Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I would like help with these questions. I would like a clear answer and clear calculation please. 12. Big Company owns all of the issued

I would like help with these questions. I would like a clear answer and clear calculation please.

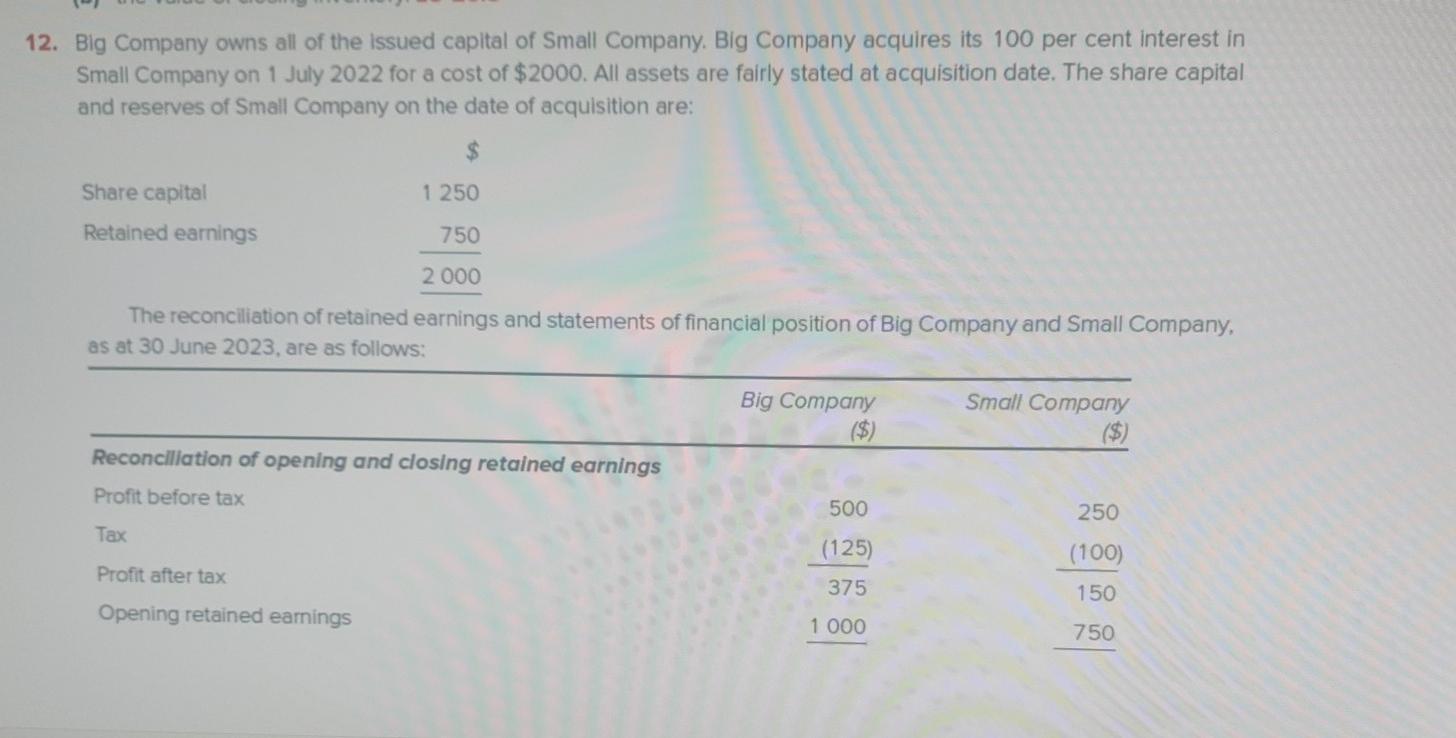

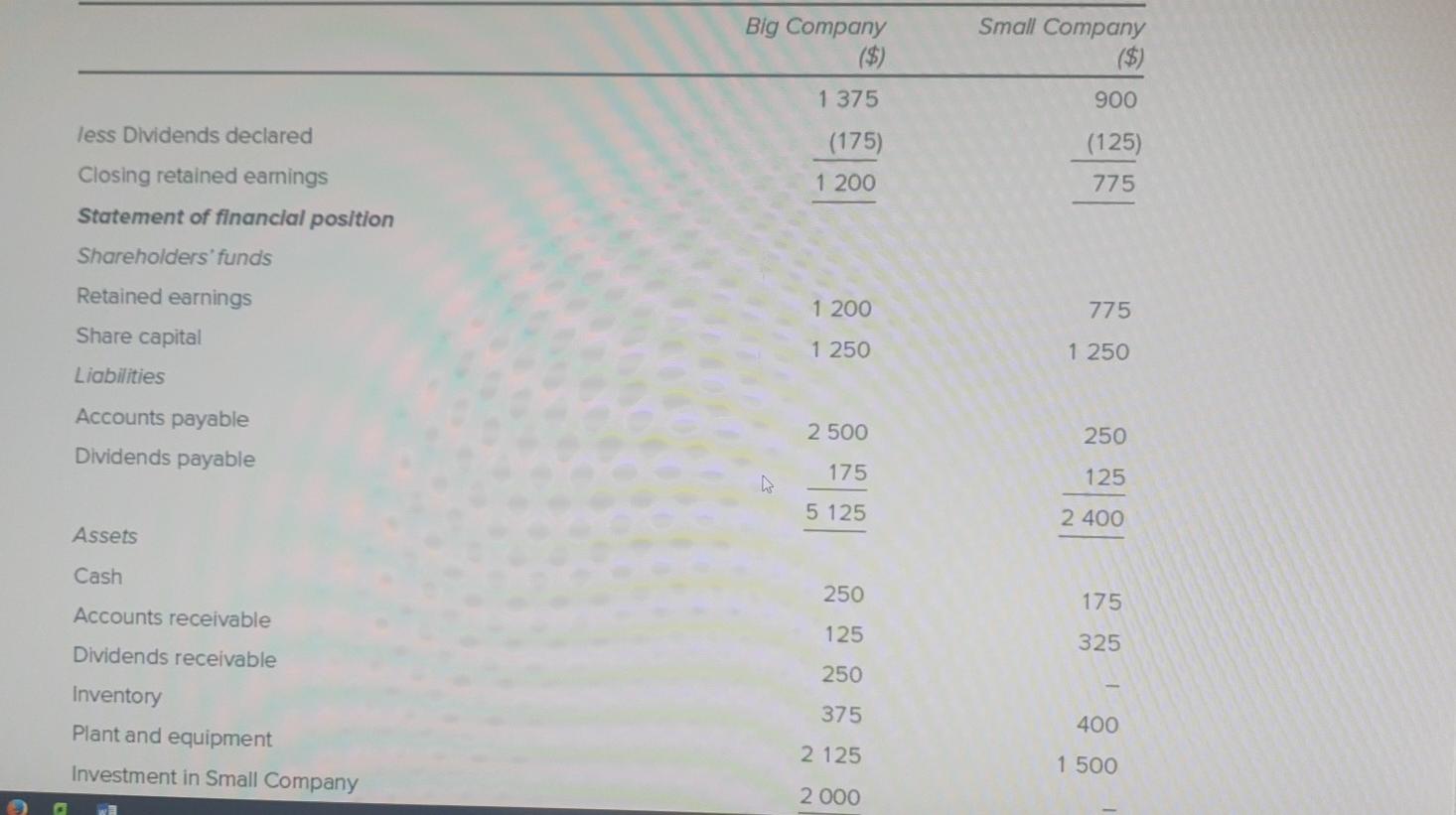

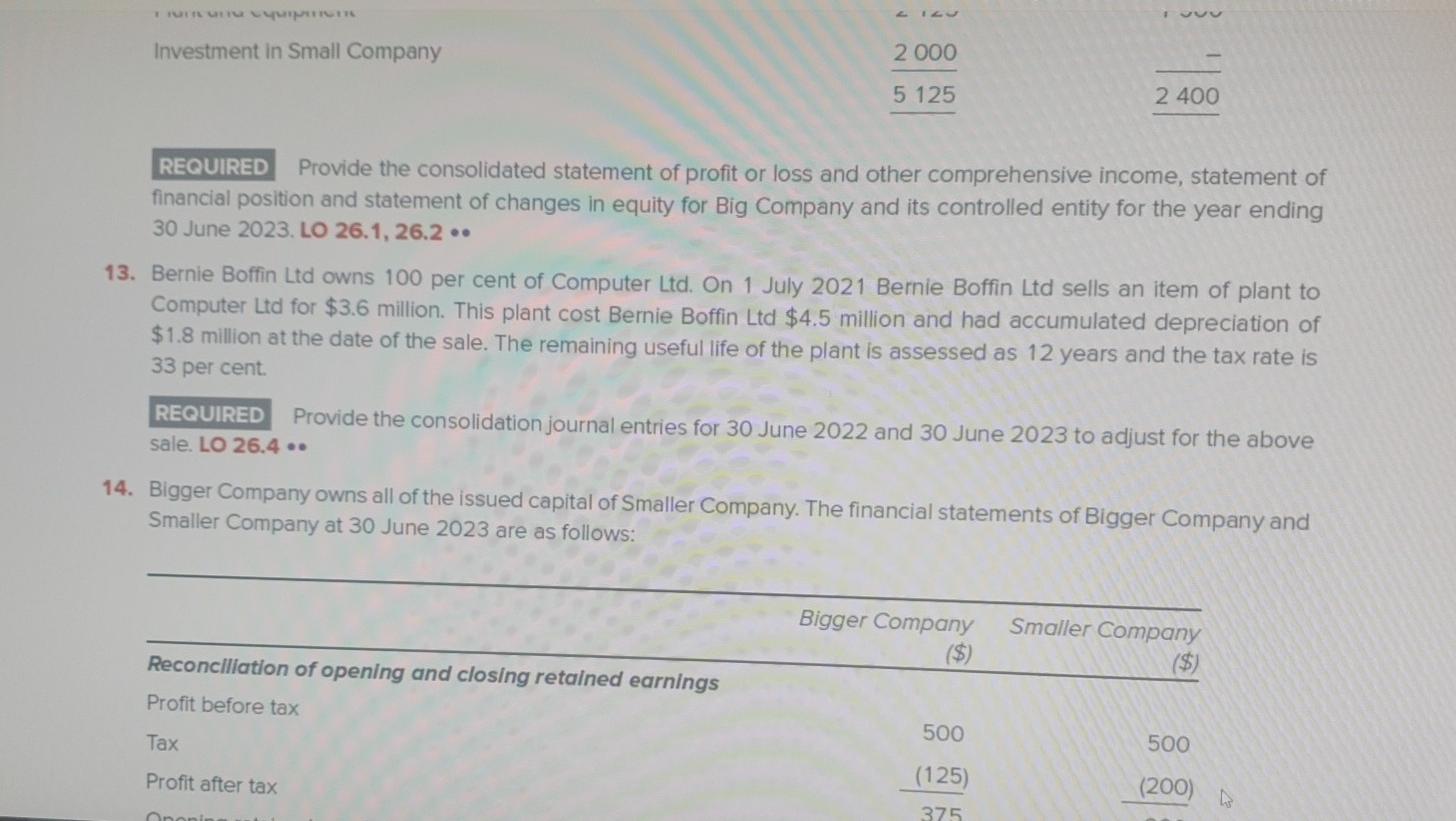

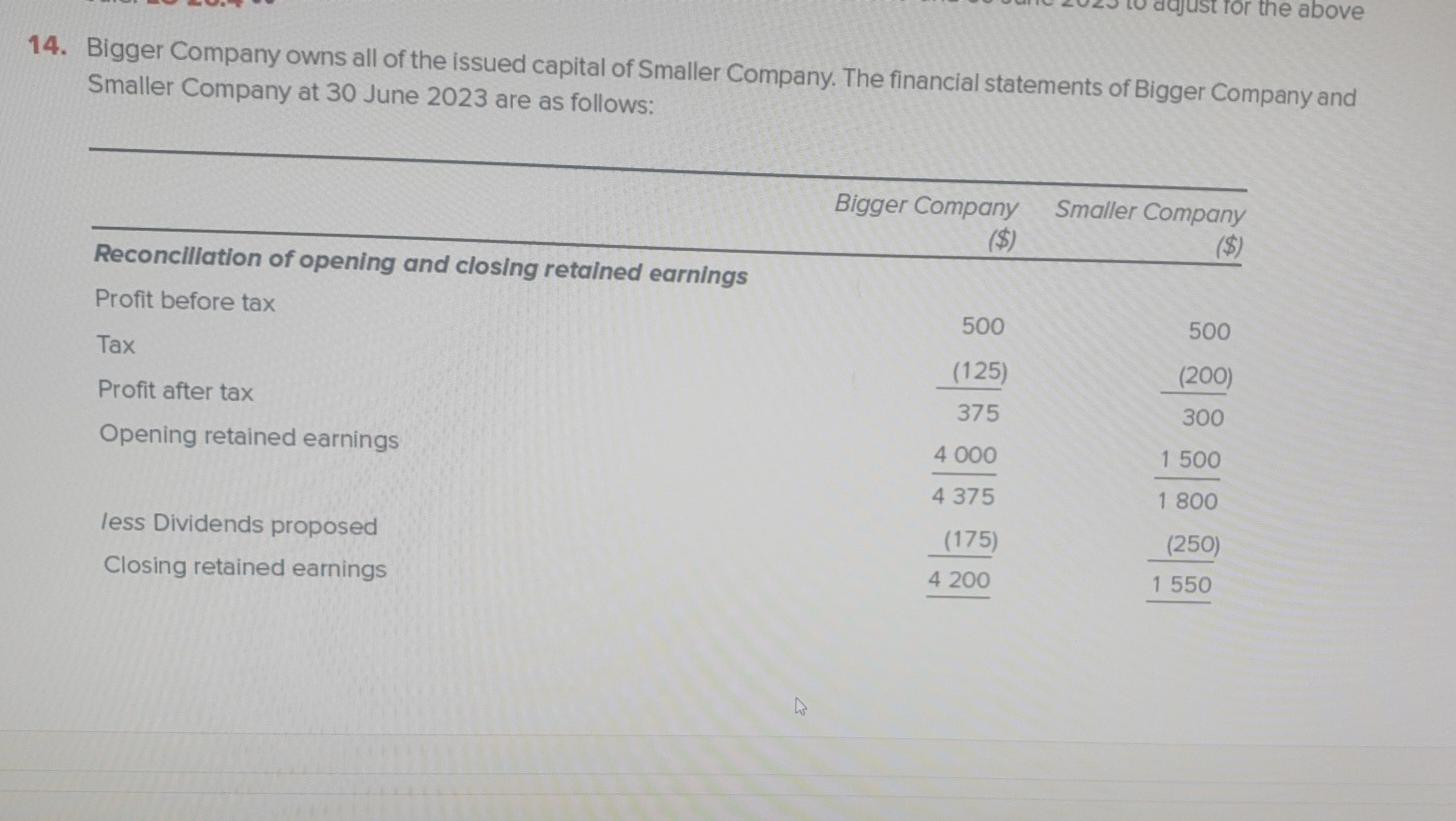

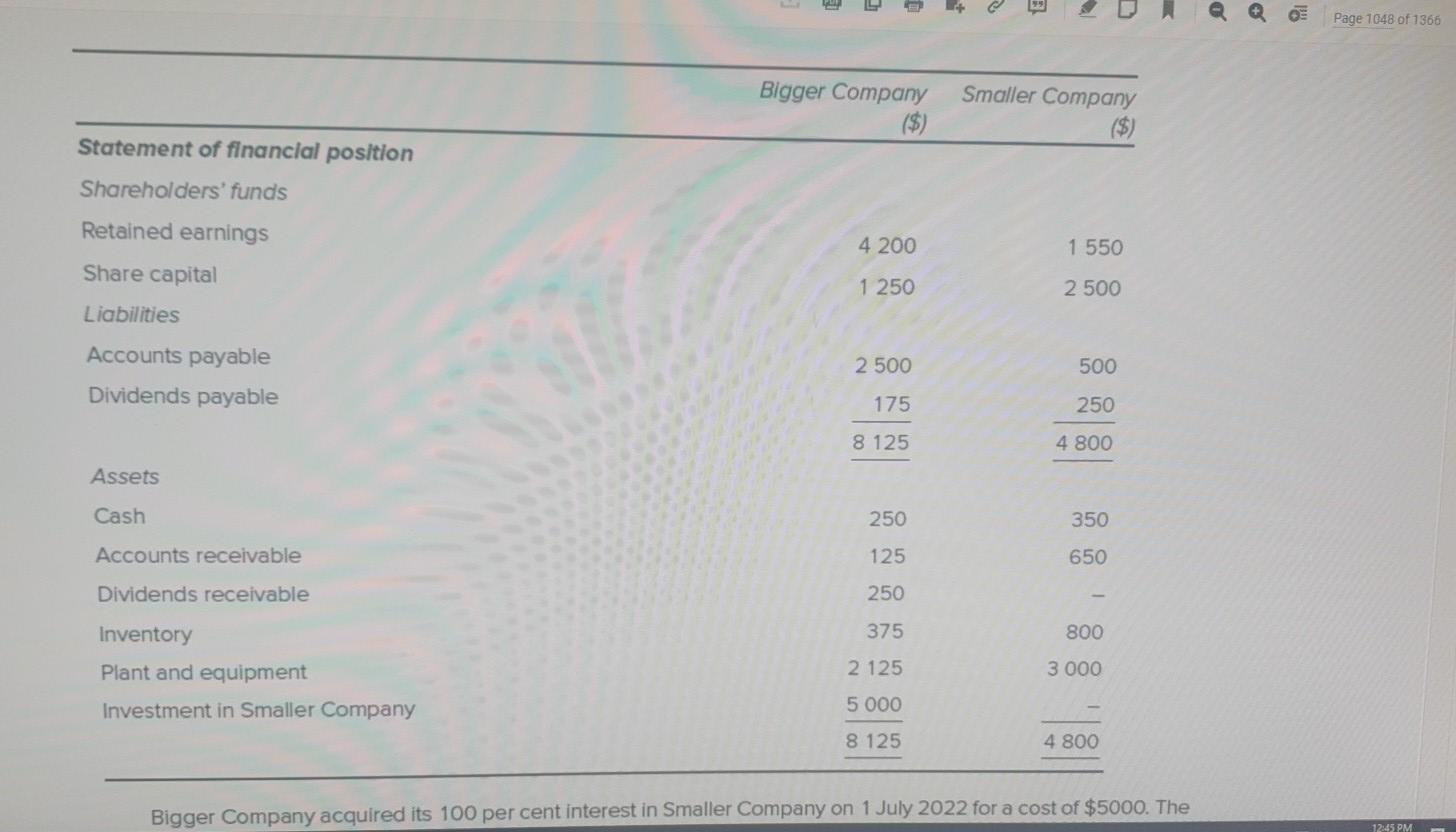

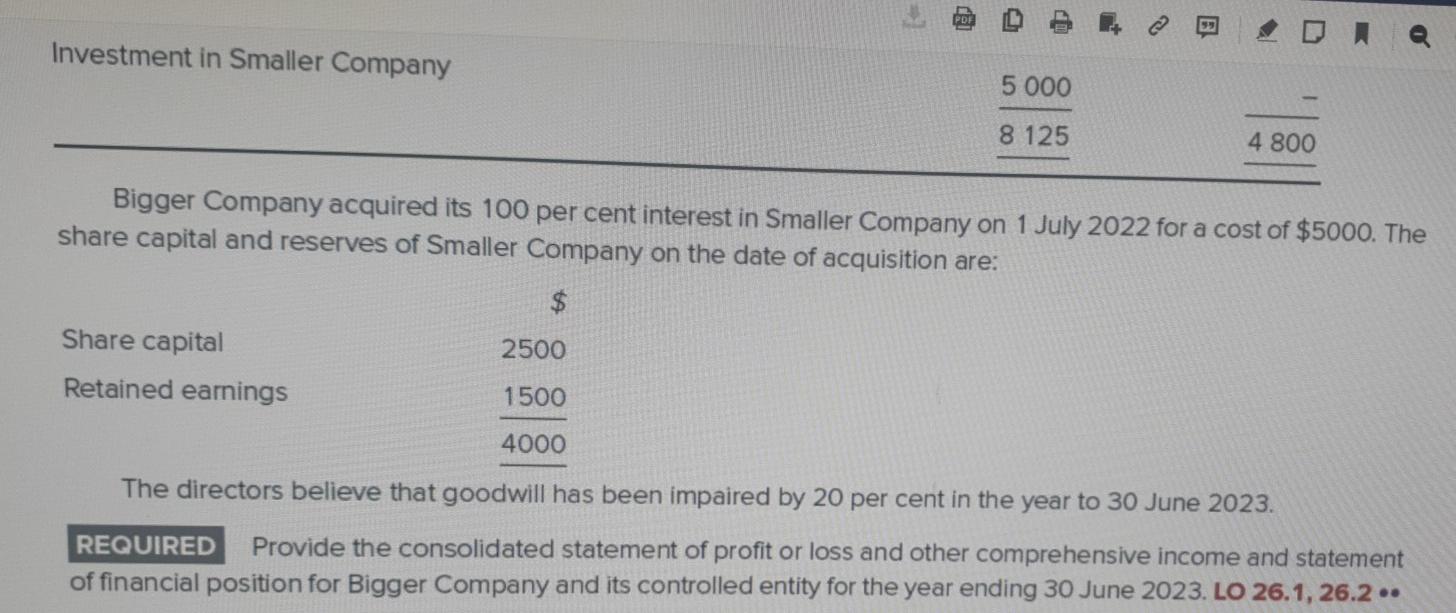

12. Big Company owns all of the issued capital of Small Company. Big Company acquires its 100 per cent interest in Small Company on 1 July 2022 for a cost of $2000. All assets are fairly stated at acquisition date. The share capital and reserves of Small Company on the date of acquisition are: $ 1 250 Share capital Retained earnings 750 2 000 The reconciliation of retained earnings and statements of financial position of Big Company and Small Company, as at 30 June 2023, are as follows: Big Company Small Company Reconciliation of opening and closing retained earnings Profit before tax 500 250 Tax (125) 375 (100) Profit after tax 150 