate strategy for Globaleye plc for its $ exposure. [6 marks] (c) If Globaleye wishes to undertake an range forward option hedge with zero cost and a worst case outcome of $1.3550/, illustrate how this might be achieved, and discuss the implications of the hedge for Globaleye [6 marks] [Total 50 marks] 2. The Finance Director of Globaleye plc, a UK company, is preparing a report on the company's currency risk strategies. The company has previously decided not to hedge, but as currency movements have recently been volatile the board of directors has asked for this to be re-considered, and for a possible hedging strategy for the next six months to be devised. Globaleye has the following receipts and payments due in 6 months' time. Assume that it is now 1 February. Country Receipts Payments USA $410,000 120,000 France Euro 340,000 Euro 110,000 Spain 210,000 Euro 406,000 Futures and options contracts may be assumed to expire at the end of the relevant month. Six month LIBOR is currently 1.25%, $ LIBOR 0.5%, and Euribor 1%. All rates are annual %. Globaleye can borrow at LIBOR and Euribor + 1.5%, and invest at LIBOR or Euribor. Foreign exchange rates ($/) Spot 1.3492 - 1.3505 3 month forward 1.3456 - 1.3479 1 year forward 1.3395 - 1.3414 Foreign exchange rates (Euros/L) Spot 1.1567 - 1.1590 3 month forward 1.1512 - 1.1543 1 year forward 1.1456 - 1.1480 Futures prices(E/Euro), Euro 125,000 contract size June 0.8710 September 0.8743 - canti Currency option prices Philadelphia Stock Exchange $/ options, contract size 62,500, premiums are cents per . Options are American style. CALLS PUTS June September June September 1.330 3.18 1.45 2.01 1.340 2.21 2.95 1.97 3.21 1.350 1.28 1.76 2.59 4.33 Required: (a) Evaluate the possible outcomes for Globaleye plc of forward market, money market, futures and currency options hedges, including the effect of any under/over hedging. Recommend which hedge(s) should be selected. [38 marks) (b) Discuss and numerically illustrate whether a collar hedge might be an appropriate strategy for Globaleye plc for its $ exposure. [6 marks] (c) If Globaleye wishes to undertake an range forward option hedge with zero cost and a worst case outcome of $1.3550/, illustrate how this might be achieved, and discuss the implications of the hedge for Globaleye [6 marks] [Total 50 marks]