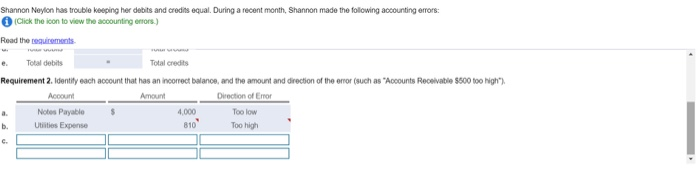

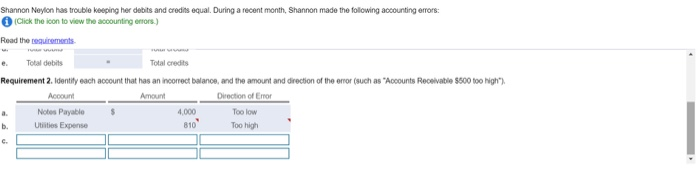

identified each that has an incorrect blance and the amount and direction of the error such as accounts recevable $500 to high

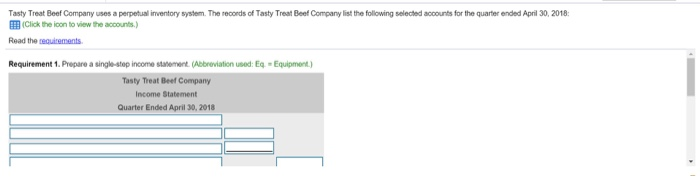

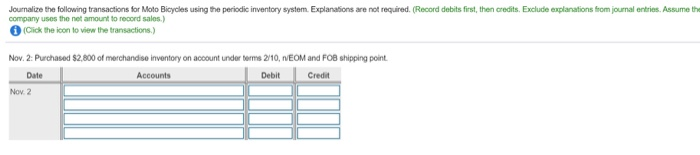

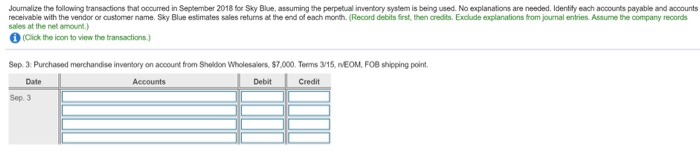

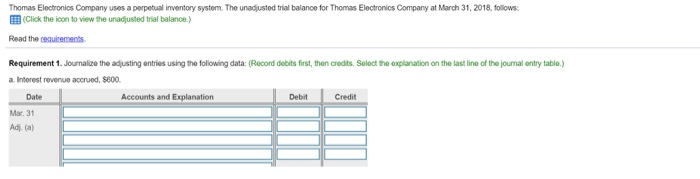

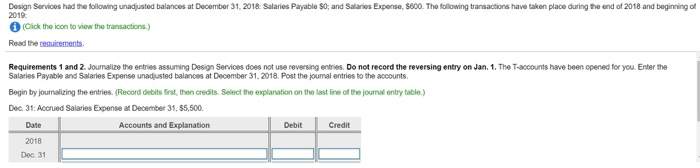

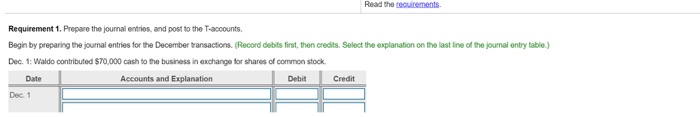

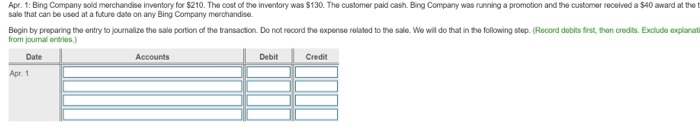

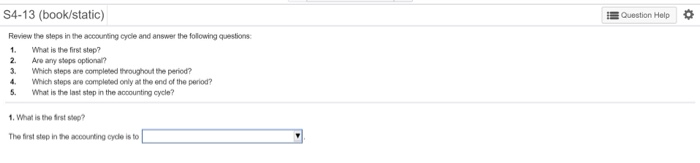

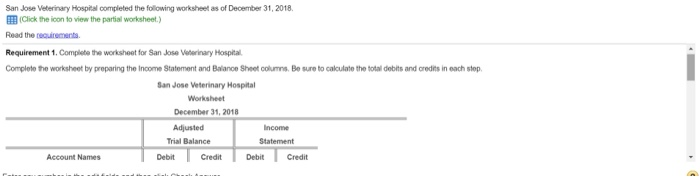

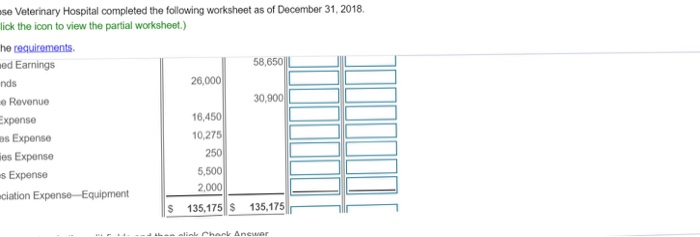

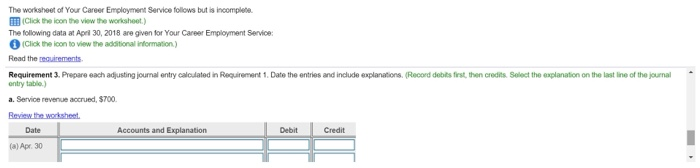

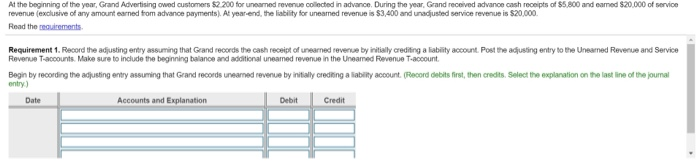

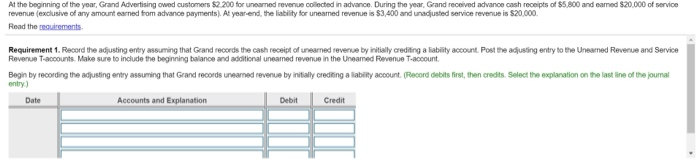

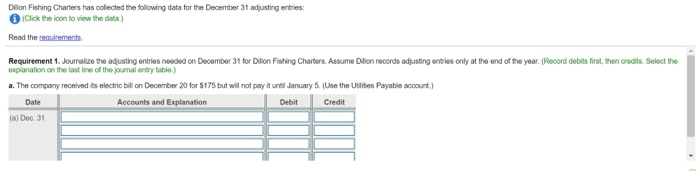

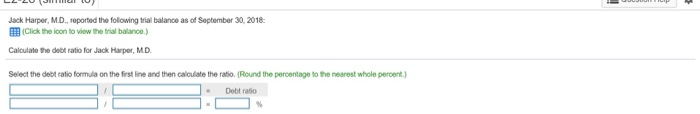

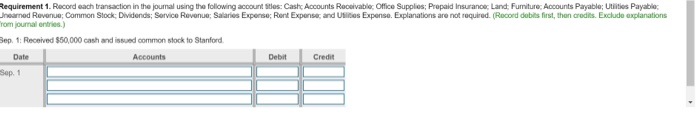

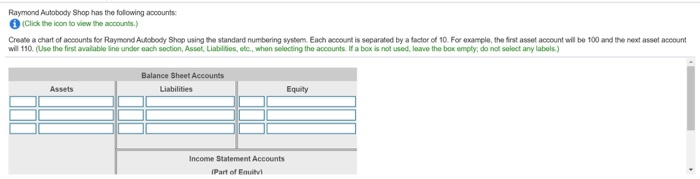

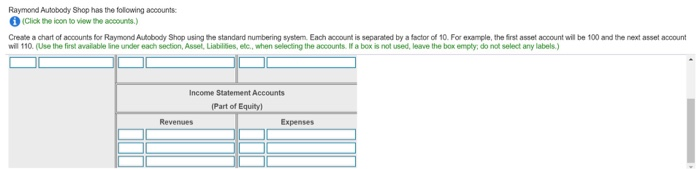

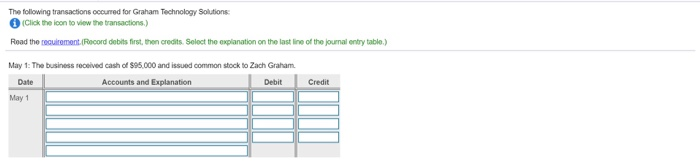

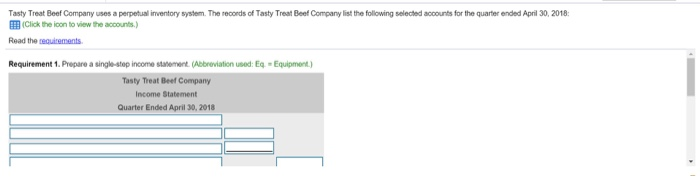

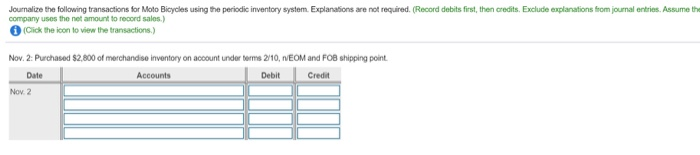

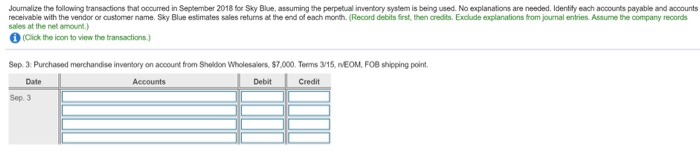

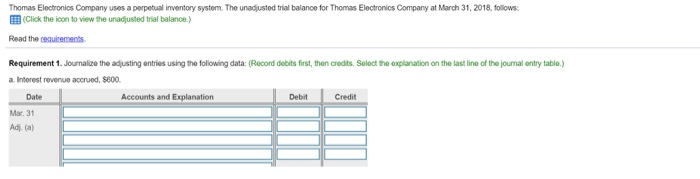

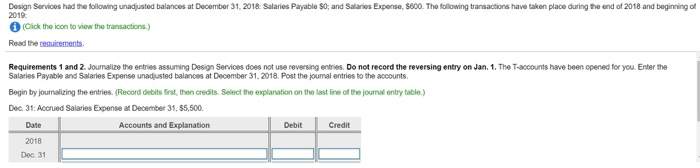

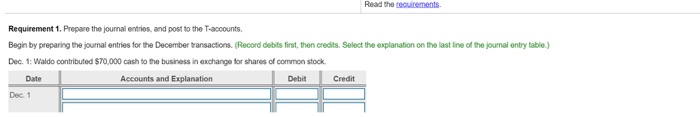

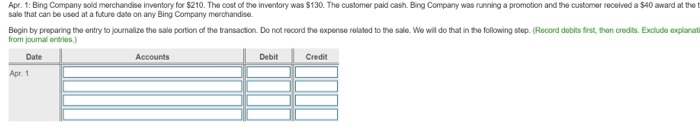

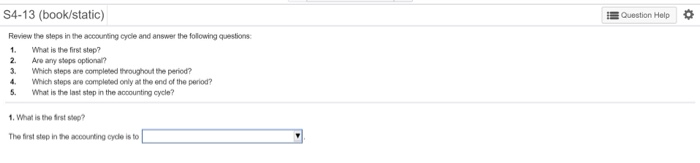

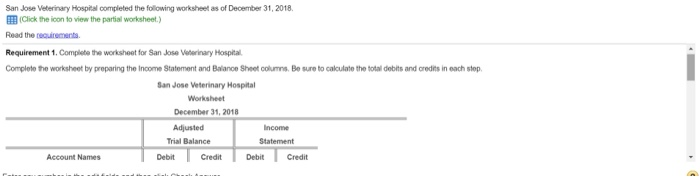

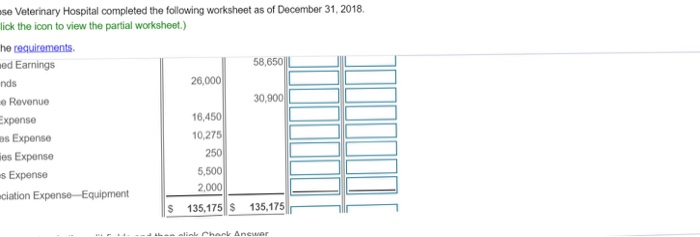

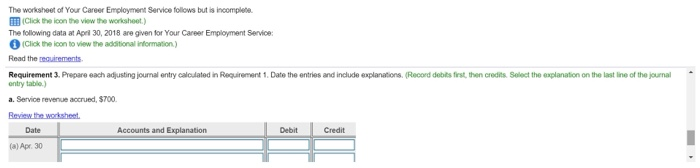

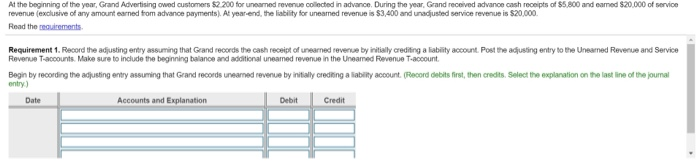

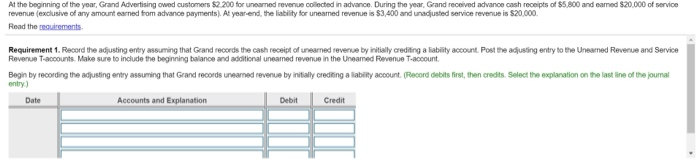

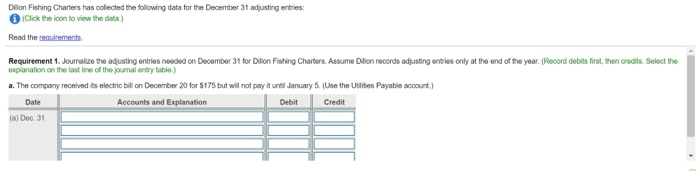

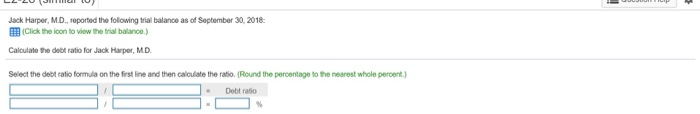

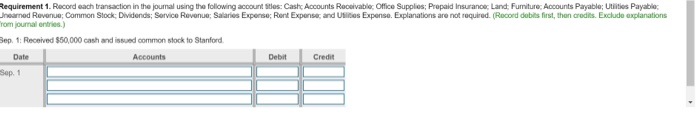

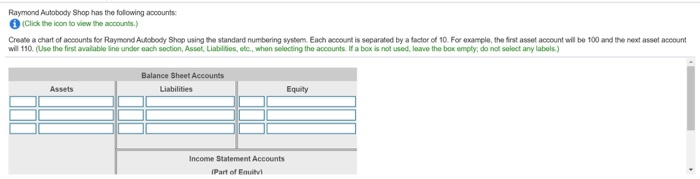

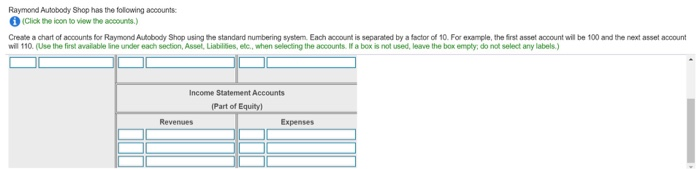

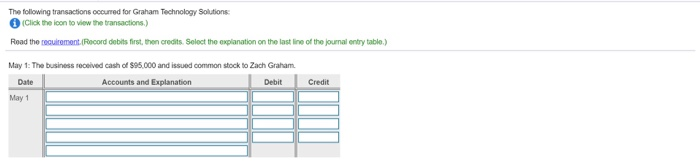

Tasty Treat Beef Company uses a perpetual inventory system. The records of Tasty Treat Boof Company list the following selected accounts for the quarter ended April 30, 2018 Click the icon to view the accounts.) Read the requirements Requirement 1. Prepare a single-stap income statement. (Abbreviation used: Eq - Equipment.) Tasty Treat Beef Company Income Statement Quarter Ended April 30, 2018 Journalize the following transactions for Moto Bicycles using the periodic inventory system. Explanations are not required. (Record debits first, then credits. Exclude explanations from journal entries. Assume the company uses the net amount to record sales.) (Click the icon to view the transactions.) Nov. 2: Purchased $2,800 of merchandise inventory on account under derme 210, IVEOM and Fo8 shipping point Accounts Debit Credit Date Nov. 2 Journalize the following transactions that occurred in September 2018 for Sky Blue, assuming the perpetual inventory system is being used. No explanations are needed. Identity each accounts payable and accounts receivable with the vendor or customer name. Sky Blue estimates sales