I would like to ask part d

I would like to ask part d

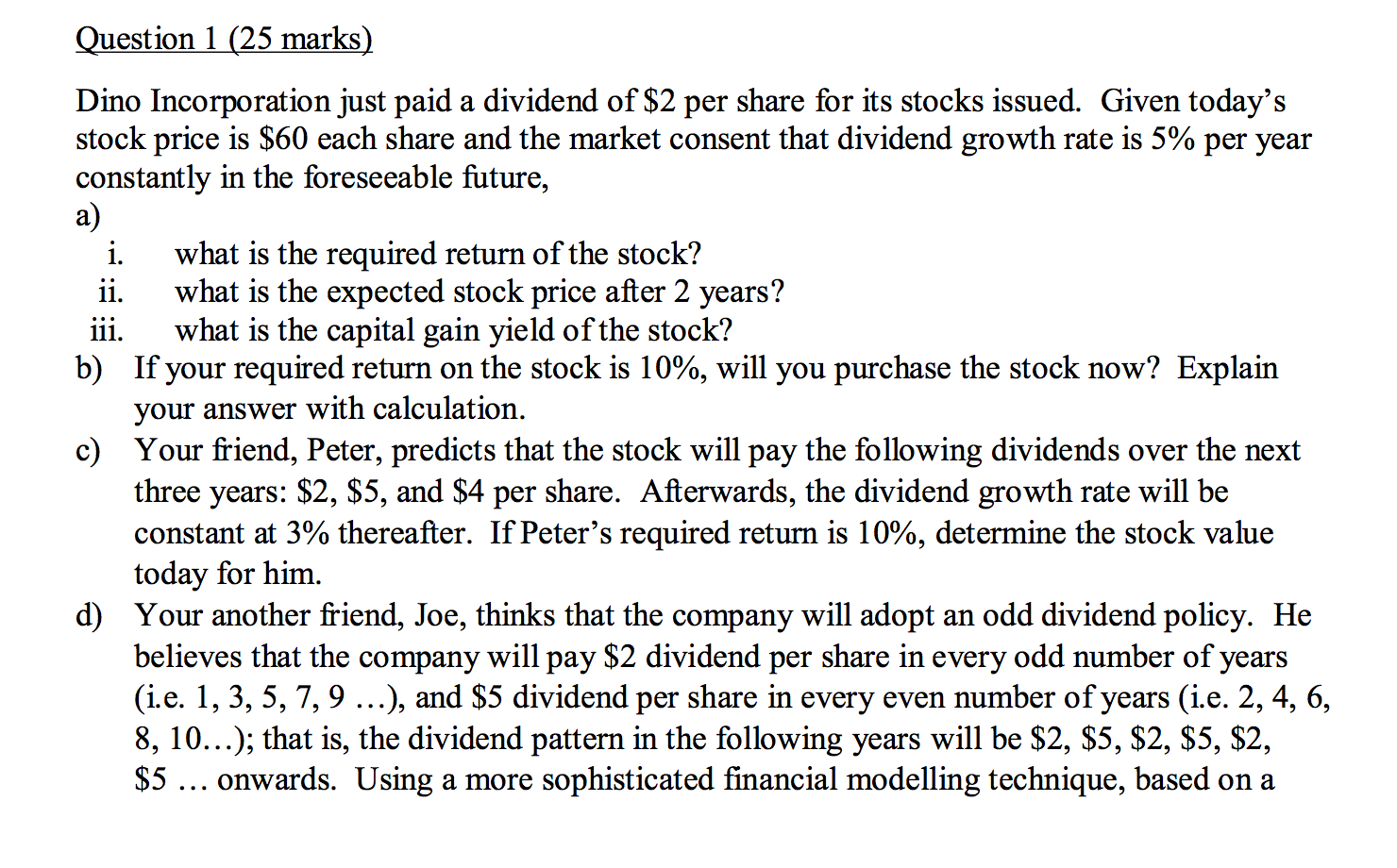

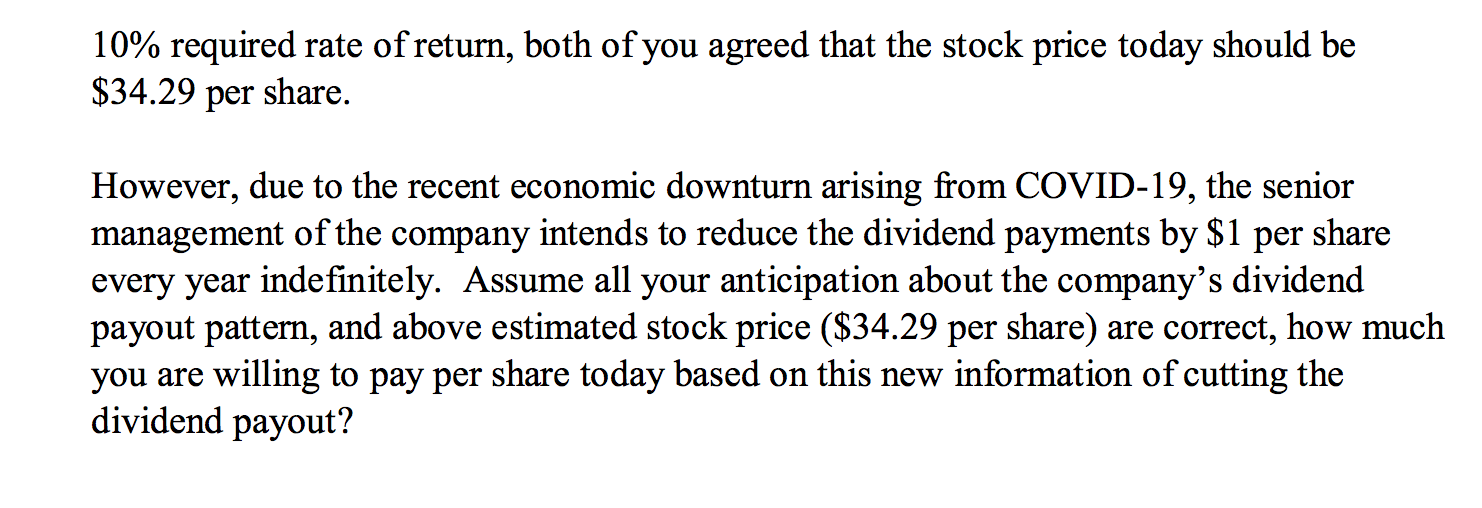

Question 1 (25 marks) Dino Incorporation just paid a dividend of $2 per share for its stocks issued. Given today's stock price is $60 each share and the market consent that dividend growth rate is 5% per year constantly in the foreseeable future, a) i. what is the required return of the stock? ii. what is the expected stock price after 2 years? iii. what is the capital gain yield of the stock? b) If your required return on the stock is 10%, will you purchase the stock now? Explain your answer with calculation. c) Your friend, Peter, predicts that the stock will pay the following dividends over the next three years: $2, $5, and $4 per share. Afterwards, the dividend growth rate will be constant at 3% thereafter. If Peter's required return is 10%, determine the stock value today for him. d) Your another friend, Joe, thinks that the company will adopt an odd dividend policy. He believes that the company will pay $2 dividend per share in every odd number of years (i.e. 1, 3, 5, 7, 9 ...), and $5 dividend per share in every even number of years (i.e. 2, 4, 6, 8, 10...); that is, the dividend pattern in the following years will be $2, $5, $2, $5, $2, $5 ... onwards. Using a more sophisticated financial modelling technique, based on a 10% required rate of return, both of you agreed that the stock price today should be $34.29 per share. However, due to the recent economic downturn arising from COVID-19, the senior management of the company intends to reduce the dividend payments by $1 per share every year indefinitely. Assume all your anticipation about the company's dividend payout pattern, and above estimated stock price ($34.29 per share) are correct, how much you are willing to pay per share today based on this new