Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I'd love and appreciate any help in this from my Agribusiness/Exonomics class 1. Balance Sheet Preparation Rhonda Rancher has applied for a loan. Her banker,

I'd love and appreciate any help in this from my Agribusiness/Exonomics class

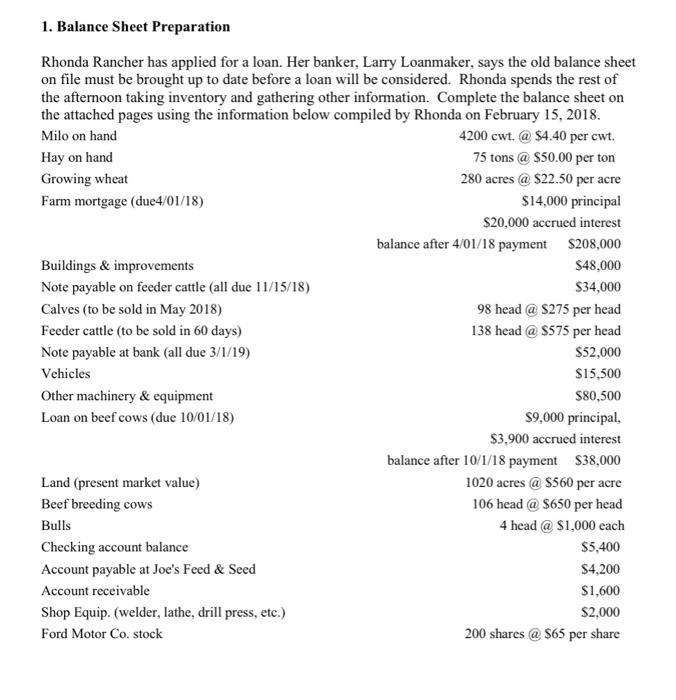

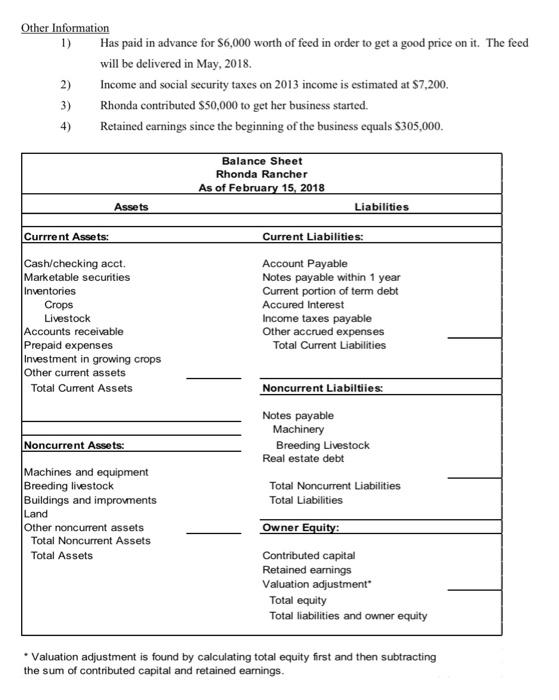

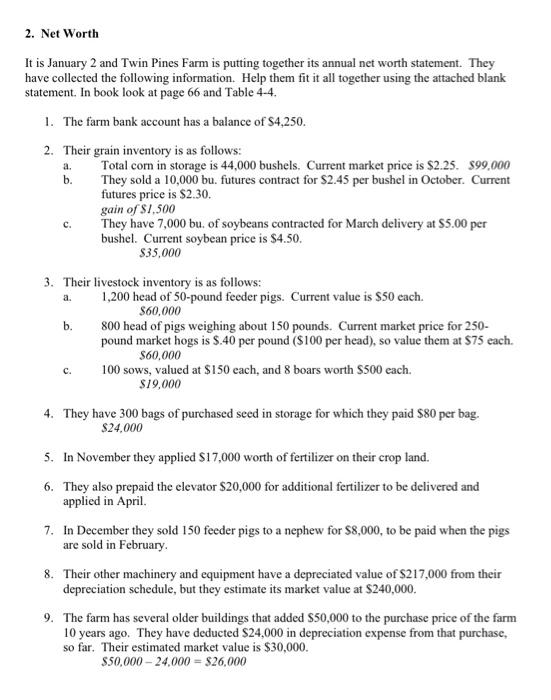

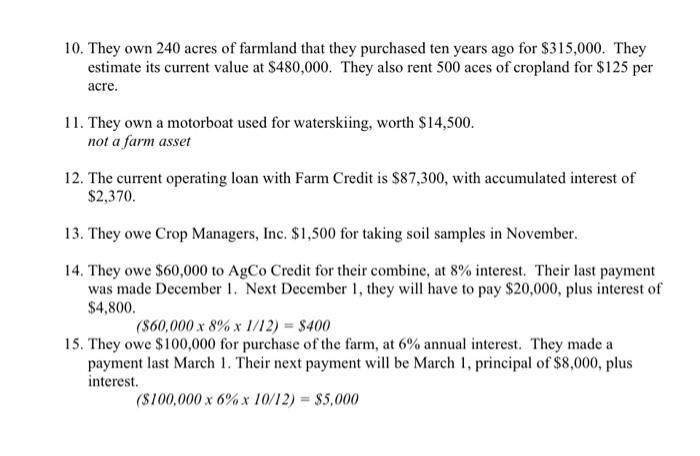

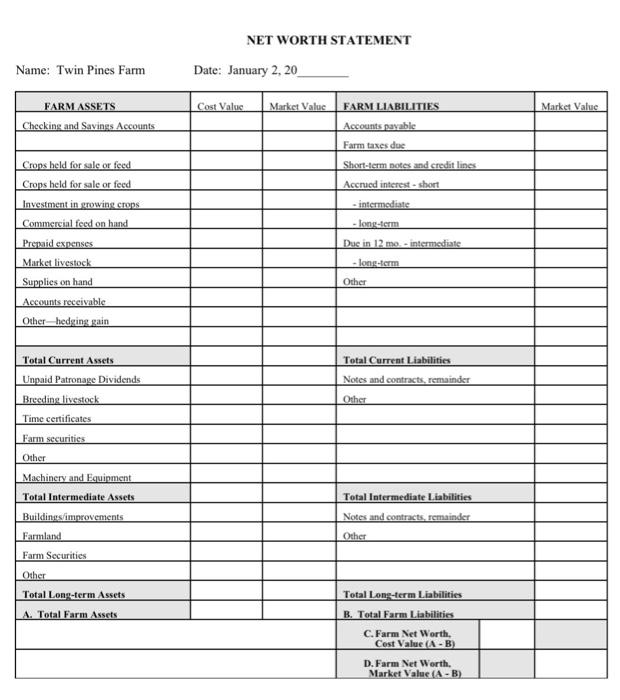

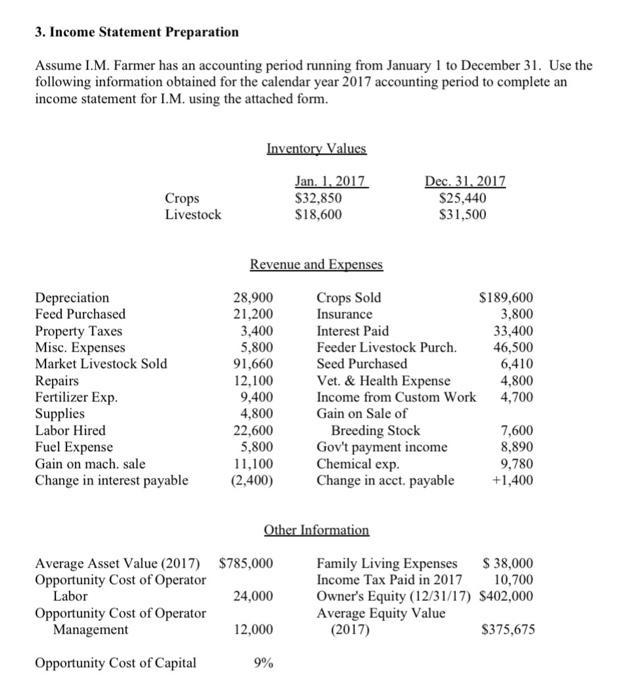

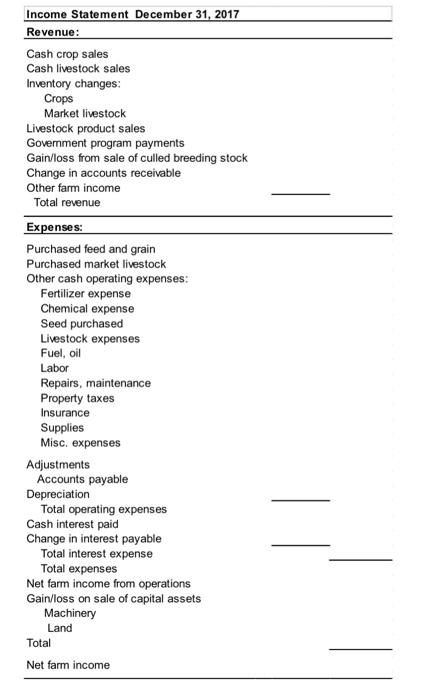

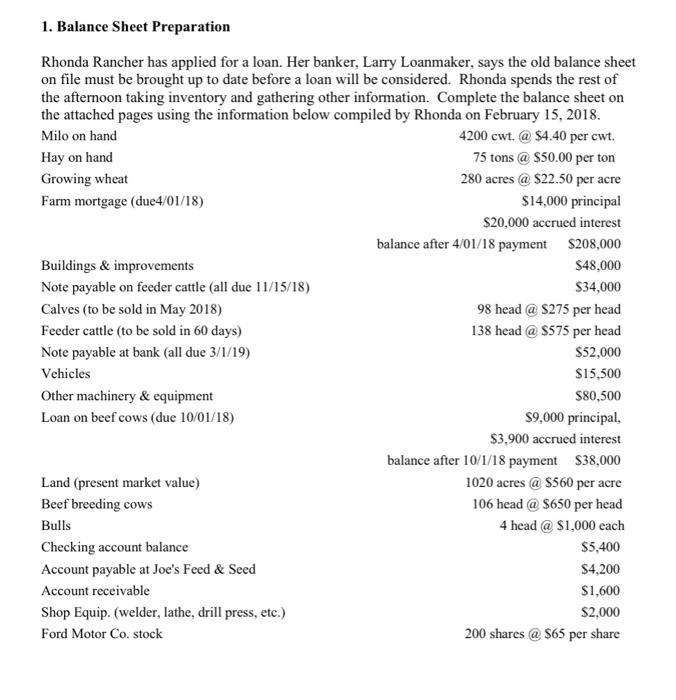

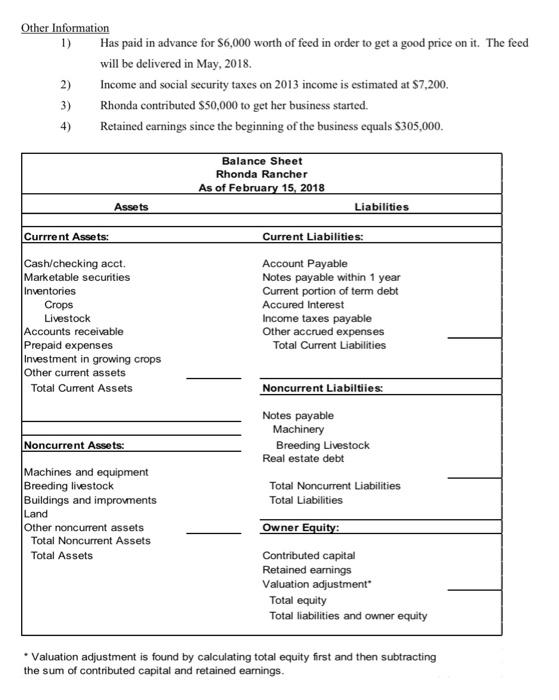

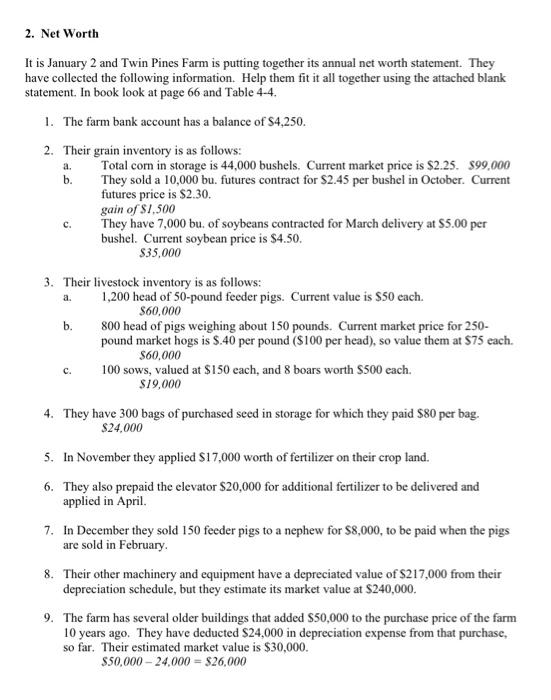

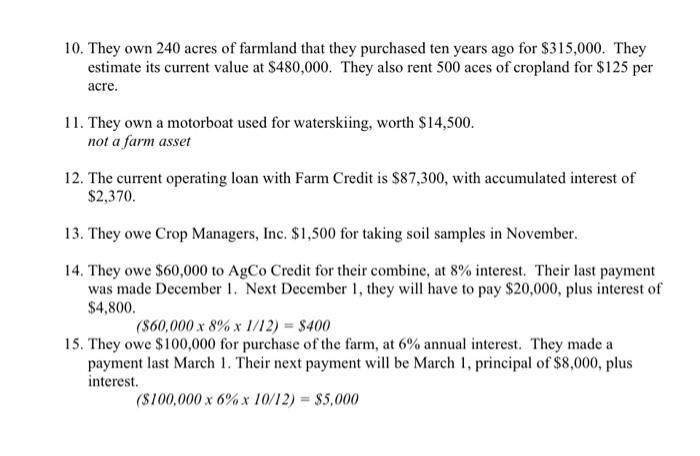

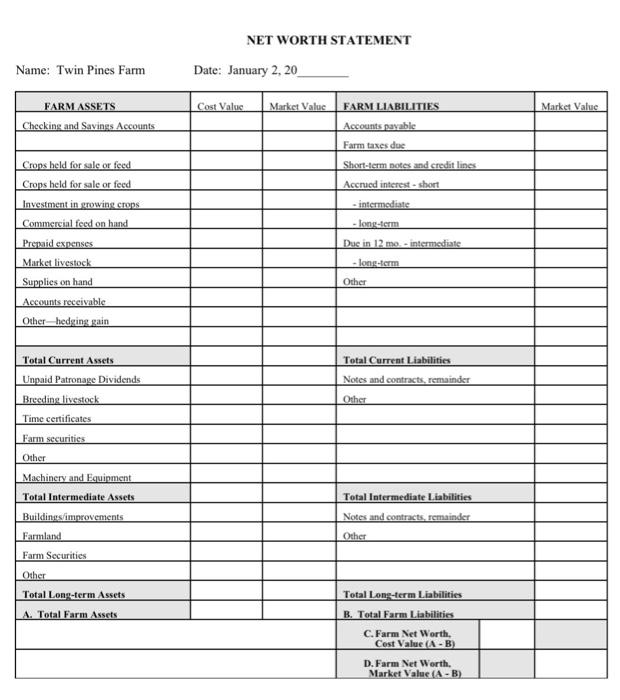

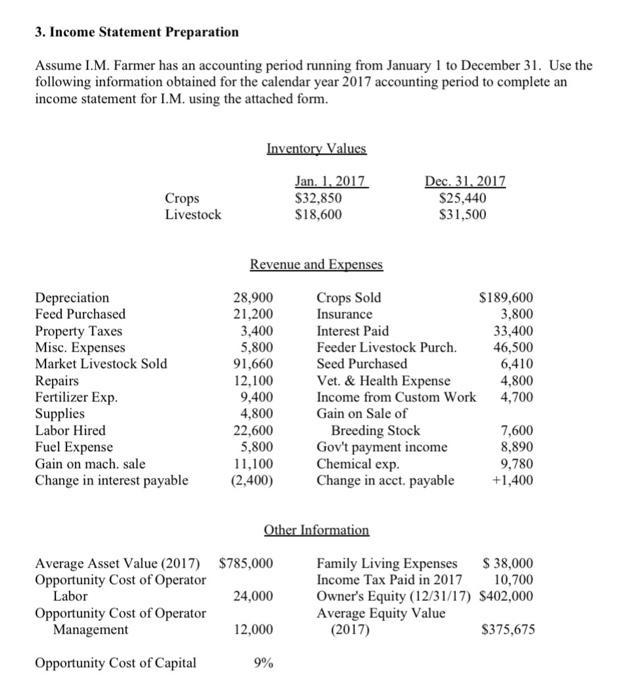

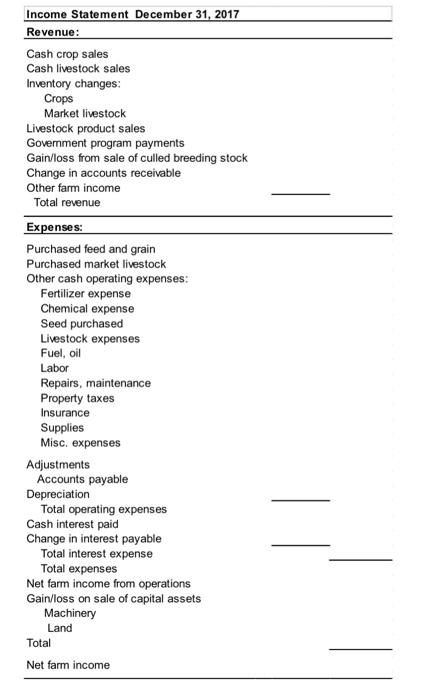

1. Balance Sheet Preparation Rhonda Rancher has applied for a loan. Her banker, Larry Loanmaker, says the old balance sheet on file must be brought up to date before a loan will be considered. Rhonda spends the rest of the afternoon taking inventory and gathering other information. Complete the balance sheet on the attached pages using the information below compiled by Rhonda on February 15, 2018. Milo on hand 4200 cwt. @ $4.40 per cwt. Hay on hand 75 tons @ $50.00 per ton Growing wheat 280 acres @ $22.50 per acre Farm mortgage (due4/01/18) $14,000 principal $20,000 accrued interest balance after 4/01/18 payment $208,000 Buildings & improvements $48.000 Note payable on feeder