returns at the end of each month (Record debits first, then credits. Exclude explanations from journal entries. Assume the company records sales at the net amount.) (Click the icon to view the transactions) Sep 3: Purchased merchandise inventory on account from Sheldon Wholesalers, 87.000. Torms 3/15, nEOM. FOB shipping point, Date Accounts Debit Credit Sep 3 Thomas Electronics Company uses a perpetual inventory system. The unadjusted trial balance for Thomas Electronics Company at March 31, 2018, follows: (Click the icon to view the unadjusted trial balance.) Read the requirements Requirement 1. Journalize the adjusting entries using the following data: (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) a. Interest revenue accrued, 8800 Date Accounts and Explanation Debit Credit Mar. 31 Ad(a) Design Services had the following unadjusted balances at December 31, 2018 Salarios Payable $0, and Salaries Expense, $800. The following transactions have taken place during the end of 2018 and beginning of (Click the icon to view the transactions.) Read the requirements Requirements 1 and 2. Joumalize the entries assuming Design Services does not use reversing entries. Do not record the reversing entry on Jan. 1. The T-accounts have been opened for you. Enter the Salaries Payable and Salaries Expense unadjusted balances at December 31, 2018. Post the joumal entries to the accounts. Begin by joumalizing the entries. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Dec. 31: Accrued Salaries Expense at December 31, 55,500 Date Accounts and Explanation Credit Debit 2018 Dec 31 Read the requirements Requirement 1. Prepare the journal entries, and post to the T-accounts. Begin by preparing the journal entries for the December transactions. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Dec. 1: Waldo contributed $70,000 cash to the business in exchange for shares of common stock Date Accounts and Explanation Debit Credit Dec 1 Apr. 1: Bing Company sold merchandise inventory for $210. The cost of the inventory was $130. The customer paid cash. Bing Company was running a promotion and the customer received a $40 award at the sale that can be used at a future date on any Bing Company merchandise Begin by preparing the entry to journalize the sale portion of the transaction. Do not record the expense related to the sale. We will do that in the following stap. (Record dobits first, then credits. Exclude explanati from journal entries.) Date Accounts Debit Credit Apr. 1 Question Help o S4-13 (book/static) Review the steps in the accounting cycle and answer the following questions: 1. What is the first step? 2 Are any stops optional? Which steps are completed throughout the period? Which steps are completed only at the end of the period? 5. What is the last stop in the accounting cycle? 