Answered step by step

Verified Expert Solution

Question

1 Approved Answer

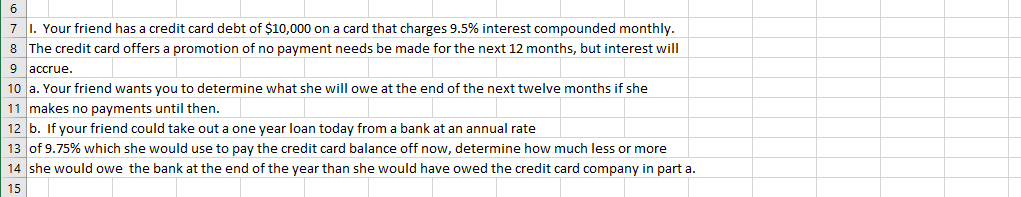

I. Your friend has a credit card debt of $ 1 0 , 0 0 0 on a card that charges 9 . 5 %

I. Your friend has a credit card debt of $ on a card that charges interest compounded monthly.

The credit card offers a promotion of no payment needs be made for the next months, but interest will

accrue.

a Your friend wants you to determine what she will owe at the end of the next twelve months if she

makes no payments until then.

b If your friend could take out a one year loan today from a bank at an annual rate

of which she would use to pay the credit card balance off now, determine how much less or more

she would owe the bank at the end of the year than she would have owed the credit card company in part a

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started