Answered step by step

Verified Expert Solution

Question

1 Approved Answer

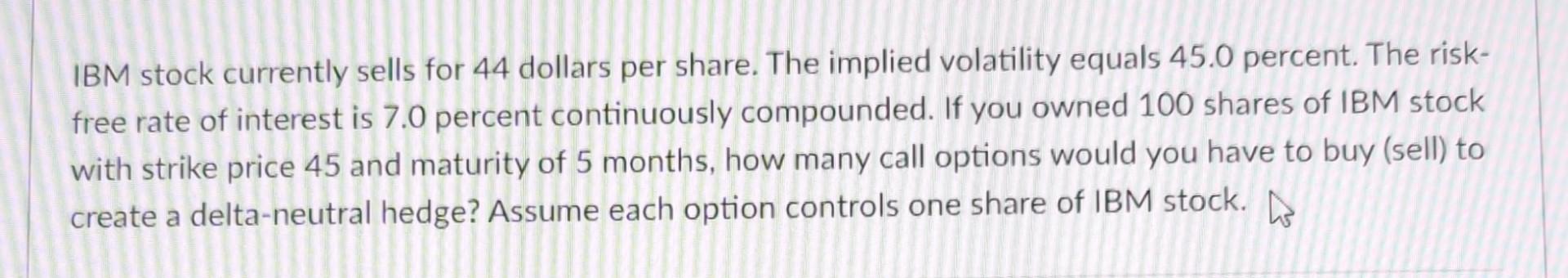

IBM stock currently sells for 44 dollars per share. The implied volatility equals 45.0 percent. The riskfree rate of interest is 7.0 percent continuously compounded.

IBM stock currently sells for 44 dollars per share. The implied volatility equals 45.0 percent. The riskfree rate of interest is 7.0 percent continuously compounded. If you owned 100 shares of IBM stock with strike price 45 and maturity of 5 months, how many call options would you have to buy (sell) to create a delta-neutral hedge? Assume each option controls one share of IBM stock

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started