1. What is the first step? The first step in the accounting cycle is to San Jose Veterinary Hospital completed the following worksheet as of December 31, 2018. Click the icon to view the partial worksheet.) Read the requirements Requirement 1. Complete the workshoot for San Jose Veterinary Hospital Complete the workshoot by proparing the Income Statement and Balance Shoot columns, Be sure to calkulato the total debts and credits in each stop, San Jose Veterinary Hospital Worksheet December 31, 2018 Adjusted Trial Balance Income Statement Account Names Debit Credit Debit Credit nds ese Veterinary Hospital completed the following worksheet as of December 31, 2018 lick the icon to view the partial worksheet.) he requirements ed Earnings 58,650 26,000 Revenue 30,900 Expense 16,450 ms Expense 10,275 es Expense 250 s Expense 5,500 2.000 ciation Expense-Equipment 135,175 $ 135,175 Laine Chan Anwar The worksheet of Your Career Employment Service follows but is incomplete Click the icon the view the workshoot) The following data at Apel 30, 2018 are given for Your Career Employment Service: (Click the icon to view the additional information) Read the requirements Requirement 3. Prepare each adjusting journal entry calculated in Requirement 1. Date the entries and include explanations. Record debts first, then credits. Select the explanation on the last line of the journal entry table.) a. Service revenue accrued, $700 Review the worksheet Accounts and Explanation Debit Credit (a) Apr 30 Date At the beginning of the year, Grand Advertising owed customers $2.200 for uncanned revenue collected in advance. During the year. Grand received advance cash receipts of $5,800 and camed $20.000 of service revenue (exclusive of any amount earned from advance payments). At year-end, the liability for unearned revenue is $3,400 and unadjusted service revenue is $20,000 Read the requirements Requirement 1. Record the adjusting entry assuming that Grand records the cash receipt of unearned revenue by initially crediting a liability account. Post the adjusting entry to the Unearned Revenue and Service Revenue T-accounts. Make sure to include the beginning balance and additional uneamed revenue in the Uneamed Revenue T-account Begin by recording the adjusting entry assuming that Grand records unearned revenue by initially crediting a liability account. (Record debits first, then credits. Select the explanation on the last line of the journal entry) Date Accounts and Explanation Debit Credit At the beginning of the year, Grand Advertising owed customers $2.200 for uncanned revenue collected in advance. During the year. Grand received advance cash receipts of $5,800 and camed $20.000 of service revenue (exclusive of any amount earned from advance payments). At year-end, the liability for unearned revenue is $3,400 and unadjusted service revenue is $20,000 Read the requirements Requirement 1. Record the adjusting entry assuming that Grand records the cash receipt of unearned revenue by initially crediting a liability