I would like these answered as soon ass possible within 1 hour please On December 31, 2017, Bridgeport Company had $1,206,000 of short-term debt in

I would like these answered as soon ass possible within 1 hour please

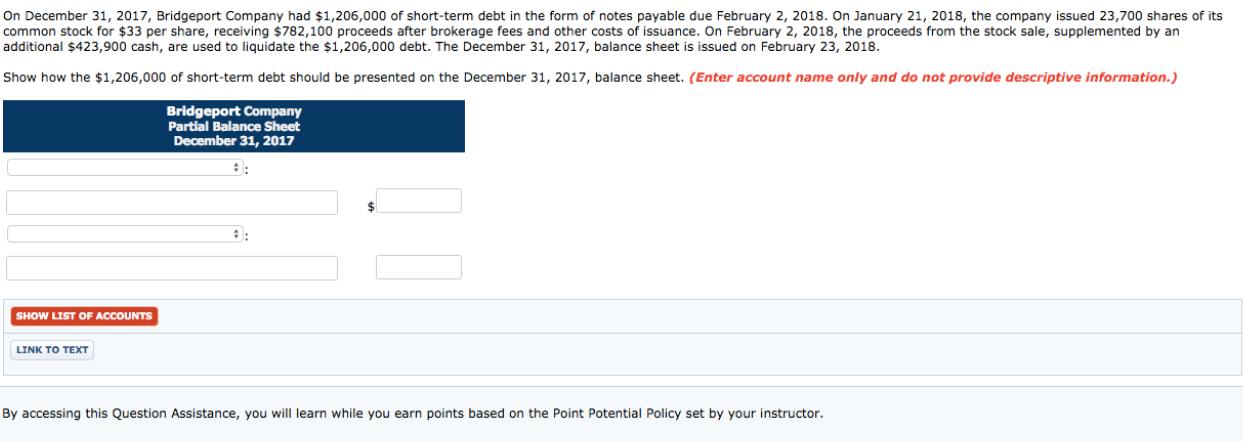

On December 31, 2017, Bridgeport Company had $1,206,000 of short-term debt in the form of notes payable due February 2, 2018. On January 21, 2018, the company issued 23,700 shares of its common stock for $33 per share, receiving $782,100 proceeds after brokerage fees and other costs of issuance. On February 2, 2018, the proceeds from the stock sale, supplemented by an additional $423,900 cash, are used to liquidate the $1,206,000 debt. The December 31, 2017, balance sheet is issued on February 23, 2018. Show how the $1,206,000 of short-term debt should be presented on the December 31, 2017, balance sheet. (Enter account name only and do not provide descriptive information.) Bridgeport Company Partial Balance Sheet December 31, 2017 SHOW LIST OF ACCOUNTS LINK TO TEXT By accessing this Question Assistance, you will learn while you earn points based on the Point Potential Policy set by your instructor.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Lets break down the exercises one by one Exercise 138 Bridgeport Company Presentation of ShortTerm D...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started