Question

I would like to check my work for problem 3.3 on pg 105 in Healthcare Finance 5th ed. Will someone help? a) This income statement

I would like to check my work for problem 3.3 on pg 105 in Healthcare Finance 5th ed. Will someone help?

I would like to check my work for problem 3.3 on pg 105 in Healthcare Finance 5th ed. Will someone help?

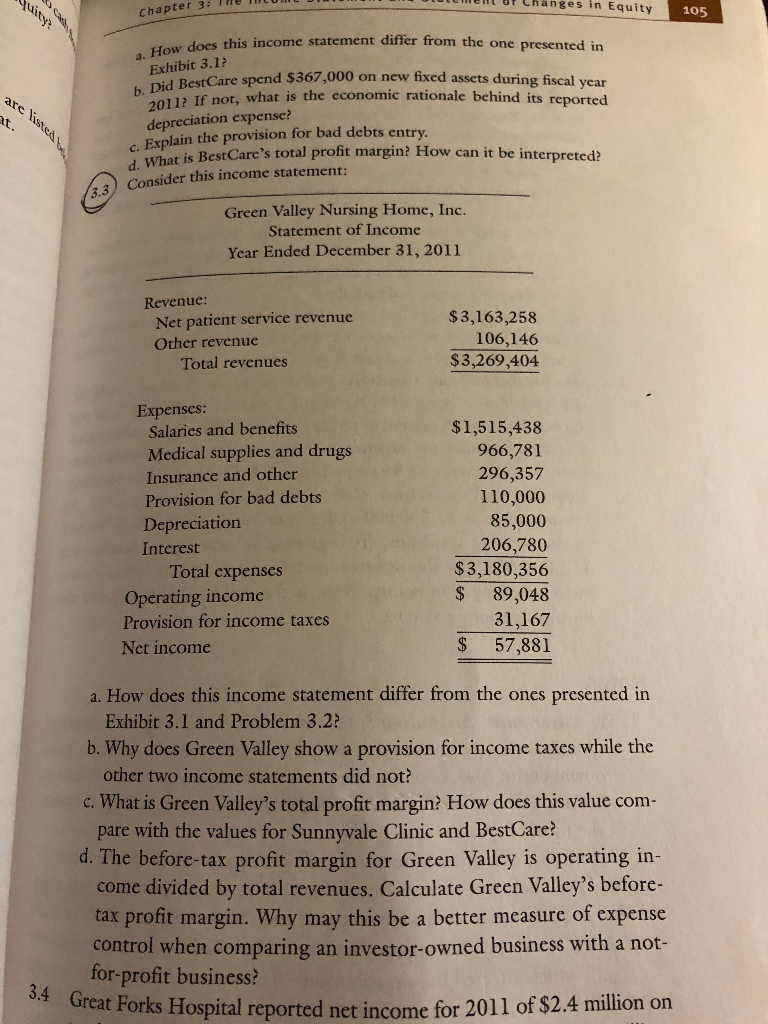

a) This income statement is different in the fact that their revenue (non-operating revenue) is combined with operating revenue and in Exhibit 3.1 the non-operating revenue is categorized at the bottom. This statement also has an addition of income taxes suggesting that they are investor-owned. This statement is true to the numbers given whereas the previous two statements are listed in thousands.

b) This particular income statement is for a business that is investor owned (for-profit) because of the addition of income taxes which they must pay. The other two statements do no show income taxes being expended.

c) Profit Margin: 57,881/3,269,404=.0177=1.8%; Therefore, 1.8 cents were generated as profit for each dollar of revenue.

d) Before taxes profit margin=89,048/3,269,404=.027=2.7%. This number suggests that the business is indeed controlling their costs and generating enough revenue from their actual operations for patient services.