account. Post the adjusting entry to the Unearned Revenue and Service Revenue T-accounts. Make sure to include the beginning balance and additional uneamed revenue in the Uneamed Revenue T-account Begin by recording the adjusting entry assuming that Grand records unearned revenue by initially crediting a liability account. (Record debits first, then credits. Select the explanation on the last line of the journal entry) Date Accounts and Explanation Debit Credit Dilon Fishing Charters has collected the following data for the December 31 adjusting entries (Click the icon to view the data) Read the requirements Requirement 1. Joumalize the adjusting entries needed on December 31 for Dillon Fishing Charters. Assume Dillon records adjusting entries only at the end of the year. (Record dobits first, then credits. Select the explanation on the last line of the journal entry table.) a. The company received its electric bill on December 20 for $175 but will not pay it until January 5. (Use the Utilities Payable account) Date Accounts and Explanation Credit (a) Dec 31 Debit Shannon Neylon has trouble keeping her debits and credits equal. During a recent month, Shannon made the following accounting errors: Click the icon to view the accounting oors.) Read the requirements e. Total debits Total credits Requirement 2. Identity each account that has an incorrect balance, and the amount and direction of the error (such as "Accounts Receivable 3800 100 high"). Account Amount Direction of Error Notes Payable Too low b. Utilities Expense 810 Too high 4.000 c. Jack Harper, M.D., reported the following trial balance as of September 30, 2018: Click the icon to view the balance.) Calculate the debt ratio for Jack Harper, MD. Select the debt ratio formula on the first line and then calculate the ratio (Round the percentage to the nearest whole percent.) Debratio Requirement 1. Record each transaction in the joumal using the following account sites: Cash Accounts Receivable: Office Supplies; Prepaid Insurance Land: Furniture: Accounts Payable; Utilities Payable neared Revenue Common Stock: Dividends; Service Revenue: Salaries Expense; Rent Expense, and Utilities Expense. Explanations are not required. (Record dubits first, then credits. Exclude explanations rom journal entries.) Sep 1: Received $50,000 cash and issued common stock to Stanford. Date Accounts Debit Credit Sup. 1 Raymond Autobody Shop has the following accounts: Click the icon to view the accounts.) Create a chart of accounts for Raymond Autobody Shop using the standard numbering system. Each account is separated by a factor of 10. For example, the first asset account will be 100 and the next asset account will 110. (Use the first available line under cach section, Asset Liabilities, etc., when selecting the accounts. If a box is not used, leave the box empty, do not select any labels) Balance Sheet Accounts Liabilities Assets Equity