Identify 3 red flags and explain in 1-2 sentences how each suggests possible financial statement manipulation

Calculate all ratios

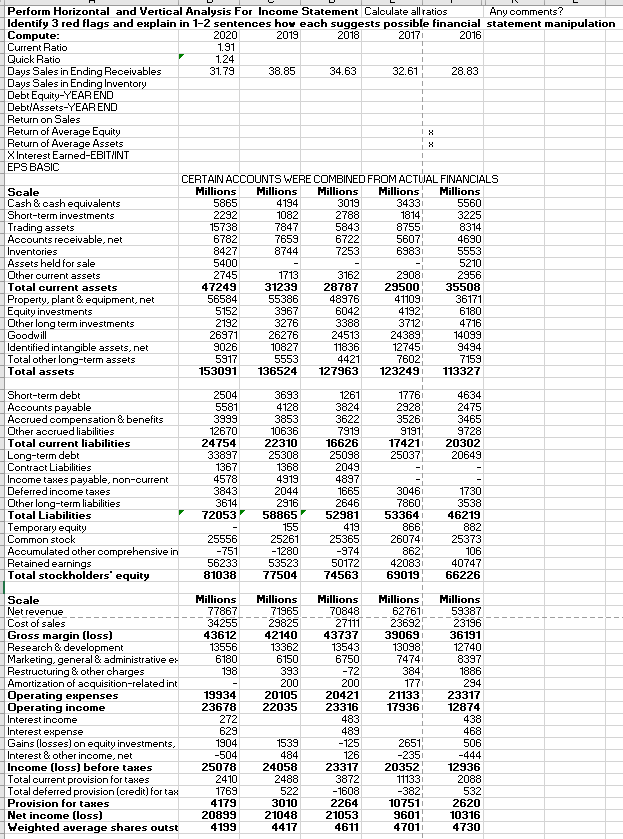

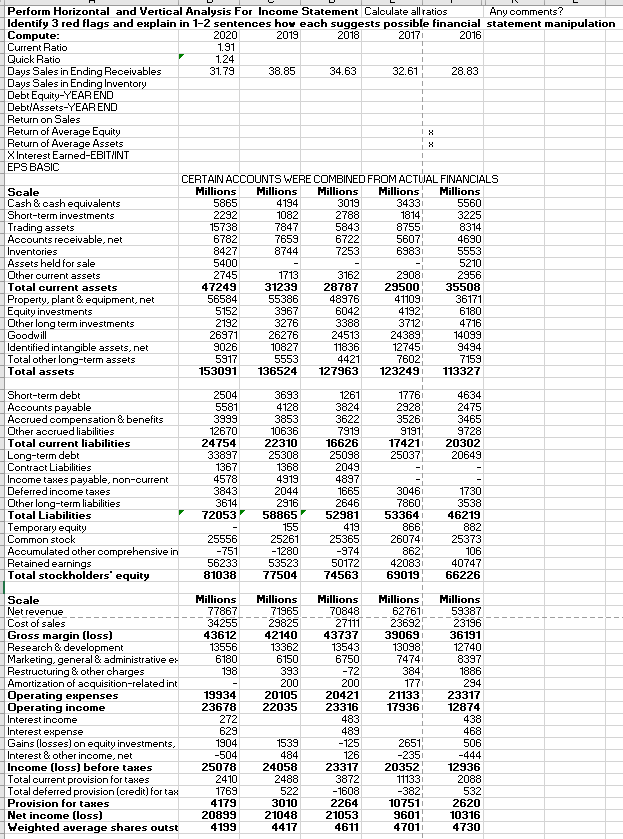

X Perform Horizontal and Vertical Analysis For Income Statement Calculate allratios Any comments? Identify 3 red flags and explain in 1-2 sentences how each suggests possible financial statement manipulation Compute: 2020 2019 2018 2017 2016 Current Ratio 1.91 Quick Ratio 1.24 Days Sales in Ending Receivables 31.79 38.85 34.63 32.61 28.83 Days Sales in Ending Inventory Debt Equity-YEAR END Debt/Assets-YEAR END Return on Sales Return of Average Equity Return of Average Assets X Interest Earned-EBIT/INT EPS BASIC CERTAIN ACCOUNTS WERE COMBINED FROM ACTUAL FINANCIALS Scale Millions Millions Millions Millions Millions Cash & cash equivalents 5865 4194 3019 3433 5560 Short-term investments 2292 1082 2788 1814 3225 Trading assets 15738 7847 5843 8755 8314 Accounts receivable, net 6782 7659 6722 5607 4690 Inventories 8427 8744 7253 6983 5553 Assets held for sale 5400 5210 Other current assets 2745 1713 3162 2908 2956 Total current assets 47249 31239 28787 29500 35508 Property, plant & equipment, net 56584 55386 48976 41109 36171 Equity investments 5152 3967 6042 4192 6180 Other long term investments 2192 3276 3388 3712 4716 Goodwill 26971 26276 24513 24389 14099 Identified intangible assets, net 9026 10827 11836 12745 9494 Total other long-term assets 5917 5553 4421 7602 7159 Total assets 153091 136524 127963 123249 113327 2504 5581 3999 12670 24754 33897 1367 4578 3843 3614 72053 1776 2928 3526 9191 17421 25037 Short-term debt Accounts payable Accrued compensation & benefits Other accrued liabilities Total current liabilities Long-term debt Contract Liabilities Income taxes payable, non-current Deferred income taxes Other long-term liabilities Total Liabilities Temporary equity Common stock Accumulated other comprehensive in Retained earnings Total stockholders' equity 4634 2475 3465 9728 20302 20649 3693 4128 3853 10636 22310 25308 1368 4919 2044 2916 58865 155 25261 -1280 53523 77504 1261 3824 3622 7919 16626 25098 2049 4897 1665 2646 52981 419 25365 -974 50172 74563 3046 7860 53364 866 26074 862 42083 69019 25556 -751 56233 81038 1730 3538 46219 882 25373 106 40747 66226 Millions 77867 34255 43612 13556 6180 198 Millions 71965 29825 42140 13362 6150 393 200 20105 22035 Millions 62761 23692 39069 13098 7474 384 177 21133 17936 Scale Net revenue Cost of sales Gross margin (loss) Research & development Marketing, general & administrative es Restructuring & other charges Amortization of acquisition-related int Operating expenses Operating income Interest income Interest expense Gains (losses) on equity investments, Interest & other income, net Income (loss) before taxes Total current provision for taxes Total deferred provision (credit) for tax Provision for taxes Net income (loss) Weighted average shares outst 19934 23678 272 629 1904 -504 25078 2410 1769 4179 20899 4199 Millions 70848 27111 43737 13543 6750 -72 200 20421 23316 483 489 -125 126 23317 3872 -1608 2264 21053 4611 Hillions 59387 23196 36191 12740 8397 1886 294 23317 12874 438 468 506 -444 12936 