Answered step by step

Verified Expert Solution

Question

1 Approved Answer

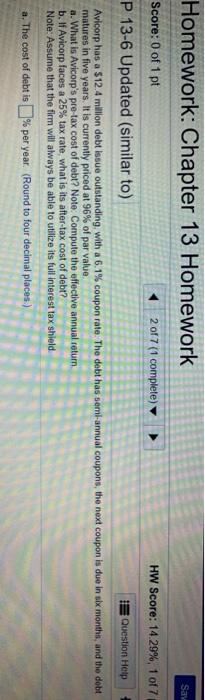

I would like to aee how to manually calculate it without using finance calcuator please. Homework: Chapter 13 Homework Sav Score: 0 of 1 pt

I would like to aee how to manually calculate it without using finance calcuator please.

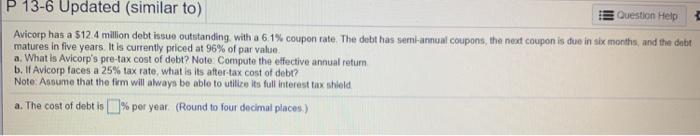

Homework: Chapter 13 Homework Sav Score: 0 of 1 pt 2 of 7 (1 complete) HW Score: 14.29%, 1 of 7 P 13-6 Updated (similar to) Question Help Avicorp has a $12.4 million debt issue outstanding, with a 6.1% coupon rate. The debt has semi-annual coupons, the next coupon is due in six months, and the debt matures in five years. It is currently priced at 96% of par value a. What is Avicorp's pre-tax cost of debt? Note: Compute the effective annual return b. If Avicorp faces a 25% tax rate, what is its after-tax cost of debt? Note: Assume that the firm will always be able to utilize its full interest tax shield a. The cost of debt is 1% per year. (Round to four decimal places) P 13-6 Updated (similar to) Question Help Avicorp has a $12.4 million debt issue outstanding, with a 61% coupon rate. The debt has semi-annual coupons, the next coupon is due in six months, and the debt matures in five years. It is currently priced at 96% of par value a. What is Avicorp's pre-tax cost of debt? Noto Compute the effective annual retum b. If Avicorp faces a 25% tax rate, what is its after-tax cost of debt? Note: Assume that the firm will always be able to utilize its full interest tax shield a. The cost of debt is % per year. (Round to four decimal places) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started