cattle (all due 11/15/18) $34,000 Calves (to be sold in May 2018) 98 head @ $275 per head Feeder cattle (to be sold in 60 days) 138 head @ $575 per head Note payable at bank (all due 3/1/19) $52,000 Vehicles $15,500 Other machinery & equipment $80,500 Loan on beef cows (due 10/01/18) $9,000 principal, $3,900 accrued interest balance after 10/1/18 payment $38.000 Land (present market value) 1020 acres @ $560 per acre Beef breeding cows 106 head @ $650 per head Bulls 4 head @ $1,000 each Checking account balance $5,400 Account payable at Joe's Feed & Seed $4,200 Account receivable $1,600 Shop Equip. (welder, lathe, drill press, etc.) $2,000 Ford Motor Co. stock 200 shares @ $65 per share Other Information 1) Has paid in advance for $6,000 worth of feed in order to get a good price on it. The feed will be delivered in May, 2018. 2) Income and social security taxes on 2013 income is estimated at $7,200. 3) Rhonda contributed $50,000 to get her business started. 4) Retained earnings since the beginning of the business equals 8305,000. Balance Sheet Rhonda Rancher As of February 15, 2018 Assets Liabilities Currrent Assets: Current Liabilities: Cash/checking acct. Marketable securities Inventories Crops Livestock Accounts receivable Prepaid expenses Investment in growing crops Other current assets Total Current Assets Account Payable Notes payable within 1 year Current portion of term debt Accured Interest Income taxes payable Other accrued expenses Total Current Liabilities Noncurrent Liabiltiies: Noncurrent Assets: Machines and equipment Breeding