Income Statement Accounts Part of Equiti Raymond Autobody Shop has the following accounts: (Click the icon to view the accounts.) Create a chart of accounts for Raymond Autobody Shop using the standard numbering systern. Each account is separated by a factor of 10. For example, the first asset account will be 100 and the next asset account will 110. (Use the first available line under each section, Asset Liabilities, etc., when selecting the accounts. If a box is not used, leave the box empty, do not select any labels) Income Statement Accounts (Part of Equity) Revenues Expenses The following transactions occurred for Graham Technology Solutions: (Click the icon to view the transactions.) Road the requirement. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) May 1: The business received cash of $95.000 and issued common stock to Zach Graham Date Accounts and Explanation Debit May 1 Credit Tasty Treat Beef Company uses a perpetual inventory system. The records of Tasty Treat Boof Company list the following selected accounts for the quarter ended April 30, 2018 Click the icon to view the accounts.) Read the requirements Requirement 1. Prepare a single-stap income statement. (Abbreviation used: Eq - Equipment.) Tasty Treat Beef Company Income Statement Quarter Ended April 30, 2018 Journalize the following transactions for Moto Bicycles using the periodic inventory system. Explanations are not required. (Record debits first, then credits. Exclude explanations from journal entries. Assume the company uses the net amount to record sales.) (Click the icon to view the transactions.) Nov. 2: Purchased $2,800 of merchandise inventory on account under derme 210, IVEOM and Fo8 shipping point Accounts Debit Credit Date Nov. 2 Journalize the following transactions that occurred in September 2018 for Sky Blue, assuming the perpetual inventory system is being used. No explanations are needed. Identity each accounts payable and accounts receivable with the vendor or customer name. Sky Blue estimates sales returns at the end of each month (Record debits first, then credits. Exclude explanations from journal entries. Assume the company records sales at the net amount.) (Click the icon to view the transactions) Sep 3: Purchased merchandise inventory on account from Sheldon Wholesalers, 87.000. Torms 3/15, nEOM. FOB shipping point, Date Accounts Debit Credit Sep 3 Thomas Electronics Company uses a perpetual inventory system. The unadjusted trial balance for Thomas Electronics Company at March 31, 2018, follows: (Click the icon to view the unadjusted trial balance.) Read the requirements Requirement 1. Journalize the adjusting entries using the following data: (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) a. Interest revenue accrued, 8800 Date Accounts and Explanation Debit Credit Mar. 31 Ad(a) Design Services had the following unadjusted balances at December 31, 2018 Salarios Payable $0, and Salaries Expense, $800. The following transactions have taken place during the end of 2018 and beginning of (Click the icon to view the transactions.) Read the requirements Requirements 1 and 2. Joumalize the entries assuming Design Services does not use reversing entries. Do not record the reversing entry on Jan. 1. The T-accounts have been opened for you. Enter the Salaries Payable and Salaries Expense unadjusted balances at December 31, 2018. Post the joumal entries to the accounts. Begin by joumalizing the entries. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Dec. 31: Accrued Salaries Expense at December 31, 55,500 Date Accounts and Explanation Credit Debit 2018 Dec 31 Read the requirements Requirement 1. Prepare the journal entries, and post to the T-accounts. Begin by preparing the journal entries for the December transactions. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Dec. 1: Waldo contributed $70,000 cash to the business in exchange for shares of common stock Date Accounts and Explanation Debit Credit Dec 1 Apr. 1: Bing Company sold merchandise inventory for $210. The cost of the inventory was $130. The customer paid cash. Bing Company was running a promotion and the customer received a $40 award at the sale that can be used at a future date on any Bing Company merchandise Begin by preparing the entry to journalize the sale portion of the transaction. Do not record the expense related to the sale. We will do that in the following stap. (Record dobits first, then credits. Exclude explanati from journal entries.) Date Accounts Debit Credit Apr. 1 Question Help o S4-13 (book/static) Review the steps in the accounting cycle and answer the following questions: 1. What is the first step? 2 Are any stops optional? Which steps are completed throughout the period? Which steps are completed only at the end of the period? 5. What is the last stop in the accounting cycle? 1. What is the first step? The first step in the accounting cycle is to San Jose Veterinary Hospital completed the following worksheet as of December 31, 2018. Click the icon to view the partial worksheet.) Read the requirements Requirement 1. Complete the workshoot for San Jose Veterinary Hospital Complete the workshoot by proparing the Income Statement and Balance Shoot columns, Be sure to calkulato the total debts and credits in each stop, San Jose Veterinary Hospital Worksheet December 31, 2018 Adjusted Trial Balance Income Statement Account Names Debit Credit Debit Credit nds ese Veterinary Hospital completed the following worksheet as of December 31, 2018 lick the icon to view the partial worksheet.) he requirements ed Earnings 58,650 26,000 Revenue 30,900 Expense 16,450 ms Expense 10,275 es Expense 250 s Expense 5,500 2.000 ciation Expense-Equipment 135,175 $ 135,175 Laine Chan Anwar The worksheet of Your Career Employment Service follows but is incomplete Click the icon the view the