Answered step by step

Verified Expert Solution

Question

1 Approved Answer

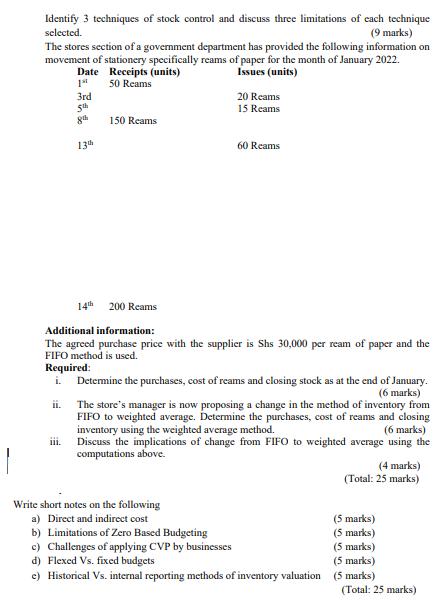

Identify 3 techniques of stock control and discuss three limitations of each technique selected. (9 marks) The stores section of a government department has

Identify 3 techniques of stock control and discuss three limitations of each technique selected. (9 marks) The stores section of a government department has provided the following information on movement of stationery specifically reams of paper for the month of January 2022. Receipts (units) Issues (units) 50 Reams Date 1st 3rd 5th 8th iii. 13% 14th Required: i. 150 Reams 200 Reams Additional information: The agreed purchase price with the supplier is Shs 30,000 per ream of paper and the FIFO method is used. 20 Reams 15 Reams 60 Reams Determine the purchases, cost of reams and closing stock as at the end of January. (6 marks) The store's manager is now proposing a change in the method of inventory from FIFO to weighted average. Determine the purchases, cost of reams and closing inventory using the weighted average method. (6 marks) Discuss the implications of change from FIFO to weighted average using the computations above. Write short notes on the following a) Direct and indirect cost b) Limitations of Zero Based Budgeting c) Challenges of applying CVP by businesses d) Flexed Vs. fixed budgets e) Historical Vs. internal reporting methods of inventory valuation (4 marks) (Total: 25 marks) (5 marks) (5 marks) (5 marks) (5 marks) (5 marks) (Total: 25 marks)

Step by Step Solution

★★★★★

3.25 Rating (143 Votes )

There are 3 Steps involved in it

Step: 1

Economic Order Quantity EOQ EOQ is a technique used to determine the optimal order quantity that minimizes the total cost of holding inventory and ord...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started