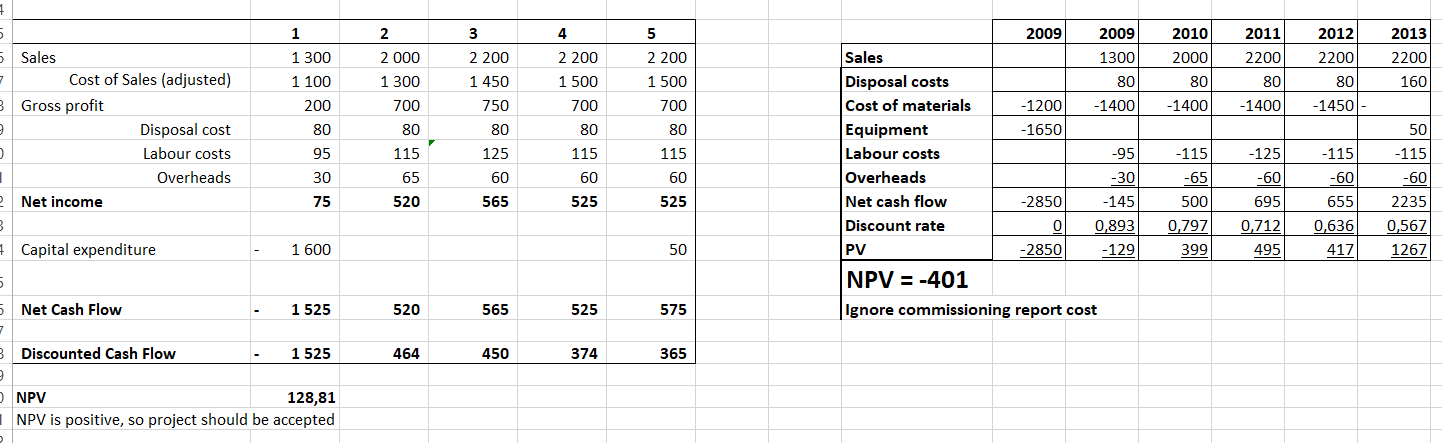

I'am confused about do we need to include depreciation in NPV calculations?

And second, how can I calculate the CapEx(Machine) when i know only amount of depreciation for it. Can you tell me is 1.600.000 is the right amount

Thank you!

