Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Identification and Preparation of Adjusting Entries Kuepper's Day Care is a large daycare center in South Orange, New Jersey. The daycare center serves several nearby

Identification and Preparation of Adjusting Entries

Kuepper's Day Care is a large daycare center in South Orange, New Jersey. The daycare center serves several nearby businesses as well as a number of individual families. The

businesses pay $ per child per year for daycare services for their employees' children. The businesses pay in advance on a quarterly basis. For individual families, daycare

services are provided monthly and billed at the beginning of the next month. The following transactions describe Kuepper's activities during December:

Required:

Identify whether each transaction is an adjusting entry or a regular journal entry. If the entry is an adjusting entry, identify it as an accrued revenue, accrued expense,

deferred revenue, or deferred expense. If the entry is a regular journal entry, select "not applicable" from the second set of dropdowns.

a On December Kuepper borrowed $ by issuing a year, $ note payable.

Reqular journal entry Not applicable

b Daycare service in the amount of $ was provided to individual families during December. These families will not be billed until next January.

Adjusting entry

Accrued revenue

c At December the balance in unearned service revenue was $ At December Kuepper determined that $ of this revenue was still unearned.

d On December the daycare center collected $ from businesses for services to be provided in

Reqular journal entry

e On December the center recorded depreciation of $ on a bus that it uses for field trips.

f The daycare center had prepaid insurance at December of $ An examination of the insurance policies indicates that prepaid insurance at $

Adjusting entry Deferred expense

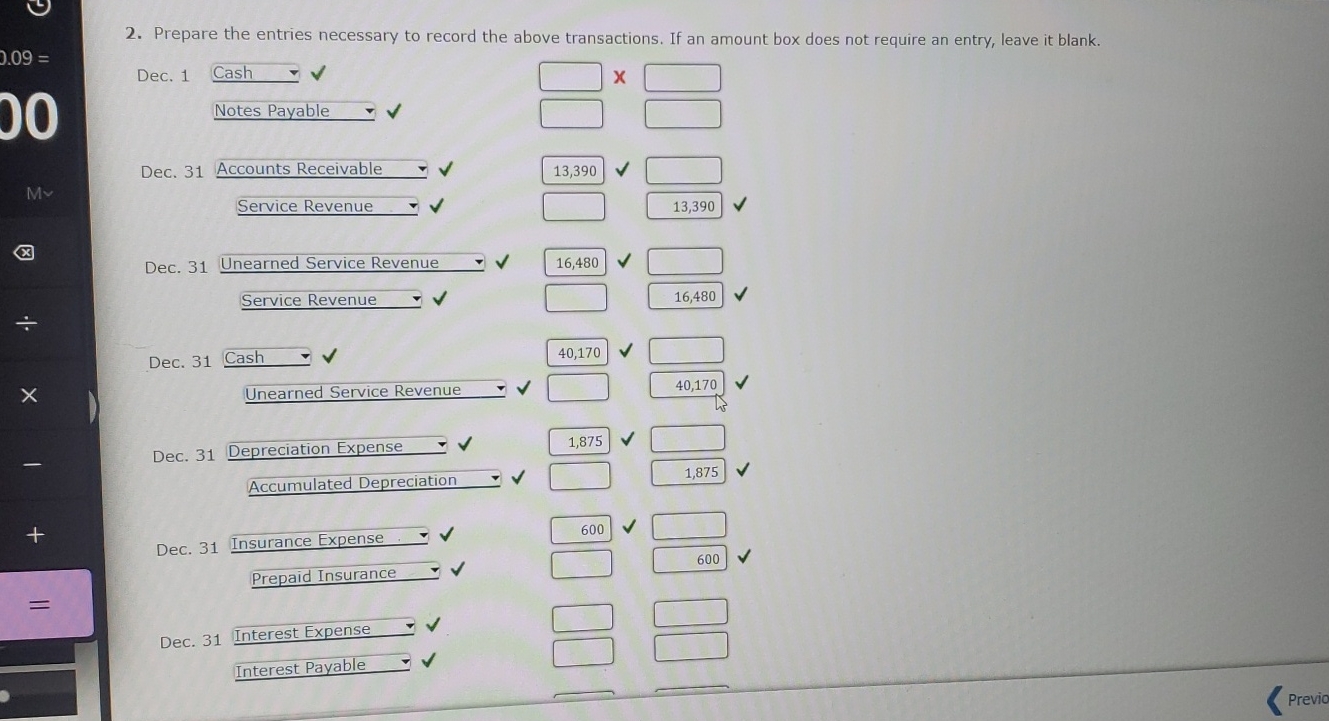

Prepare the entries necessary to record the above transactions. If an amount box does not require an entry, leave it blank.

Dec.

Notes Payable

Dec.

Dec.

Dec.

Service Revenue

Dec.

Accumulated Depreciation

Dec. Insurance Expense

Dec.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started