workshoot) The following data at Apel 30, 2018 are given for Your Career Employment Service: (Click the icon to view the additional information) Read the requirements Requirement 3. Prepare each adjusting journal entry calculated in Requirement 1. Date the entries and include explanations. Record debts first, then credits. Select the explanation on the last line of the journal entry table.) a. Service revenue accrued, $700 Review the worksheet Accounts and Explanation Debit Credit (a) Apr 30 Date At the beginning of the year, Grand Advertising owed customers $2.200 for uncanned revenue collected in advance. During the year. Grand received advance cash receipts of $5,800 and camed $20.000 of service revenue (exclusive of any amount earned from advance payments). At year-end, the liability for unearned revenue is $3,400 and unadjusted service revenue is $20,000 Read the requirements Requirement 1. Record the adjusting entry assuming that Grand records the cash receipt of unearned revenue by initially crediting a liability account. Post the adjusting entry to the Unearned Revenue and Service Revenue T-accounts. Make sure to include the beginning balance and additional uneamed revenue in the Uneamed Revenue T-account Begin by recording the adjusting entry assuming that Grand records unearned revenue by initially crediting a liability account. (Record debits first, then credits. Select the explanation on the last line of the journal entry) Date Accounts and Explanation Debit Credit At the beginning of the year, Grand Advertising owed customers $2.200 for uncanned revenue collected in advance. During the year. Grand received advance cash receipts of $5,800 and camed $20.000 of service revenue (exclusive of any amount earned from advance payments). At year-end, the liability for unearned revenue is $3,400 and unadjusted service revenue is $20,000 Read the requirements Requirement 1. Record the adjusting entry assuming that Grand records the cash receipt of unearned revenue by initially crediting a liability account. Post the adjusting entry to the Unearned Revenue and Service Revenue T-accounts. Make sure to include the beginning balance and additional uneamed revenue in the Uneamed Revenue T-account Begin by recording the adjusting entry assuming that Grand records unearned revenue by initially crediting a liability account. (Record debits first, then credits. Select the explanation on the last line of the journal entry) Date Accounts and Explanation Debit Credit Dilon Fishing Charters has collected the following data for the December 31 adjusting entries (Click the icon to view the data) Read the requirements Requirement 1. Joumalize the adjusting entries needed on December 31 for Dillon Fishing Charters. Assume Dillon records adjusting entries only at the end of the year. (Record dobits first, then credits. Select the explanation on the last line of the journal entry table.) a. The company