Answered step by step

Verified Expert Solution

Question

1 Approved Answer

12. Carson, age 34 and single, is an electrical engineer employed by Summit Corporation. Carson's annual salary is $84,000. Summit Corporation's qualified pension plan

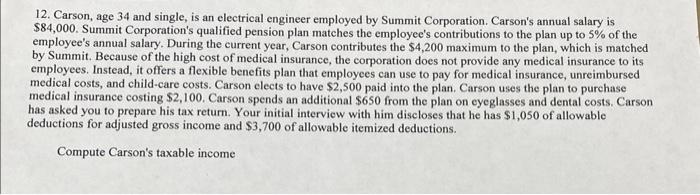

12. Carson, age 34 and single, is an electrical engineer employed by Summit Corporation. Carson's annual salary is $84,000. Summit Corporation's qualified pension plan matches the employee's contributions to the plan up to 5% of the employee's annual salary. During the current year, Carson contributes the $4,200 maximum to the plan, which is matched by Summit. Because of the high cost of medical insurance, the corporation does not provide any medical insurance to its employees. Instead, it offers a flexible benefits plan that employees can use to pay for medical insurance, unreimbursed medical costs, and child-care costs. Carson elects to have $2,500 paid into the plan. Carson uses the plan to purchase medical insurance costing $2,100. Carson spends an additional $650 from the plan on eyeglasses and dental costs. Carson has asked you to prepare his tax return. Your initial interview with him discloses that he has $1,050 of allowable deductions for adjusted gross income and $3,700 of allowable itemized deductions. Compute Carson's taxable income.

Step by Step Solution

★★★★★

3.38 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

To compute Carsons taxable income we will start by calculating ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started