Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I would like to know the answer by step by step. and detail explanation uestion 4 (25 marks anjung Bhd is a property firm and

I would like to know the answer by step by step. and detail explanation

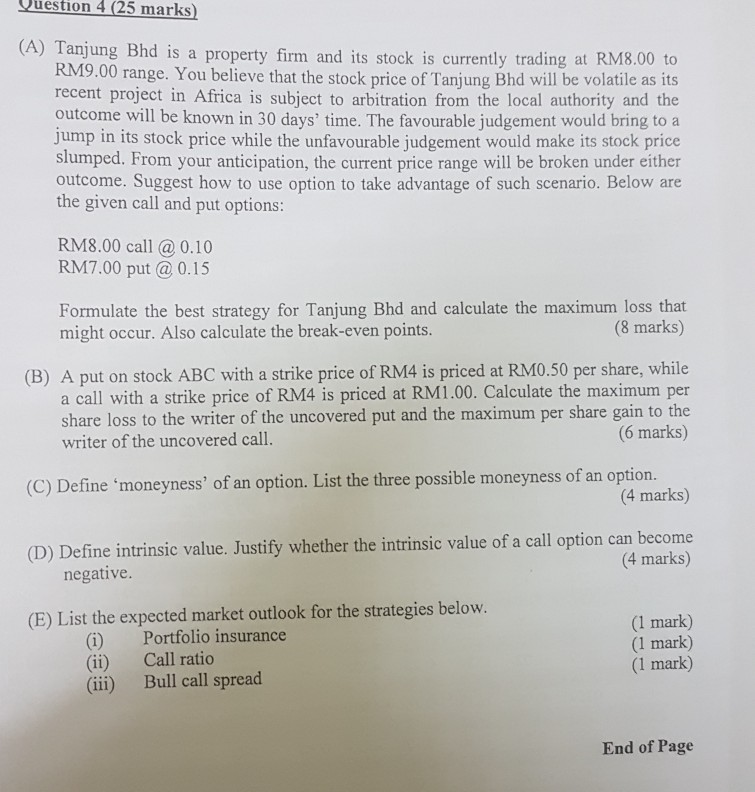

uestion 4 (25 marks anjung Bhd is a property firm and its stock is currently trading at RM8.00 to RM 9.00 range. You believe that the stock price of Tanjung Bhd will be volatile as its recent project in Africa is subject to arbitration from the local authority and the outcome will be known in 30 days' time. The favourable judgement would bring to a jump in its stock price while the unfavourable judgement would make its stock price slumped. From your anticipation, the current price range will be broken under either outcome. Suggest how to use option to take advantage of such scenario. Below are the given call and put options: RM8.00 call @ 0.10 RM7.00 put @ 0.15 Formulate the best strategy for Tanjung Bhd and calculate the maximum loss that (8 marks) might occur. Also calculate the break-even points (B) A put on stock ABC with a strike price of RM4 is priced at RM0.50 per share, while a call with a strike price of RM4 is priced at RM1.00. Calculate the maximum per share loss to the writer of the uncovered put and the maximum per share gain to the (6 marks) writer of the uncovered call. (C) Define 'moneyness' of an option. List the three possible moneyness of an option. (D) Define intrinsic value. Justify whether the intrinsic value of a call option can become (E) List the expected market outlook for the strategies below. (4 marks) (4 marks) negative. (i) Portfolio insurance (ii) Call ratio (ii) Bull call spread (1 mark) (1 mark) (1 mark) End of Page uestion 4 (25 marks anjung Bhd is a property firm and its stock is currently trading at RM8.00 to RM 9.00 range. You believe that the stock price of Tanjung Bhd will be volatile as its recent project in Africa is subject to arbitration from the local authority and the outcome will be known in 30 days' time. The favourable judgement would bring to a jump in its stock price while the unfavourable judgement would make its stock price slumped. From your anticipation, the current price range will be broken under either outcome. Suggest how to use option to take advantage of such scenario. Below are the given call and put options: RM8.00 call @ 0.10 RM7.00 put @ 0.15 Formulate the best strategy for Tanjung Bhd and calculate the maximum loss that (8 marks) might occur. Also calculate the break-even points (B) A put on stock ABC with a strike price of RM4 is priced at RM0.50 per share, while a call with a strike price of RM4 is priced at RM1.00. Calculate the maximum per share loss to the writer of the uncovered put and the maximum per share gain to the (6 marks) writer of the uncovered call. (C) Define 'moneyness' of an option. List the three possible moneyness of an option. (D) Define intrinsic value. Justify whether the intrinsic value of a call option can become (E) List the expected market outlook for the strategies below. (4 marks) (4 marks) negative. (i) Portfolio insurance (ii) Call ratio (ii) Bull call spread (1 mark) (1 mark) (1 mark) End of PageStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started