livestock Buildings and improvments Other noncurrent assets Total Noncurrent Assets Total Assets Land Notes payable Machinery Breeding Livestock Real estate debt Total Noncurrent Liabilities Total Liabilities Owner Equity: Contributed capital Retained earnings Valuation adjustment Total equity Total liabilities and owner equity Valuation adjustment is found by calculating total equity first and then subtracting the sum of contributed capital and retained earnings. 2. Net Worth b. C. It is January 2 and Twin Pines Farm is putting together its annual net worth statement. They have collected the following information. Help them fit it all together using the attached blank statement. In book look at page 66 and Table 4-4. 1. The farm bank account has a balance of $4,250. 2. Their grain inventory is as follows: Total corn in storage is 44,000 bushels. Current market price is $2.25. 899,000 They sold a 10,000 bu. futures contract for $2.45 per bushel in October. Current futures price is $2.30. gain of $1.500 They have 7,000 bu. of soybeans contracted for March delivery at $5.00 per bushel. Current soybean price is $4.50. $35,000 3. Their livestock inventory is as follows: 1,200 head of 50-pound feeder pigs. Current value is $50 cach. $60,000 800 head of pigs weighing about 150 pounds. Current market price for 250- pound market hogs is 5.40 per pound ($100 per head), so value them at $75 cach. $60,000 100 sows, valued at $150 each, and 8 boars worth $500 each. $19,000 4. They have 300 bags of purchased seed in storage for which they paid $80 