Answered step by step

Verified Expert Solution

Question

1 Approved Answer

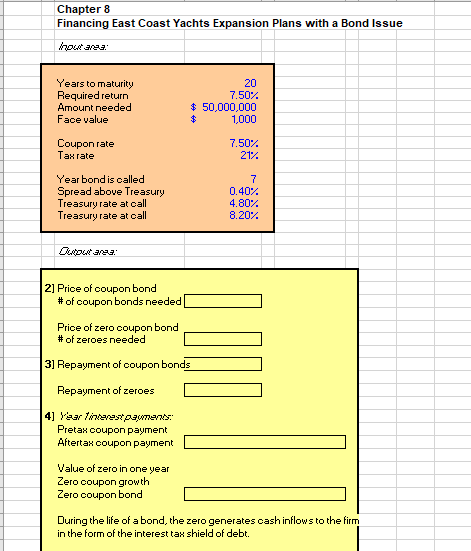

I would like help with figuring out how to solve this. Chapter 8 Financing East Coast Yachts Expansion Plans with a Bond Issue hutang Years

I would like help with figuring out how to solve this.

Chapter 8 Financing East Coast Yachts Expansion Plans with a Bond Issue hutang Years to maturity Required return Amount needed Face value 20 7.50% $ 50,000,000 $ 1,000 Coupon rate Taurate 7.50% 21% Year bond is called Spread above Treasury Treasury rate at call Treasury rate at call 7 0.40% 4.80% 8.20% U279 2] Price of coupon bond # of coupon bonds needed Price of zero coupon bond # of zeroes needed 3] Repayment of coupon bonds Repayment of zeroes 4] Yaar Test pameras Pretax coupon payment Aftertax coupon payment Value of zero in one year Zero coupon growth Zero coupon bond During the life of a bond, the zero generates cash inflows to the firm in the form of the interest tax shield of debt. Chapter 8 Financing East Coast Yachts Expansion Plans with a Bond Issue hutang Years to maturity Required return Amount needed Face value 20 7.50% $ 50,000,000 $ 1,000 Coupon rate Taurate 7.50% 21% Year bond is called Spread above Treasury Treasury rate at call Treasury rate at call 7 0.40% 4.80% 8.20% U279 2] Price of coupon bond # of coupon bonds needed Price of zero coupon bond # of zeroes needed 3] Repayment of coupon bonds Repayment of zeroes 4] Yaar Test pameras Pretax coupon payment Aftertax coupon payment Value of zero in one year Zero coupon growth Zero coupon bond During the life of a bond, the zero generates cash inflows to the firm in the form of the interest tax shield of debtStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started