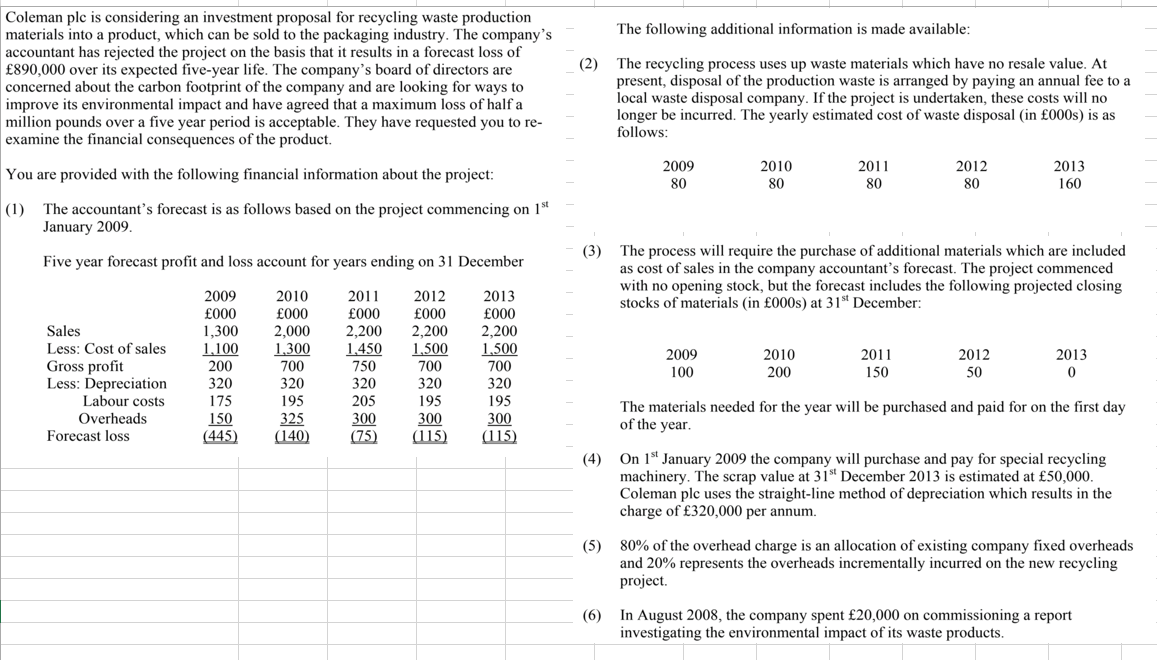

Coleman plc is considering an investment proposal for recycling waste production materials into a product. which can be sold to the packaging industry. The company's accountant has rejected the project on the basis that it results in a forecast loss of 890,000 over its expected ve-year life. The company's board of directors are concerned about the carbon footprint of tire company and are looking for ways to improve its environmental impact and have agreed that a maximum loss of half a million pounds over a ve year period is acceptable. They have requested you to re- examine the nancial consequences of the product. You are provided with the following nancial information about the project: (I) The accountant's forecast is as follows based on the project commencing on 1" January 2009. Five year forecast prot and loss account for years ending on 31 December 2009 2010 2011 2012 2013 000 000 000 000 000 Sales 1,300 2,000 2,200 2,200 2,200 Less: Cost ot'sales [.100 1.300 1.450 1.500 I.500 Gross prot 2011 1'00 1'50 700 700 Less: Depreciation 320 320 320 320 320 Labour costs I75 195 205 195 195 Overheads I50 325 300 300 300 Forecast loss mi] m (121 LL15) H IE} (2} (3) (4) (5) (5) The following additional infomtation is made available: The recycling process uses up waste materials which have no resale value. At present, disposal of the production waste is arranged by paying an annual fee to a local waste disposal company. If the project is undertaken, these costs will no longer be incurred. The yearly estimated cost of waste disposal (in 0003) is as follows: 2009 2010 2011 2012 2013 80 80 80 80 160 The process will require the purchase or" additional materials which are included as cost of sales in the campany accountant's forecast. The project commenced with no opening stock, but the forecast includes the following projected closing stocks of materials (in 0003) at 31\" December: 2009 2010 2011 2012 2013 100 200 150 50 0 The materials needed for the year will be purchased and paid for on the rst day of the year. On 1\" January 2009 the company will purchase and pay for special recycling machinery. The scrap value at 315' December 2013 is estimated at 50,000. Coleman plc uses the straight-line method of depreciation which results in the charge \"320,000 perannum. 80% of the overhead charge is an allocation of existing company fixed overheads and 20% represents the overheads incrementally incurred on the new recycling project. In August 2008, the company spent 20,000 on commissioning a report investigating the environmental impact of its waste products. 1 2 3 4 5 Sales 1 300 2 000 2 200 2 200 2 200 Cost of Sales (adjusted) 1 100 1 300 1 450 1 500 1 500 Gross profit 200 700 750 700 T00 Disposal cost 80 80 80 80 80 Labour costs 95 115 125 115 115 Overheads 30 65 60 60 60 Net income 75 520 565 525 525 Capital expenditure 1 600 50 Net Cash Flow 1 525 520 565 525 575 Discounted Cash Flow 1 525 464 450 374 365 NW 128,31 NPV is positive, so project should be accepted 2009 2009 2010 2011 2012 2013 Sales 1300 2000 2200 2200 2200 Disposal costs 80 80 80 80 160 Cost of materials 71200 71400 71400 71400 71450 Equipment 1650 50 Labour costs -95 115 -125 115 115 Overheads 730 765 ,50 760 ,50 Net cash flow 2850 -145 500 695 655 2235 Discount rate Q QBQS 9'79? g712 9.636 9567 PV 72850 7129 399 495 417 1267 NPV = -401 Ignore commissioning report cost