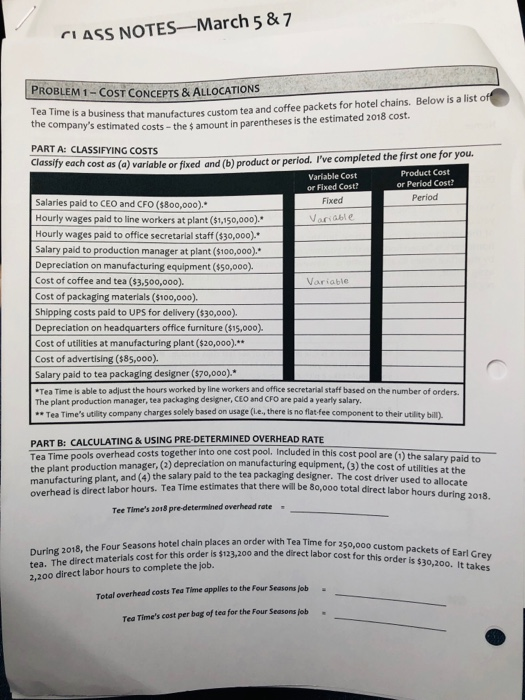

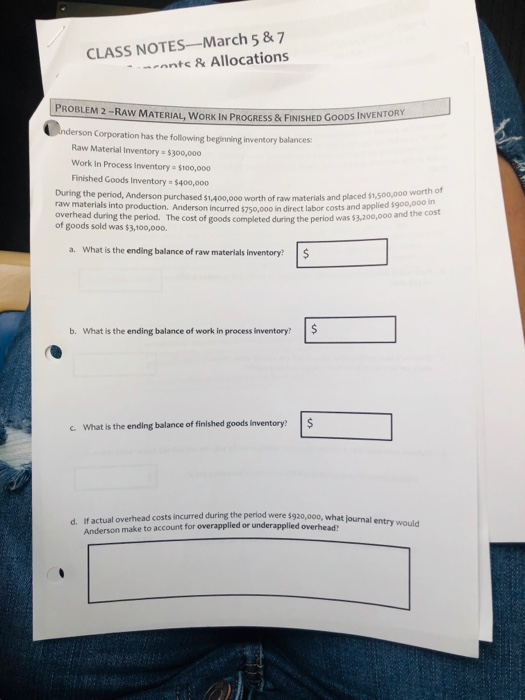

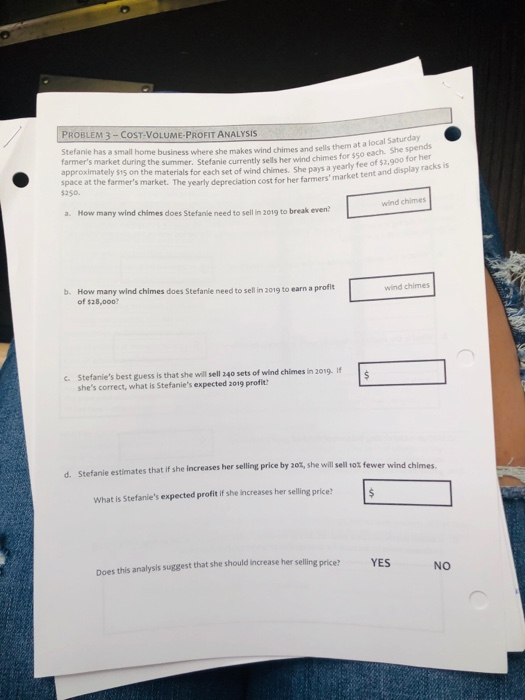

IASS NOTES-March 5 & 7 PROBLEM 1- COST CONCEPTS & ALLOCATIONS Tea Time is company's estimated costs-the $ amount in parentheses is the estimated 2018 cost PART A: CLASSIFYING COSTS Classify each cost as (c a business that manufactures custom tea and coffee packets for hotel chains. Below is a list of variable or fixed and (b) product or period. I've completed the first one for you. Variable Cost or Fixed Cost? Fixed Product Cost or Period Cost? Period Salaries paid to CEO and CFO (800,000). Hourly wages paid to line workers at plant ($1,150,000). Hourly wages paid to office secretarial staff ($30,000).. Salary paid to production manager at plant ($100,000). Varsable Depreciation on manufacturing equipment ($50,000) Cost of coffee and tea ($3.500,000). Variable Cost of packaging materials($100,000). Shipping costs paid to UPS for delivery (30,000). Depreciation on headquarters office furniture ($15,000) Cost of utilities at manufacturing plant ($20,000).* Cost of advertising ($85,000) Salary paid to tea packaging designer ($70,000).* Tea Time is able to adjust the hours worked by line workers and office secretarial staff based on the number of orders. The plant production manager, tea packaging desiger, CtO and CFo are paid a yearly salary .* Tea Time's utility company charges solely based on usage (Le., there is no flat-fee component to their utility bin PART B: CALCULATING & USING PRE-DETERMINED OVERHEAD RATE Tea Time pools overhead costs together into one cost pool, Included in this cost pool are (1) the sa the plant production manager, (2) depreciation on mcngquipment, (3) the cost of utilities at the manufacturing plant, and (4) the salary paid to the t overhead is direct labor hours. Tea Time estimates that there will be lary paid to ea packaging designer. The cost driver used to allocate 0,000 total direct la bor hours during 2018. Tee Time's z018 pre-determined overhead rate During 2018, the Four Seasons hotel chain places an order with Tea Time for tea. The direct materials cost for this order is $123,20o and the direct labor s 2,200 direct labor hours to complete the job. 250,000 custom packets of Earl Grey cost for this order is $30,200. It takes Total overhead costs Tea Time applies to the Four Seasons job Tea Time's cost per bag of tea for the Four Seasons job CLASS NOTES-March 5&7 ont&Allocations PROBLEM 2 -RAW MATERIAL, WORK IN PROGRESS & FINISHED GOODS ISHED Go erson Corporation has the following beginning inventory balances: Raw Material Inventory $300,000 Work In Process Inventory $100,000 Finished Goods Inventory $400,000 During the period, Anderson purchased $1,400,000 worth of raw materials and placed st,500 000 raw materials into production. Anderson incurred $750,000 in direct labor costs and applied $900,000 overhead during the period. The cost of goods completed during the period was $3,200,000 of goods sold was $3,100,ooo. and the cost a. What is the ending balance of raw materials Inventory$ b. What is the ending balance of work in process inventory? What is the ending balance of finished goods inventory?$ c. the period were $920,000, what journal entry would d. If actual overhead costs incurred during rapplied overhead? Anderson make to account for overapplied or unde PROBLEM 3- CosT-VOLUME-PROFIT ANALYSIS Stefanie has a small home business where she makes wind chimes and sells them farmer's market at a local Saturday She spends during the summer. Stefanie currently sells her wind chimes for $50 each approximately $t5 on the materials for each set of wind chimes. She pays a yearly fee of S space at the farmer's market. The yearly depreciation cost for her farmers' i 250. for her disolay How many wind chimes does Stefanie need to sell in 2019 to break even? wind chimes a. L How many wind chimes does Stefanie need to sell in 2019 to earn a profis of $28,000 b. wind chimes c. Stefanie's best guess is that she will sell 240 sets of wind chimes in 2019. If she's correct, what is Stefanie's expected 2019 profit d. Stefanie estimates that if she increases her selling price by 20t, she will sell tox fewer wind chimes What is Stefanie's expected profitif she icraes her selling price Does this analysis suggest that she should Increase her selling price? YES NO