Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I would like to know the answer by step by step. and detail explanation Question 2 (25 marks) (A) Define 'naked' or uncovered position. List

I would like to know the answer by step by step. and detail explanation

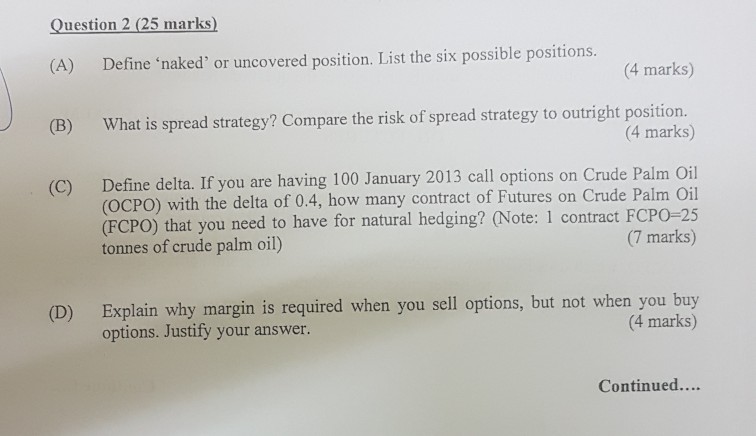

Question 2 (25 marks) (A) Define 'naked' or uncovered position. List the six possible positions. (4 marks) What is spread strategy? Compare the risk of spread strategy to outright position. (4 marks) (B) Define delta. If you are having 100 January 2013 call options on Crude Palm Oil (OCPO) with the delta of 0.4, how many contract of Futures on Crude Palm Oil (FCPO) that you need to have for natural hedging? (Note: 1 contract FCPO-25 (7 marks) (C) tonnes of crude palm oil) Explain why margin is required when you sell options, but not when you buy (4 marks) (D) options. Justify your answer. ContinuedStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started