Opening retained earnings 1 000 750 Big Company Small Company 1 375 900 (175) 1 200 less Dividends declared Closing retained earings Statement of financial position Shareholders' funds (125) 775 Retained earnings 1 200 775 Share capital 1 250 1 250 Liabilities Accounts payable Dividends payable 2 500 250 175 N 125 5 125 2 400 Assets Cash 250 175 Accounts receivable Dividends receivable 125 325 250 375 400 Inventory Plant and equipment Investment in Small Company 2125 1 500 2 000 Investment in Small Company 2 000 5 125 2 400 REQUIRED Provide the consolidated statement of profit or loss and other comprehensive income, statement of financial position and statement of changes in equity for Big Company and its controlled entity for the year ending 30 June 2023. LO 26.1, 26.2 .. 13. Bernie Boffin Ltd owns 100 per cent of Computer Ltd. On 1 July 2021 Bernie Boffin Ltd sells an item of plant to Computer Ltd for $3.6 million. This plant cost Bernie Boffin Ltd $4.5 million and had accumulated depreciation of $1.8 million at the date of the sale. The remaining useful life of the plant is assessed as 12 years and the tax rate is 33 per cent REQUIRED Provide the consolidation journal entries for 30 June 2022 and 30 June 2023 to adjust for the above sale. LO 26.4 .. 