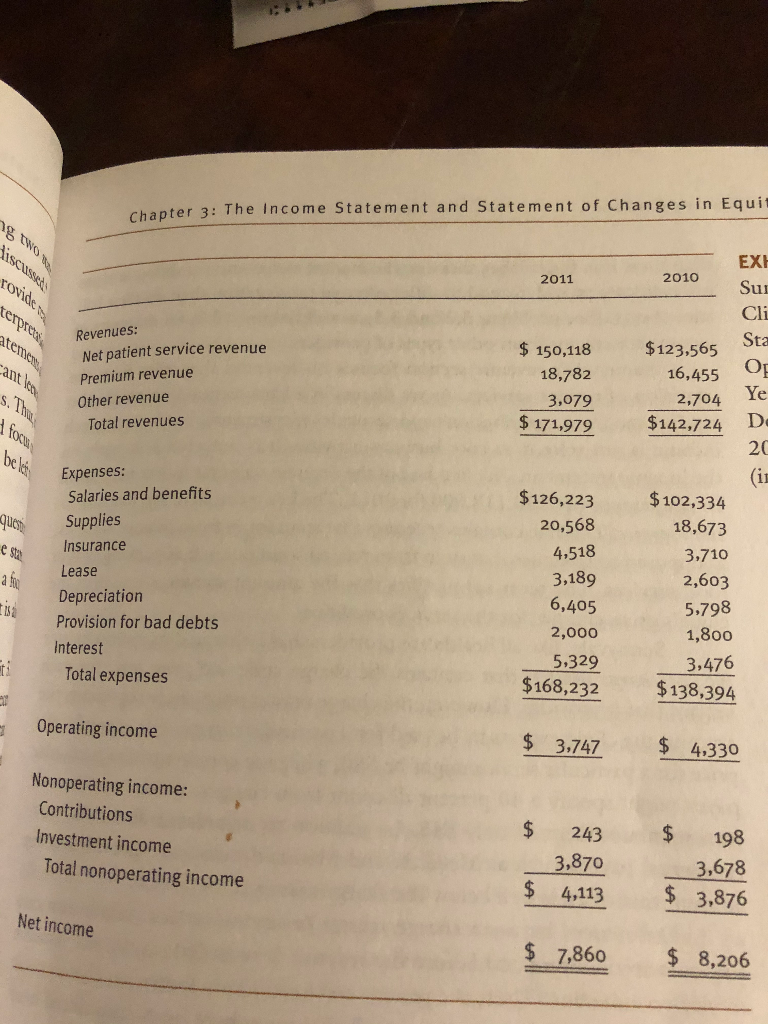

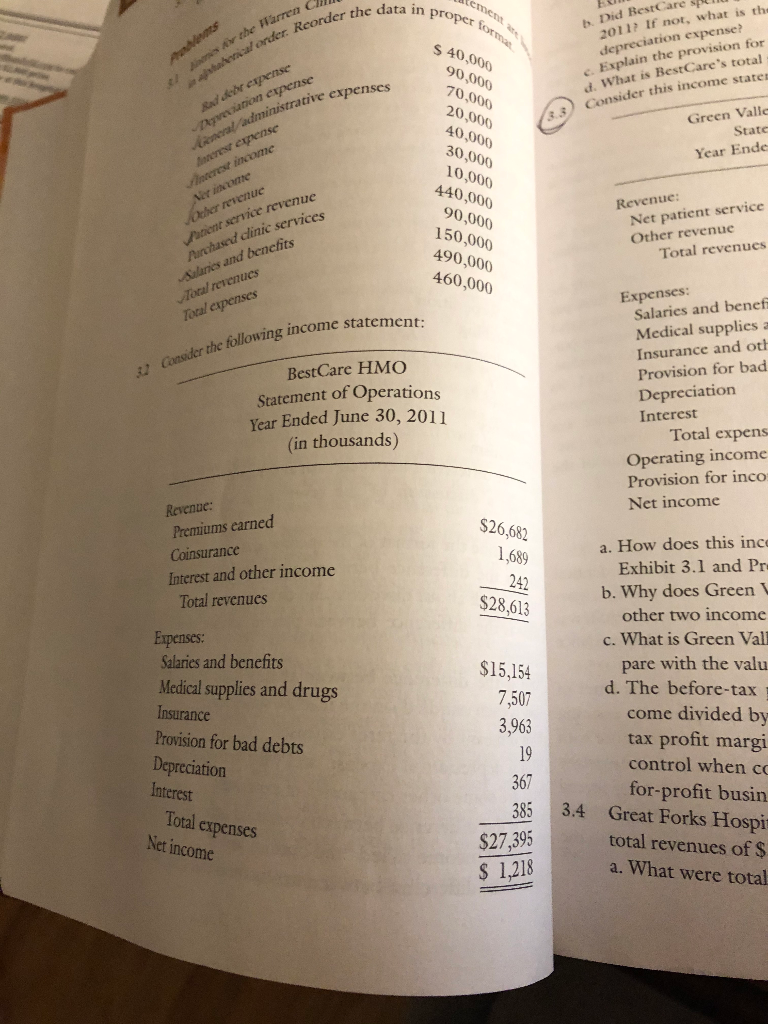

Mellor Changes in Equity Chapter 3: The 105 this income statement differ from the one presented in a. How does this in are listed Exhibit 3.1? h. Did BestCare spend $367,000 2011? If not, what is the economic rationale behind its reported depreciation expense? Explain the provision for bad debts entry. is BestCare's total profit margin? How can it be interpreted? Consider this income statement: d. What is BestCare Green Valley Nursing Home, Inc. Statement of Income Year Ended December 31, 2011 Revenue: Net patient service revenue Other revenue Total revenues $3,163,258 106,146 $3,269,404 Expenses: Salaries and benefits Medical supplies and drugs Insurance and other Provision for bad debts Depreciation Interest Total expenses Operating income Provision for income taxes Net income $1,515,438 966,781 296,357 110,000 85,000 206,780 $3,180,356 $ 89,048 31,167 $ 57,881 a. How does this income statement differ from the ones presented in Exhibit 3.1 and Problem 3.2? b. Why does Green Valley show a provision for income taxes while the other two income statements did not? c. What is Green Valley's total profit margin? How does this value com- pare with the values for Sunnyvale Clinic and BestCare? d. The before-tax profit margin for Green Valley is operating in- come divided by total revenues. Calculate Green Valley's before- tax profit margin. Why may this be a better measure of expense control when comparing an investor-owned business with a not- for-profit business? Forks Hospital reported net income for 2011 of $2.4 million on 3.4 Great Forks Hospital Chapter 3: The Income Statement and Statement of Changes in Equi rovides 2011 2010 terrace stemmen ant EX Sus CH Sta Revenues: Net patient service revenue Premium revenue Other revenue Total revenues O! $ 150,118 18,782 3,079 $ 171,979 $123,565 16,455 2,704 $142,724 