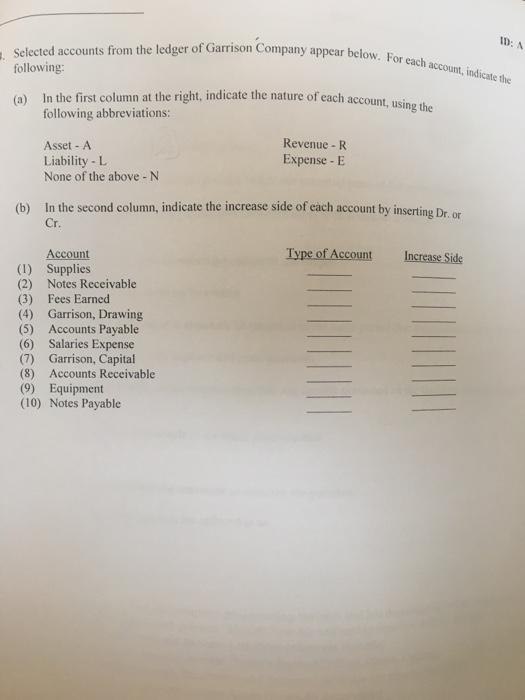

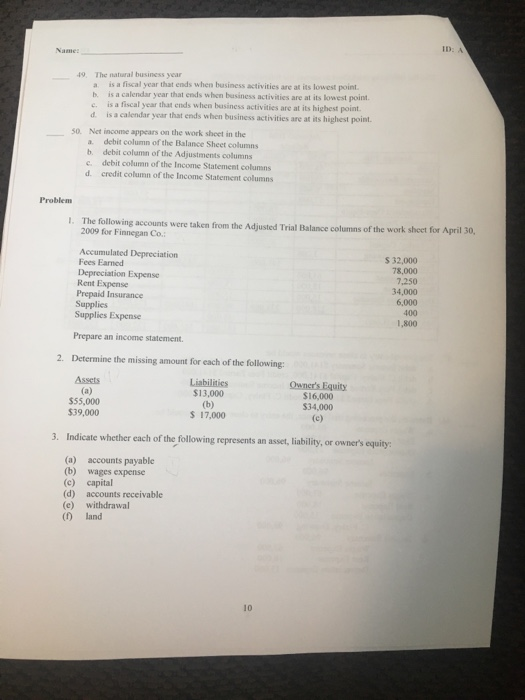

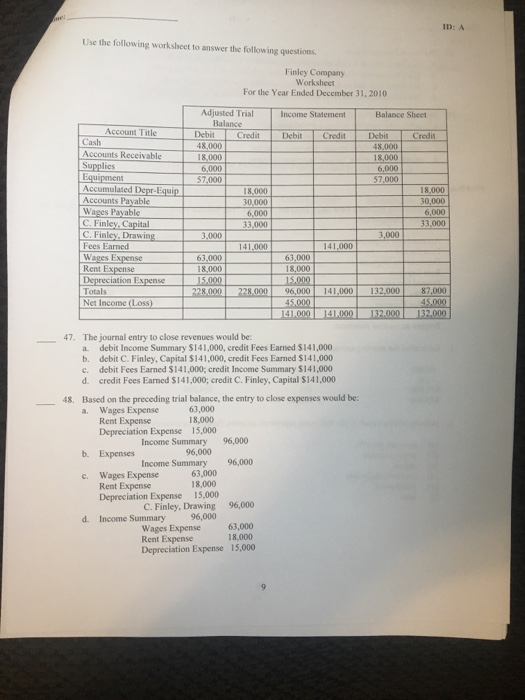

ID: A . Selected accounts from the ledger of Garrison Company appear below. For each account, indicate the following: (a) In the first column at the right, indicate the nature of each accourn following abbreviations: Asset -A Liability - None of the above - N Revenue-R Expense - E (b) In the second column, indicate the increase side of each account by inserting Dr. or Cr. Type of Account Increase Side Account (1) Supplies (2) Notes Receivable (3) Fees Earned (4) Garrison, Drawing (5) Accounts Payable (6) Salaries Expense (7) Garrison, Capital (8) Accounts Receivable (9) Equipment (10) Notes Payable ID: A The natural business year a is a fiscal year that ends when business activities are at its lowest point b. is a calendar year that ends when business activities are at its lowest point 49 c. is a fiscal year that ends when basiness activiaties are at its highest point. a calendar year that ends when business activities are at its highest point Net income appears on the work sheet in the a. debit column of the Balance Sheet columns b. debit column of the Adjustments columns c. debit column of the Income Statement columns d. credit column of the Income Statement columns S0. Problem I. The following accounts were taken from the Adjusted Trial Balance columns of the work shect for April 30, 2009 for Finnegan Co Accumulated Depreciation Fees Earned Depreciation Expense Rent Expense Prepaid Insurance Supplies Supplies Expense S 32,000 78,000 7,250 34,000 6,000 400 1,800 Prepare an income statement 2. Determine the missing amount for each of the following: Liabilitics $13,000 Owner's Equity $16,000 $34,000 $55,000 $39,000 17,000 Indicate whether each of the following represents an asset, liability, or owner's equity (a) accounts payable (b) wages expense (c) capital (d) accounts receivable (e) withdrawal () land 10 ID: A Use the following worksheet to answer the following questions. Finley Company Worksheet For the Year Ended December 31, 2010 Adjusted Trial Income Statement Balance Sheet Balance Account Title Debit Credit Debit Credit Debit Cash Accounts Receivable 48,000 18,000 6,000 57,000 48,000 18,000 6,000 Equipment Accumulated Depr-Eq Accounts Payable 18,000 0,000 6,000 - 30,000 6,000 33,000 C.Finley. Drawing141.000 Fees Earned Wages Expense Rent Ex Depreciation Expense Totals 3,000 3,000 141,000 63,000 18,000 63,000 18,000 28,000228,00096,000 141.000 132.000 87.000 LL0001 141.002 1 1320001 132000 47. The journal entry to close revenues would be: a. debit Income Summary $141,000, credit Fees Eamed S141,000 b. debit C. Finley, Capital $141,000, credit Fees Earned S141,000 c. debit Fees Earned $141,000; credit Income Summary $141,000 d. credit Fees Earned S141,000; credit C. Finley, Capital $141,000 Based on the preceding trial balance, the entry to close expenses would be: a. Wages Expense 48. 63,000 18,000 Depreciation Expense 15,000 Rent Expense Income Summary 96,000 b. Expenses 96,000 Income Summary 96,000 e. Wages Expense 63,000 18,000 Depreciation Expense 15,000 C. Finley, Drawing d. Income Summary 96,000 Rent Expense 96,000 Wages Expense Rent Expense 63,000 8,000 Depreciation Expense 15,000