! Required information [The following information applies to the questions displayed below.] Target Corporation prepares its financial statements according to U.S. GAAP. Target's financial

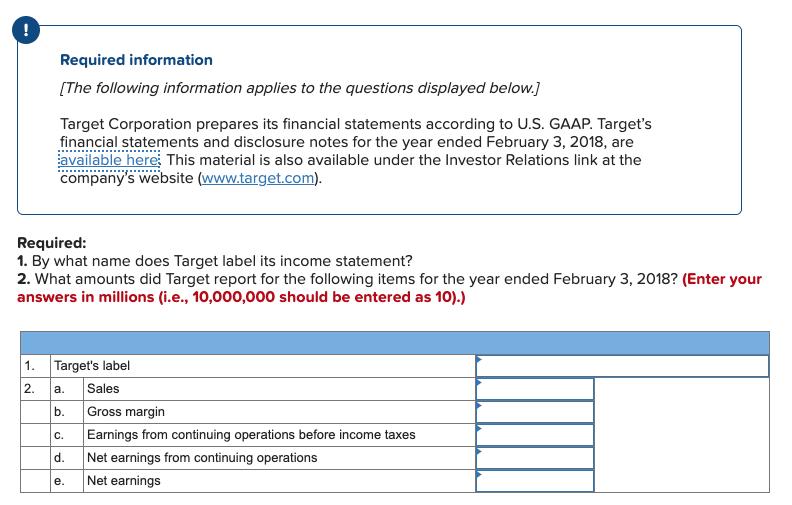

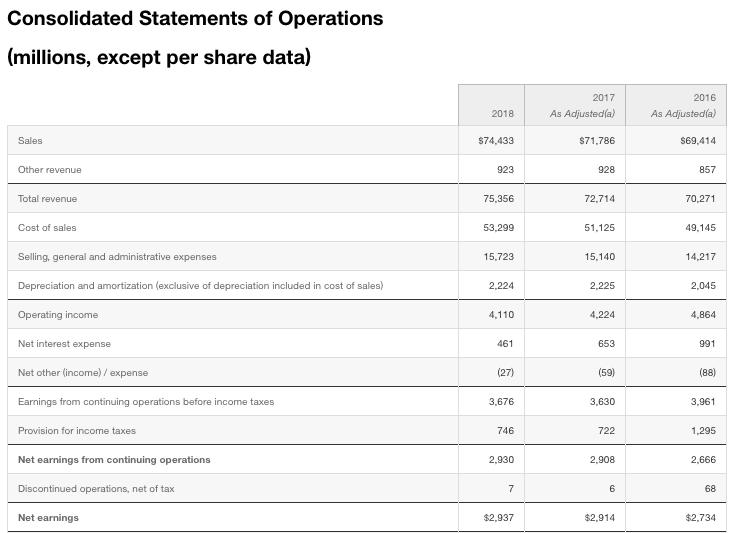

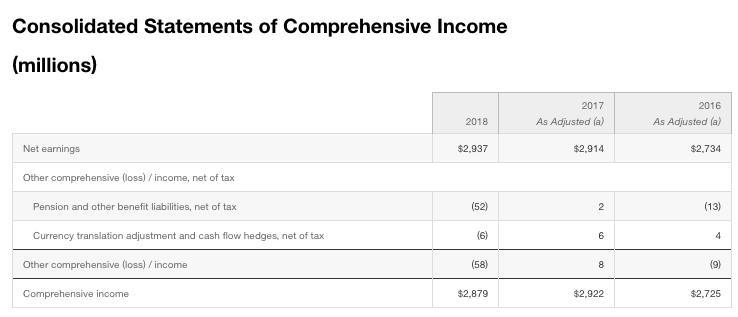

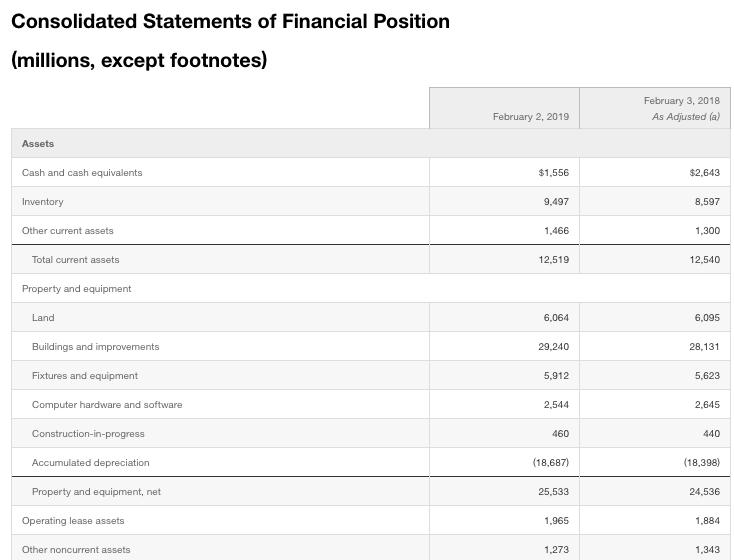

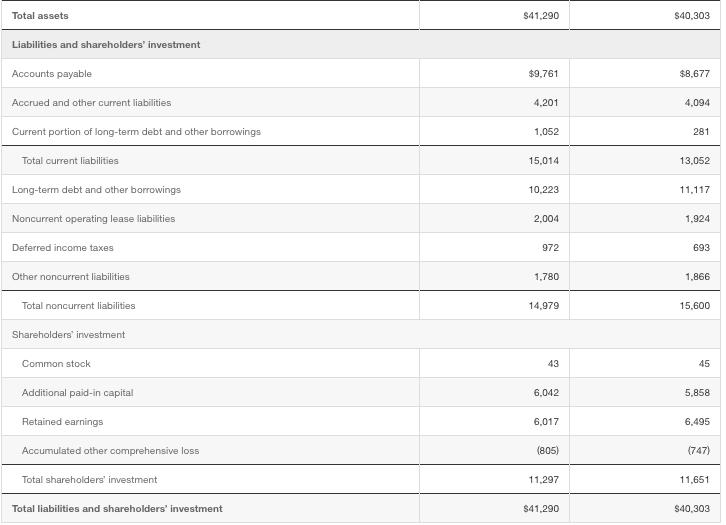

! Required information [The following information applies to the questions displayed below.] Target Corporation prepares its financial statements according to U.S. GAAP. Target's financial statements and disclosure notes for the year ended February 3, 2018, are available here. This material is also available under the Investor Relations link at the company's website (www.target.com). Required: 1. By what name does Target label its income statement? 2. What amounts did Target report for the following items for the year ended February 3, 2018? (Enter your answers in millions (i.e., 10,000,000 should be entered as 10).) 1. Target's label 2. a. Sales b. Gross margin C. Earnings from continuing operations before income taxes Net earnings from continuing operations d. e. Net earnings Consolidated Statements of Operations (millions, except per share data) Sales Other revenue Total revenue Cost of sales 2017 2016 2018 As Adjusted(a) As Adjusted(a) $74,433 $71,786 $69,414 923 928 857 75,356 72,714 70,271 53,299 51,125 49,145 Selling, general and administrative expenses 15,723 15,140 14,217 Depreciation and amortization (exclusive of depreciation included in cost of sales) 2,224 2,225 2,045 Operating income 4,110 4,224 4,864 Net interest expense 461 653 991 Net other (income) / expense Earnings from continuing operations before income taxes (27) (59) (88) 3,676 3,630 3,961 Provision for income taxes 746 722 1,295 Net earnings from continuing operations 2,930 2,908 2,666 Discontinued operations, net of tax Net earnings 7 $2,937 6 68 $2,914 $2,734 Consolidated Statements of Comprehensive Income (millions) Net earnings Other comprehensive (loss)/income, net of tax 2017 2016 2018 As Adjusted (a) As Adjusted (a) $2,937 $2,914 $2,734 Pension and other benefit liabilities, net of tax (52) 2 (13) Currency translation adjustment and cash flow hedges, net of tax (6) 6 4 Other comprehensive (loss)/income (58) 8 (9) Comprehensive income $2,879 $2,922 $2,725 Consolidated Statements of Financial Position (millions, except