received its electric bill on December 20 for $175 but will not pay it until January 5. (Use the Utilities Payable account) Date Accounts and Explanation Credit (a) Dec 31 Debit Shannon Neylon has trouble keeping her debits and credits equal. During a recent month, Shannon made the following accounting errors: Click the icon to view the accounting oors.) Read the requirements e. Total debits Total credits Requirement 2. Identity each account that has an incorrect balance, and the amount and direction of the error (such as "Accounts Receivable 3800 100 high"). Account Amount Direction of Error Notes Payable Too low b. Utilities Expense 810 Too high 4.000 c. Jack Harper, M.D., reported the following trial balance as of September 30, 2018: Click the icon to view the balance.) Calculate the debt ratio for Jack Harper, MD. Select the debt ratio formula on the first line and then calculate the ratio (Round the percentage to the nearest whole percent.) Debratio Requirement 1. Record each transaction in the joumal using the following account sites: Cash Accounts Receivable: Office Supplies; Prepaid Insurance Land: Furniture: Accounts Payable; Utilities Payable neared Revenue Common Stock: Dividends; Service Revenue: Salaries Expense; Rent Expense, and Utilities Expense. Explanations are not required. (Record dubits first, then credits. Exclude explanations rom journal entries.) Sep 1: Received $50,000 cash and issued common stock to Stanford. Date Accounts Debit Credit Sup. 1 Raymond Autobody Shop has the following accounts: Click the icon to view the accounts.) Create a chart of accounts for Raymond Autobody Shop using the standard numbering system. Each account is separated by a factor of 10. For example, the first asset account will be 100 and the next asset account will 110. (Use the first available line under cach section, Asset Liabilities, etc., when selecting the accounts. If a box is not used, leave the box empty, do not select any labels) Balance Sheet Accounts Liabilities Assets Equity Income Statement Accounts Part of Equiti Raymond Autobody Shop has the following accounts: (Click the icon to view the accounts.) Create a chart of accounts for Raymond Autobody Shop using the standard numbering systern. Each account is separated by a factor of 10. For example, the first asset account will be 100 and the next asset account will 110. (Use the first available line under each section, Asset Liabilities, etc., when selecting the accounts. If a box is not used, leave the box empty, do not select any labels) Income Statement Accounts (Part of Equity) Revenues Expenses The following transactions occurred for Graham Technology Solutions: (Click the icon to view the transactions.) Road the requirement. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) May 1: The business received cash of $95.000 and issued common stock to Zach Graham Date Accounts and Explanation Debit May 1 Credit