per bag. $24,000 a. b. C. 5. In November they applied $17,000 worth of fertilizer on their crop land. 6. They also prepaid the elevator $20,000 for additional fertilizer to be delivered and applied in April 7. In December they sold 150 feeder pigs to a nephew for $8,000, to be paid when the pigs are sold in February 8. Their other machinery and equipment have a depreciated value of $217,000 from their depreciation schedule, but they estimate its market value at $240,000. 9. The farm has several older buildings that added $50,000 to the purchase price of the farm 10 years ago. They have deducted $24,000 in depreciation expense from that purchase, so far. Their estimated market value is $30,000. $50,000 - 24.000 = $26,000 10. They own 240 acres of farmland that they purchased ten years ago for $315,000. They estimate its current value at $480,000. They also rent 500 aces of cropland for $125 per acre. 11. They own a motorboat used for waterskiing, worth $14,500. not a farm asset 12. The current operating loan with Farm Credit is $87,300, with accumulated interest of $2,370. 13. They owe Crop Managers, Inc. $1,500 for taking soil samples in November 14. They owe $60,000 to AgCo Credit for their combine, at 8% interest. Their last payment was made December 1. Next December 1, they will have to pay $20,000, plus interest of $4,800. ($60,000 x 8% x 1/12) = $400 15. They owe $100,000 for purchase of the farm, at 6% annual interest. They made a payment last March 1. Their next payment will be March 1, principal of $8,000, plus interest ($100,000 x 