footnotes) Assets Cash and cash equivalents Inventory Other current assets Total current assets Property and equipment Land Buildings and improvements February 2, 2019 February 3, 2018 As Adjusted (a) $1,556 $2,643 9,497 8,597 1,466 1,300 12,519 12,540 6,064 6,095 29,240 28,131 Fixtures and equipment 5,912 5,623 Computer hardware and software 2,544 2,645 Construction-in-progress 460 440 Accumulated depreciation (18,687) (18,398) Property and equipment, net 25,533 24,536 Operating lease assets 1,965 1,884 Other noncurrent assets 1,273 1,343 Total assets Liabilities and shareholders' investment Accounts payable Accrued and other current liabilities Current portion of long-term debt and other borrowings Total current liabilities Long-term debt and other borrowings Noncurrent operating lease liabilities Deferred income taxes Other noncurrent liabilities Total noncurrent liabilities Shareholders' investment $41,290 $40,303 $9,761 $8,677 4.201 4,094 1,052 2811 15,014 13,052 10,223 11,117 2,004 1,924 972 693 1,780 1,866 14,979 15,600 Common stock Additional paid-in capital 43 6,042 5,858 45 Retained earnings 6,017 6,495 Accumulated other comprehensive loss (805) (747) Total shareholders' investment 11,297 11,651 Total liabilities and shareholders' investment $41,290 $40,303 ! Required information [The following information applies to the questions displayed below.] Target Corporation prepares its financial statements according to U.S. GAAP. Target's financial statements and disclosure notes for the year ended February 3, 2018, are available here. This material is also available under the Investor Relations link at the company's website (www.target.com). Required: 1. By what name does Target label its income statement? 2. What amounts did Target report for the following items for the year ended February 3, 2018? (Enter your answers in millions (i.e., 10,000,000 should be entered as 10).) 1. Target's label 2. a. Sales b. Gross margin C. Earnings from continuing operations before income taxes Net earnings from continuing operations d. e. Net earnings Consolidated Statements of Operations (millions, except per share data) Sales Other revenue Total revenue Cost of sales 2017 2016 2018 As Adjusted(a) As Adjusted(a) $74,433 $71,786 $69,414 923 928 857 75,356 72,714 70,271 53,299 51,125 49,145 Selling, general and administrative expenses 15,723 15,140 14,217 Depreciation and amortization (exclusive of depreciation