1 form Ye D 20 belt ques esta Expenses: Salaries and benefits Supplies Insurance Lease Depreciation Provision for bad debts Interest Total expenses $126,223 20,568 4,518 3,189 6,405 2,000 5,329 $168,232 $102,334 18,673 3,710 2,603 5,798 1,800 3,476 $ 138,394 Operating income $ 3,747 $ 4,330 Nonoperating income: Contributions Investment income Total nonoperating income $ $ 243 3,870 4,113 198 3,678 3,876 $ $ Net income $ 7,860 $ 8,206 Nemete a en Cum der the data in prop proper lo sonder Did BestCare 2011? If not, what is the depreciation expense? c. Explain the provision for d. What is BestCare's total Consider this income states rative expenses $ 40,000 90,000 70,000 20,000 40.000 30,000 10,000 440,000 Green Valle Statc Year Ende R etanse on eipense en administrative anestepense rest income Time Daher revenue 90,000 150,000 490,000 Revenue: Net patient service Other revenue Total revenues Patient service revenue Panchased clinic services Salaries and benefits Tool revenues Tocal expenses 460,000 following income statement: U Consider the following in BestCare HMO Statement of Operations Year Ended June 30, 2011 (in thousands) Expenses: Salaries and benef Medical supplies a Insurance and oth Provision for bad Depreciation Interest Total expens Operating income Provision for inco Net income Ravenue: Premiums earned Coinsurance Interest and other income $26,682 1,689 242 $28,613 Total revenues Expenses: Salaries and benefits Medical supplies and drugs Insurance Provision for bad debts $15,154 7,507 3,963 a. How does this ince Exhibit 3.1 and Pr b. Why does Green other two income c. What is Green Vall pare with the valu d. The before-tax come divided by tax profit margi control when ce for-profit busin Depreciation 367 Interest Total expenses Net income 385 3.4 $27,395 Great Forks Hospit total revenues of $ a. What were total $ 1,218Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started