6% x 10/12) = $5,000 NET WORTH STATEMENT Name: Twin Pines Farm Date: January 2, 20 Cost Value Market Value FARM ASSETS Checking and Savings Accounts Crops held for sale or feed Crops held for sale or feed Investment in growing crops Commercial feed on hand Prepaid expenses Market livestock Supplies on hand Accounts receivable Other hedging gain Market Value FARM LIABILITIES Accounts payable Farm taxes due Short-term potes and credit lines Accrued interest - short - intermediate - long-term Dus in 12 mo. intermediate long term Other Total Current Liabilities Notes and contracts, remainder Other Total Current Assets Unpaid Patronage Dividends Breeding livestock Time certificates Farm securities Other Machinery and Equipment Total Intermediate Assets Buildings improvements Farmland Farm Securities Other Total Long-term Assets A. Total Farm Assets Total Intermediate Liabilities Notes and contracts, remainder Other Total Long-term Liabilities B. Total Farm Liabilities C.Farm Net Worth, Cost Value (A-B) D. Farm Net Worth, Market Value (A-B) 3. Income Statement Preparation Assume I.M. Farmer has an accounting period running from January 1 to December 31. Use the following information obtained for the calendar year 2017 accounting period to complete an income statement for I.M. using the attached form. Inventory Values Jan 1, 2017 $32,850 $18,600 Crops Livestock Dec. 31, 2017 $25,440 $31,500 Revenue and Expenses Depreciation Feed Purchased Property Taxes Misc. Expenses Market Livestock Sold Repairs Fertilizer Exp. Supplies Labor Hired Fuel Expense Gain on mach, sale Change in interest payable 28,900 21,200 3,400 5,800 91,660 12,100 9,400 4,800 22,600 5,800 11,100 (2,400) Crops Sold $189,600 Insurance 3,800 Interest Paid 33,400 Feeder Livestock Purch. 