included in cost of sales) 2,224 2,225 2,045 Operating income 4,110 4,224 4,864 Net interest expense 461 653 991 Net other (income) / expense Earnings from continuing operations before income taxes (27) (59) (88) 3,676 3,630 3,961 Provision for income taxes 746 722 1,295 Net earnings from continuing operations 2,930 2,908 2,666 Discontinued operations, net of tax Net earnings 7 $2,937 6 68 $2,914 $2,734 Consolidated Statements of Comprehensive Income (millions) Net earnings Other comprehensive (loss)/income, net of tax 2017 2016 2018 As Adjusted (a) As Adjusted (a) $2,937 $2,914 $2,734 Pension and other benefit liabilities, net of tax (52) 2 (13) Currency translation adjustment and cash flow hedges, net of tax (6) 6 4 Other comprehensive (loss)/income (58) 8 (9) Comprehensive income $2,879 $2,922 $2,725 Consolidated Statements of Financial Position (millions, except footnotes) Assets Cash and cash equivalents Inventory Other current assets Total current assets Property and equipment Land Buildings and improvements February 2, 2019 February 3, 2018 As Adjusted (a) $1,556 $2,643 9,497 8,597 1,466 1,300 12,519 12,540 6,064 6,095 29,240 28,131 Fixtures and equipment 5,912 5,623 Computer hardware and software 2,544 2,645 Construction-in-progress 460 440 Accumulated depreciation (18,687) (18,398) Property and equipment, net 25,533 24,536 Operating lease assets 1,965 1,884 Other noncurrent assets 1,273 1,343 Total assets Liabilities and shareholders' investment Accounts payable Accrued and other current liabilities Current portion of long-term debt and other borrowings Total current liabilities Long-term debt and other borrowings Noncurrent operating lease liabilities Deferred income taxes Other noncurrent liabilities Total noncurrent liabilities Shareholders' investment $41,290 $40,303 $9,761 $8,677 4.201 4,094 1,052 2811 15,014 13,052 10,223 11,117 2,004 1,924 972 693 1,780 1,866 14,979 15,600 Common stock Additional paid-in capital 43 6,042 5,858 45 Retained earnings 6,017 6,495 Accumulated other comprehensive loss (805) (747) Total shareholders' investment 11,297 11,651 Total liabilities and shareholders' investment $41,290 $40,303

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Targets Label for Income Statement Label Target uses Consolidated Statements of Operations as the label for its income statement 2 Financial Informa...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started