I would rate if your answer is helpful, the answer is in red as an aid for you to explain, please try!

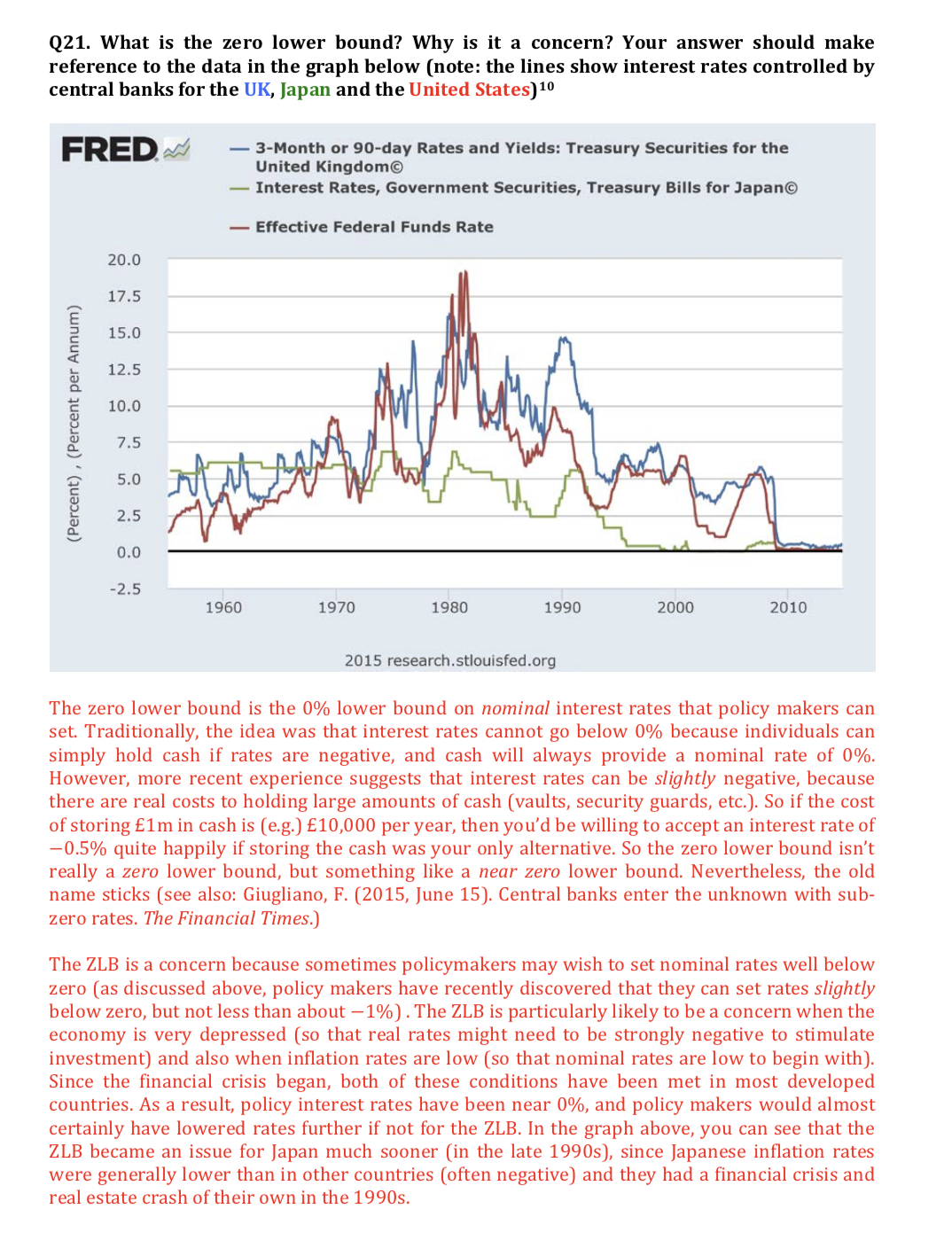

Q21. What is the zero lower bound? Why is it a concern? Your answer should make reference to the data in the graph below (note: the lines show interest rates controlled by central banks for the UK, Japan and the United States)\" FRED 94$ 3-Month or 90-day Rates and elds: Treasury Securltlee for the United Kingdom Interest Rates, Government Securities, Treasuryr Bills for Jepen Effective Federal Funds Rate 20.0 .--. 17.5 E c 15.0 E I. 12.5 2. E. 10.0 a: 7.5 :5- 5.0 E 2.5 .12, 0.0 -2.5 1960 1970 1900 1990 2000 2010 2015 researd1.stlouisfed.0rg The zero lower bound is the 0% lower bound on nominal interest rates that policy makers can set. Traditionally, the idea was that interest rates cannot go below 0% because individuals can simply hold cash if rates are negative, and cash will always provide a nominal rate of 0%. However, more recent experience suggests that interest rates can be slightly negative, because there are real costs to holding large amounts of cash (vaults, security guards, etc.). So ifthe cost of storing Elm in cash is [e.g.) 10,000 per year, then you'd be willing to accept an interest rate of 0.5% quite happily if storing the cash was your only alternative. So the zero lower bound isn't really a zero lower bound, but something like a near zero lower bound. Nevertheless, the old name sticks [see also: Giugliano, F. [2015, June 15). Central banks enter the unknown with sub- zero rates. The Financial Times.) The ZLB is a concern because sometimes policymakers may wish to set nominal rates well below zero [as discussed above, policy makers have recently discovered that they can set rates slightly below zero, but not less than about 1%) . The ZLB is particularly likely to be a concern when the economy is very depressed [so that real rates might need to be strongly negative to stimulate investment) and also when ination rates are low [so that nominal rates are low to begin with). Since the financial crisis began, both of these conditions have been met in most developed countries. As a result, policy interest rates have been near 0%, and policy makers would almost certainly have lowered rates further if not for the ZLB. In the graph above, you can see that the ZLB became an issue for Japan much sooner [in the late 19905), since Japanese ination rates were generally lower than in other countries [often negative) and they had a financial crisis and real estate crash of their own in the 19905