46,500 Seed Purchased 6,410 Vet. & Health Expense 4,800 Income from Custom Work 4,700 Gain on Sale of Breeding Stock 7,600 Gov't payment income 8,890 Chemical exp. 9,780 Change in acct. payable +1,400 Other Information Average Asset Value (2017) $785,000 Family Living Expenses $ 38,000 Opportunity Cost of Operator Income Tax Paid in 2017 10,700 Labor 24,000 Owner's Equity (12/31/17) S402,000 Opportunity Cost of Operator Average Equity Value Management 12,000 (2017) $375,675 Opportunity Cost of Capital 9% Income Statement December 31, 2017 Revenue: Cash crop sales Cash livestock sales Inventory changes: Crops Market livestock Livestock product sales Government program payments Gain/loss from sale of culled breeding stock Change in accounts receivable Other farm income Total revenue Expenses: Purchased feed and grain Purchased market livestock Other cash operating expenses: Fertilizer expense Chemical expense Seed purchased Livestock expenses Fuel, oil Labor Repairs, maintenance Property taxes Insurance Supplies Misc. expenses Adjustments Accounts payable Depreciation Total operating expenses Cash interest paid Change in interest payable Total interest expense Total expenses Net farm income from operations Gain/loss on sale of capital assets Machinery Land Total Net farm income

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started