Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I would like to know the answer by step by step. and detail explanation Answer all questions in the answer booklet provided Question 1 (25

I would like to know the answer by step by step. and detail explanation

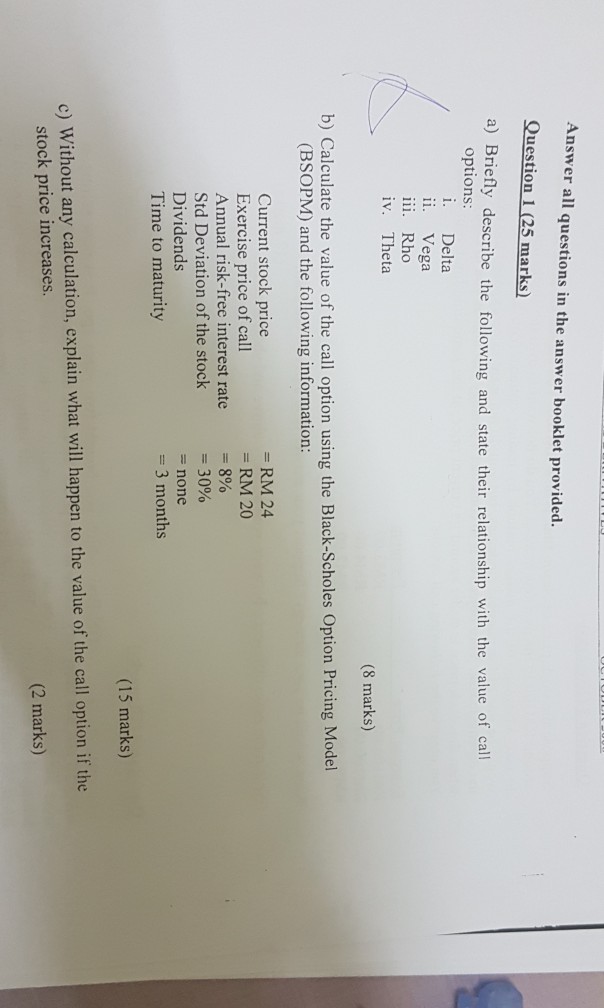

Answer all questions in the answer booklet provided Question 1 (25 marks a) Briefly describe the following and state their relationship with the value of call options i. Delta ii. Vega iii. Rho iv. Theta (8 marks) b) Calculate the value of the call option using the Black-Scholes Option Pricing Model (BSOPM) and the following information: =RM 24 =RM 20 = 8% Current stock price Exercise price of call Annual risk-free interest rate Std Deviation of the stock Dividends Time to maturity 30% = none 3 months (15 marks) c) Without any calculation, explain what will happen to the value of the call option if the stock price increases. (2 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started