Question

IAS 16 Cost model/Revaluation model The information given below relates to two companies, Cooper ltd and Spielberg ltd, both of which prepare accounts to 31

IAS 16 Cost model/Revaluation model

The information given below relates to two companies, Cooper ltd and Spielberg ltd, both of which prepare accounts to 31 December.

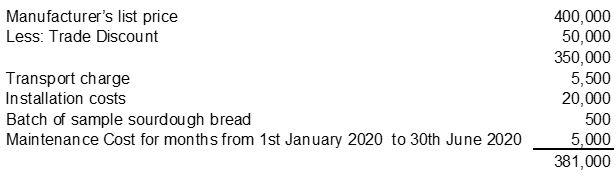

Cooper ltd: bought a high quality oven on 30 June 2019 and paid a total of 381,000. The suppliers invoice showed that this sum was made up of the following items:

Spielberg ltd: On 1 January 2010, Spielberg ltd bought freehold property for 550,000. This figure was made up of land 150,000 and buildings 400,000. It was decided to depreciate the buildings on the straight-line basis, assuming a useful life of 40 years and a residual value of zero.

On 1 January 2020, the land was revalued at 200,000 and the buildings were revalued at 350,000. The company decided to incorporate these valuations into its accounts. The previous estimates of the buildings useful life and residual value remain unchanged.

Please solve following exercise:

- According to the rules of IAS 16, calculate the cost figure at which the oven bought by Cooper Ltd should initially be measured. Also, explain the correct accounting treatment of any component of the 381,000 expenditure which cannot be treated as part of the assets cost.

- Explain the accounting treatment required for the revaluation of Spielberg ltd freehold property on 1 January 2020. Also, calculate the amount of depreciation, which would be charged in relation to the building for the year to 31 December 2021.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started