information of cutting the dividend payout? Question 1 (25 marks) Dino Incorporation just paid a dividend of $2 per share for its stocks issued. Given today's stock price is $60 each share and the market consent that dividend growth rate is 5% per year constantly in the foreseeable future, a) i. what is the required return of the stock? ii. what is the expected stock price after 2 years? iii. what is the capital gain yield of the stock? b) If your required return on the stock is 10%, will you purchase the stock now? Explain your answer with calculation. c) Your friend, Peter, predicts that the stock will pay the following dividends over the next three years: $2, $5, and $4 per share. Afterwards, the dividend growth rate will be constant at 3% thereafter. If Peter's required return is 10%, determine the stock value today for him. d) Your another friend, Joe, thinks that the company will adopt an odd dividend policy. He believes that the company will pay $2 dividend per share in every odd number of years (i.e. 1, 3, 5, 7, 9 ...), and $5 dividend per share in every even number of years (i.e. 2, 4, 6, 8, 10...); that is, the dividend pattern in the following years will be $2, $5, $2, $5, $2, $5 ... onwards. Using a more sophisticated financial modelling technique, based on a 10% required rate of return, both of you agreed that the stock price today should be $34.29 per share. However, due to the recent economic downturn arising from COVID-19, the senior management of the company intends to reduce the dividend payments by $1 per share every year indefinitely. Assume all your anticipation about the company's dividend payout pattern, and above estimated stock price ($34.29 per share) are correct, how much you are willing to pay per share today based on this new information of cutting the dividend payout

I would like to ask part d

I would like to ask part d