Answered step by step

Verified Expert Solution

Question

1 Approved Answer

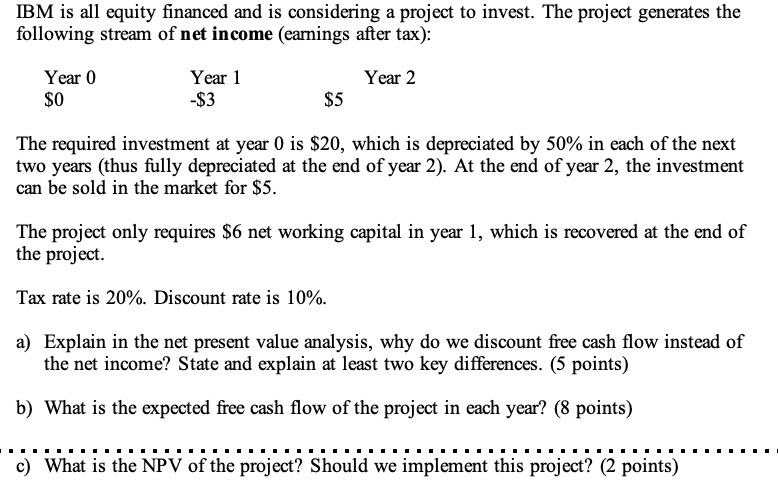

IBM is all equity financed and is considering a project to invest. The project generates the following stream of net income (earnings after tax):

IBM is all equity financed and is considering a project to invest. The project generates the following stream of net income (earnings after tax): Year 0 $0 Year 1 -$3 Year 2 $5 The required investment at year 0 is $20, which is depreciated by 50% in each of the next two years (thus fully depreciated at the end of year 2). At the end of year 2, the investment can be sold in the market for $5. The project only requires $6 net working capital in year 1, which is recovered at the end of the project. Tax rate is 20%. Discount rate is 10%. a) Explain in the net present value analysis, why do we discount free cash flow instead of the net income? State and explain at least two key differences. (5 points) b) What is the expected free cash flow of the project in each year? (8 points) c) What is the NPV of the project? Should we implement this project? (2 points)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started