2088 532 2620 10316 4730 2651 -235 20352 11133 1539 484 24058 2488 522 3010 21048 4417 -382 10751 9601 4701 X Perform Horizontal and Vertical Analysis For Income Statement Calculate allratios Any comments? Identify 3 red flags and explain in 1-2 sentences how each suggests possible financial statement manipulation Compute: 2020 2019 2018 2017 2016 Current Ratio 1.91 Quick Ratio 1.24 Days Sales in Ending Receivables 31.79 38.85 34.63 32.61 28.83 Days Sales in Ending Inventory Debt Equity-YEAR END Debt/Assets-YEAR END Return on Sales Return of Average Equity Return of Average Assets X Interest Earned-EBIT/INT EPS BASIC CERTAIN ACCOUNTS WERE COMBINED FROM ACTUAL FINANCIALS Scale Millions Millions Millions Millions Millions Cash & cash equivalents 5865 4194 3019 3433 5560 Short-term investments 2292 1082 2788 1814 3225 Trading assets 15738 7847 5843 8755 8314 Accounts receivable, net 6782 7659 6722 5607 4690 Inventories 8427 8744 7253 6983 5553 Assets held for sale 5400 5210 Other current assets 2745 1713 3162 2908 2956 Total current assets 47249 31239 28787 29500 35508 Property, plant & equipment, net 56584 55386 48976 41109 36171 Equity investments 5152 3967 6042 4192 6180 Other long term investments 2192 3276 3388 3712 4716 Goodwill 26971 26276 24513 24389 14099 Identified intangible assets, net 9026 10827 11836 12745 9494 Total other long-term assets 5917 5553 4421 7602 7159 Total assets 153091 136524 127963 123249 113327 2504 5581 3999 12670 24754 33897 1367 4578 3843 3614 72053 1776 2928 3526 9191 17421 25037 Short-term debt Accounts payable Accrued compensation & benefits Other accrued liabilities Total current liabilities Long-term debt Contract Liabilities Income taxes payable, non-current Deferred income taxes Other long-term liabilities Total Liabilities Temporary equity Common stock Accumulated other comprehensive in Retained earnings Total stockholders' equity 4634 2475 3465 9728 20302 20649 3693 4128 3853 10636 22310 25308 1368 4919 2044 2916 58865 155 25261 -1280 53523 77504 1261 3824 3622 7919 16626 25098 2049 4897 1665 2646 52981 419 25365 -974 50172 74563 3046 7860 53364 866 26074 862 42083 69019 25556 -751 56233 81038 1730 3538 46219 882 25373 106 40747 66226 Millions 77867 34255 43612 13556 6180 198 Millions 71965 29825 42140 13362 6150 393 200 20105 22035 Millions 62761 23692 39069 13098 7474 384 177 21133 17936 Scale Net revenue Cost of sales Gross margin (loss) Research & development Marketing, general & administrative es Restructuring & other charges Amortization of acquisition-related int Operating expenses Operating income Interest income Interest expense Gains (losses) on equity investments, Interest & other income, net Income (loss) before taxes Total current provision for taxes Total deferred provision (credit) for tax Provision for taxes Net income (loss) Weighted average shares outst 19934 23678 272 629 1904 -504 25078 2410 1769 4179 20899 4199 Millions 70848 27111 43737 13543 6750 -72 200 20421 23316 483 489 -125 126 23317 3872 -1608 2264 21053 4611 Hillions 59387 23196 36191 12740 8397 1886 294 23317 12874 438 468 506 -444 12936 2088 532 2620 10316 4730 2651 -235 20352 11133 1539 484 24058 2488 522 3010 21048 4417 -382 10751 9601 4701