Answered step by step

Verified Expert Solution

Question

1 Approved Answer

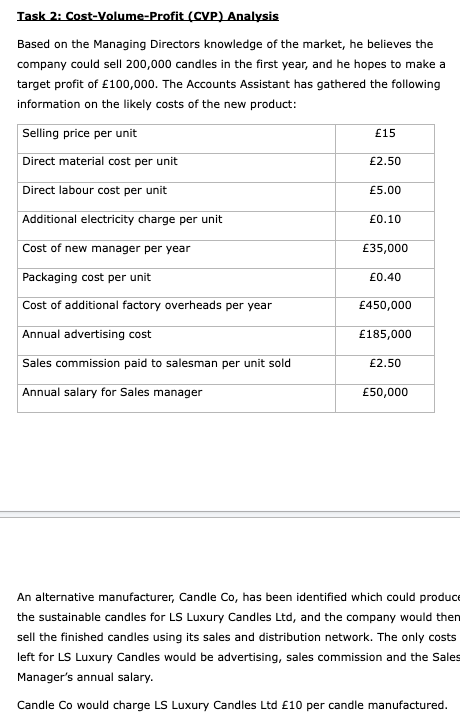

Iask 2: Cost-Volume-Profit (CVP) Analysis Based on the Managing Directors knowledge of the market, he believes the company could sell 200,000 candles in the first

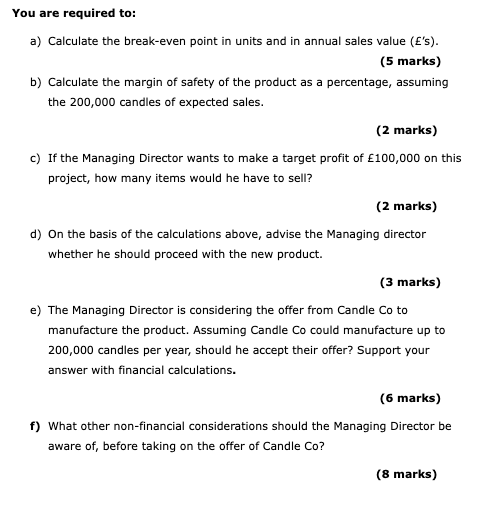

Iask 2: Cost-Volume-Profit (CVP) Analysis Based on the Managing Directors knowledge of the market, he believes the company could sell 200,000 candles in the first year, and he hopes to make a target profit of 100,000. The Accounts Assistant has gathered the following information on the likely costs of the new product: An alternative manufacturer, Candle Co, has been identified which could produc the sustainable candles for LS Luxury Candles Ltd, and the company would then sell the finished candles using its sales and distribution network. The only costs left for LS Luxury Candles would be advertising, sales commission and the Sales Manager's annual salary. Candle Co would charge LS Luxury Candles Ltd 10 per candle manufactured. You are required to: a) Calculate the break-even point in units and in annual sales value ( Es ). (5 marks) b) Calculate the margin of safety of the product as a percentage, assuming the 200,000 candles of expected sales. (2 marks) c) If the Managing Director wants to make a target profit of 100,000 on this project, how many items would he have to sell? (2 marks) d) On the basis of the calculations above, advise the Managing director whether he should proceed with the new product. (3 marks) e) The Managing Director is considering the offer from Candle Co to manufacture the product. Assuming Candle Co could manufacture up to 200,000 candles per year, should he accept their offer? Support your answer with financial calculations. (6 marks) f) What other non-financial considerations should the Managing Director be aware of, before taking on the offer of Candle Co ? (8 marks)

Iask 2: Cost-Volume-Profit (CVP) Analysis Based on the Managing Directors knowledge of the market, he believes the company could sell 200,000 candles in the first year, and he hopes to make a target profit of 100,000. The Accounts Assistant has gathered the following information on the likely costs of the new product: An alternative manufacturer, Candle Co, has been identified which could produc the sustainable candles for LS Luxury Candles Ltd, and the company would then sell the finished candles using its sales and distribution network. The only costs left for LS Luxury Candles would be advertising, sales commission and the Sales Manager's annual salary. Candle Co would charge LS Luxury Candles Ltd 10 per candle manufactured. You are required to: a) Calculate the break-even point in units and in annual sales value ( Es ). (5 marks) b) Calculate the margin of safety of the product as a percentage, assuming the 200,000 candles of expected sales. (2 marks) c) If the Managing Director wants to make a target profit of 100,000 on this project, how many items would he have to sell? (2 marks) d) On the basis of the calculations above, advise the Managing director whether he should proceed with the new product. (3 marks) e) The Managing Director is considering the offer from Candle Co to manufacture the product. Assuming Candle Co could manufacture up to 200,000 candles per year, should he accept their offer? Support your answer with financial calculations. (6 marks) f) What other non-financial considerations should the Managing Director be aware of, before taking on the offer of Candle Co ? (8 marks) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started