14. Bigger Company owns all of the issued capital of Smaller Company. The financial statements of Bigger Company and Smaller Company at 30 June 2023 are as follows: Bigger Company Smaller Company ($) Reconciliation of opening and closing retained earnings Profit before tax 500 Tax 500 Profit after tax (125) (200) nonin 375. dajust for the above 14. Bigger Company owns all of the issued capital of Smaller Company. The financial statements of Bigger Company and Smaller Company at 30 June 2023 are as follows: Bigger Company Smaller Company ($) Reconciliation of opening and closing retained earnings Profit before tax 500 500 Tax (125) (200) Profit after tax 375 300 Opening retained earnings 4 000 1 500 4 375 1 800 less Dividends proposed Closing retained earnings (175) 4 200 (250) 1 550 Page 1048 of 1366 Bigger Company Smaller Company Statement of financial position Shareholders' funds Retained earnings 4 200 1 550 Share capital 1 250 2500 Liabilities Accounts payable Dividends payable 2500 500 175 250 8 125 4 800 Assets Cash 250 350 Accounts receivable 125 650 Dividends receivable 250 375 800 Inventory Plant and equipment Investment in Smaller Company 2 125 3 000 5 000 8 125 4 800 Bigger Company acquired its 100 per cent interest in Smaller Company on 1 July 2022 for a cost of $5000. The 12:45 PM Investment in Smaller Company 5 000 8 125 4 800 Bigger Company acquired its 100 per cent interest in Smaller Company on 1 July 2022 for a cost of $5000. The share capital and reserves of Smaller Company on the date of acquisition are: $ 2500 Share capital Retained earnings 1500 4000 The directors believe that goodwill has been impaired by 20 per cent in the year to 30 June 2023. REQUIRED Provide the consolidated statement of profit or loss and other comprehensive income and statement of financial position for Bigger Company and its controlled entity for the year ending 30 June 2023. LO 26.1, 26.2.. 12. Big Company owns all of the issued capital of Small Company. Big Company acquires its 100 per cent interest in Small Company on 1 July 2022 for a cost of $2000. All assets are fairly stated at acquisition date. The share capital and reserves of Small Company on the date of acquisition are: $ 1 250 Share capital Retained earnings 750 2 000 The