Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I would appreciate it if you could tell me the answer as soon as possible. No explanation or commentary is required on the above accounting

I would appreciate it if you could tell me the answer as soon as possible. No explanation or commentary is required on the above accounting question.

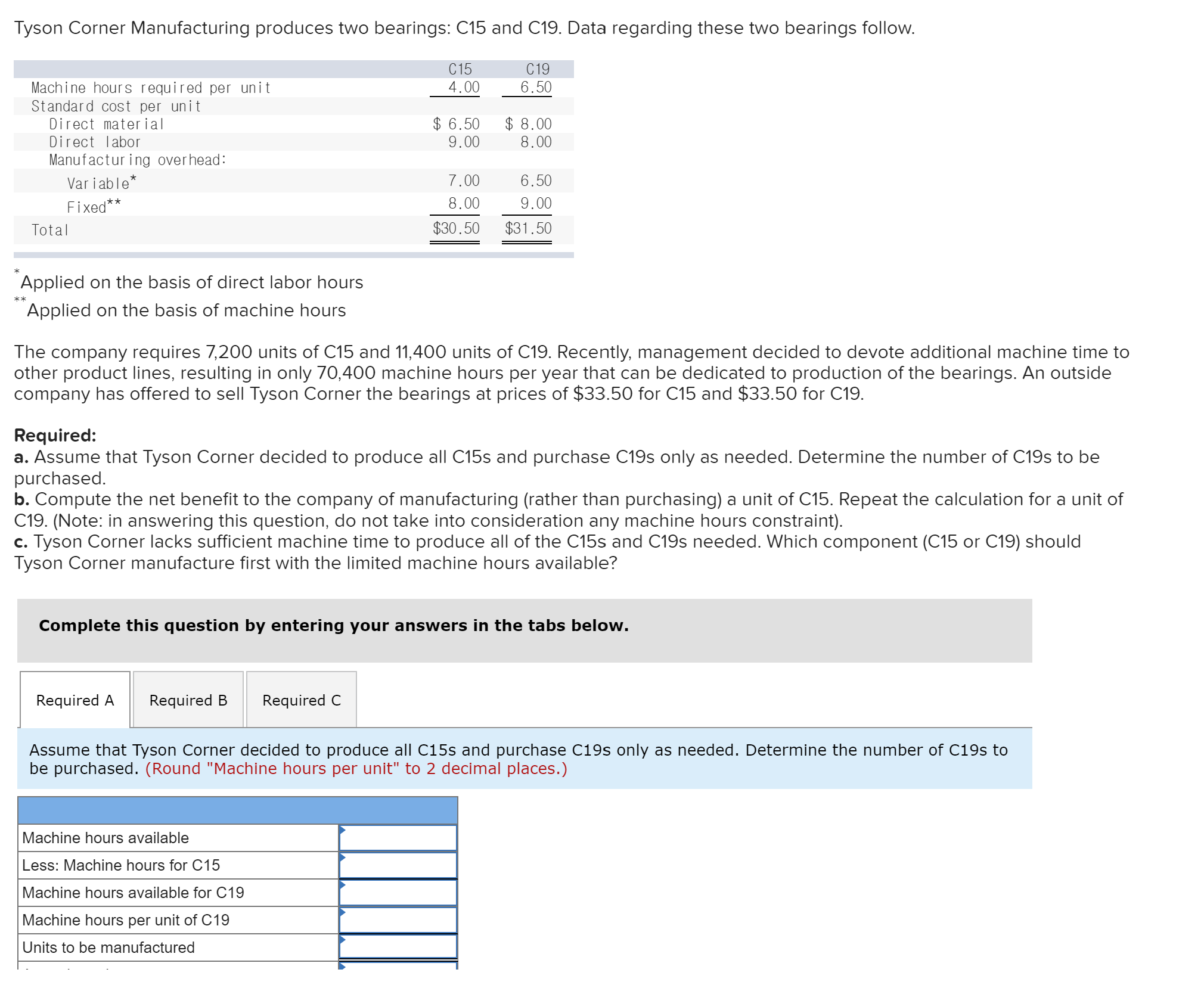

Tyson Corner Manufacturing produces two bearings: C15 and C19. Data regarding these two bearings follow. *Applied on the basis of direct labor hours A* Applied on the basis of machine hours The company requires 7,200 units of C15 and 11,400 units of C19. Recently, management decided to devote additional machine time to other product lines, resulting in only 70,400 machine hours per year that can be dedicated to production of the bearings. An outside company has offered to sell Tyson Corner the bearings at prices of $33.50 for C15 and $33.50 for C19. Required: a. Assume that Tyson Corner decided to produce all C15s and purchase C19s only as needed. Determine the number of C19s to be purchased. b. Compute the net benefit to the company of manufacturing (rather than purchasing) a unit of C15. Repeat the calculation for a unit of C19. (Note: in answering this question, do not take into consideration any machine hours constraint). c. Tyson Corner lacks sufficient machine time to produce all of the C15s and C19s needed. Which component (C15 or C19) should Tyson Corner manufacture first with the limited machine hours available? Complete this question by entering your answers in the tabs below. Assume that Tyson Corner decided to produce all C15s and purchase C19s only as needed. Determine the number of C19s to be purchased. (Round "Machine hours per unit" to 2 decimal places.)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started