reconciliation of retained earnings and statements of financial position of Big Company and Small Company, as at 30 June 2023, are as follows: Big Company Small Company Reconciliation of opening and closing retained earnings Profit before tax 500 250 Tax (125) 375 (100) Profit after tax 150 Opening retained earnings 1 000 750 Big Company Small Company 1 375 900 (175) 1 200 less Dividends declared Closing retained earings Statement of financial position Shareholders' funds (125) 775 Retained earnings 1 200 775 Share capital 1 250 1 250 Liabilities Accounts payable Dividends payable 2 500 250 175 N 125 5 125 2 400 Assets Cash 250 175 Accounts receivable Dividends receivable 125 325 250 375 400 Inventory Plant and equipment Investment in Small Company 2125 1 500 2 000 Investment in Small Company 2 000 5 125 2 400 REQUIRED Provide the consolidated statement of profit or loss and other comprehensive income, statement of financial position and statement of changes in equity for Big Company and its controlled entity for the year ending 30 June 2023. LO 26.1, 26.2 .. 13. Bernie Boffin Ltd owns 100 per cent of Computer Ltd. On 1 July 2021 Bernie Boffin Ltd sells an item of plant to Computer Ltd for $3.6 million. This plant cost Bernie Boffin Ltd $4.5 million and had accumulated depreciation of $1.8 million at the date of the sale. The remaining useful life of the plant is assessed as 12 years and the tax rate is 33 per cent REQUIRED Provide the consolidation journal entries for 30 June 2022 and 30 June 2023 to adjust for the above sale. LO 26.4 .. 14. Bigger Company owns all of the issued capital of Smaller Company. The financial statements of Bigger Company and Smaller Company at 30 June 2023 are as follows: Bigger Company Smaller Company ($) Reconciliation of opening and closing retained earnings Profit before tax 500 Tax 500 Profit after tax (125) (200) nonin 375. dajust for the above 14. Bigger Company owns all of the issued capital of Smaller Company. The financial statements of Bigger Company and Smaller Company at 30 June 2023 are as follows: Bigger Company Smaller Company ($) Reconciliation of opening and closing retained earnings Profit before tax 500 500 Tax (125) (200) Profit after tax 375 300 Opening retained earnings 4 000 1 500 4 375 1 800 less Dividends proposed Closing retained earnings (175) 4 200 (250) 1 550 Page 1048 of 1366 Bigger Company Smaller Company Statement of financial position Shareholders' funds Retained earnings 4 200 1 550 Share capital 1 250 2500 Liabilities Accounts payable Dividends payable 2500 500 175 250 8 125 4 800 Assets Cash 250 350 Accounts receivable 125 650 Dividends receivable 250 375 800 Inventory Plant and equipment Investment in Smaller Company 2 125 3 000 5 000 8 125 4 800 Bigger Company acquired its 100 per cent interest in Smaller Company on 1 July 2022 for a cost of $5000. The 12:45 PM Investment in Smaller Company 5 000 8 125 4 800 Bigger Company acquired its 100 per cent interest in Smaller Company on 1 July 2022 for a cost of $5000. The share capital and reserves of Smaller Company on the date of acquisition are: $ 2500 Share capital Retained earnings 1500 4000 The directors believe that goodwill has been impaired by 20 per cent in the year to 30 June 2023. REQUIRED Provide the consolidated statement of profit or loss and other comprehensive income and statement of financial position for Bigger Company and its controlled entity for the year ending 30 June 2023. LO 26.1, 26.2Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started