Answered step by step

Verified Expert Solution

Question

1 Approved Answer

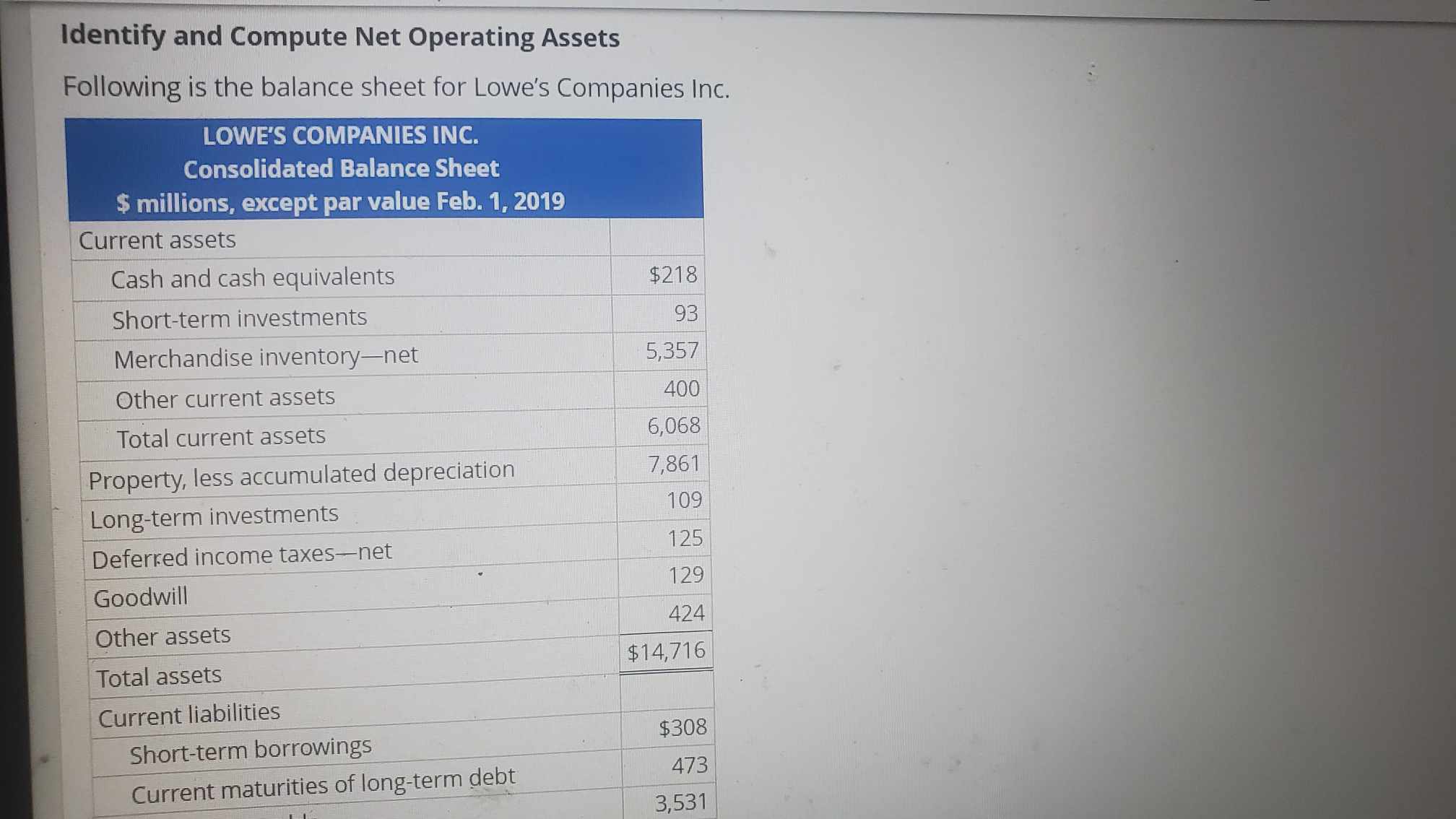

Identify and Compute Net Operating Assets Following is the balance sheet for Lowe's Companies Inc. LOWE'S COMPANIES INC. Consolidated Balance Sheet $ millions, except

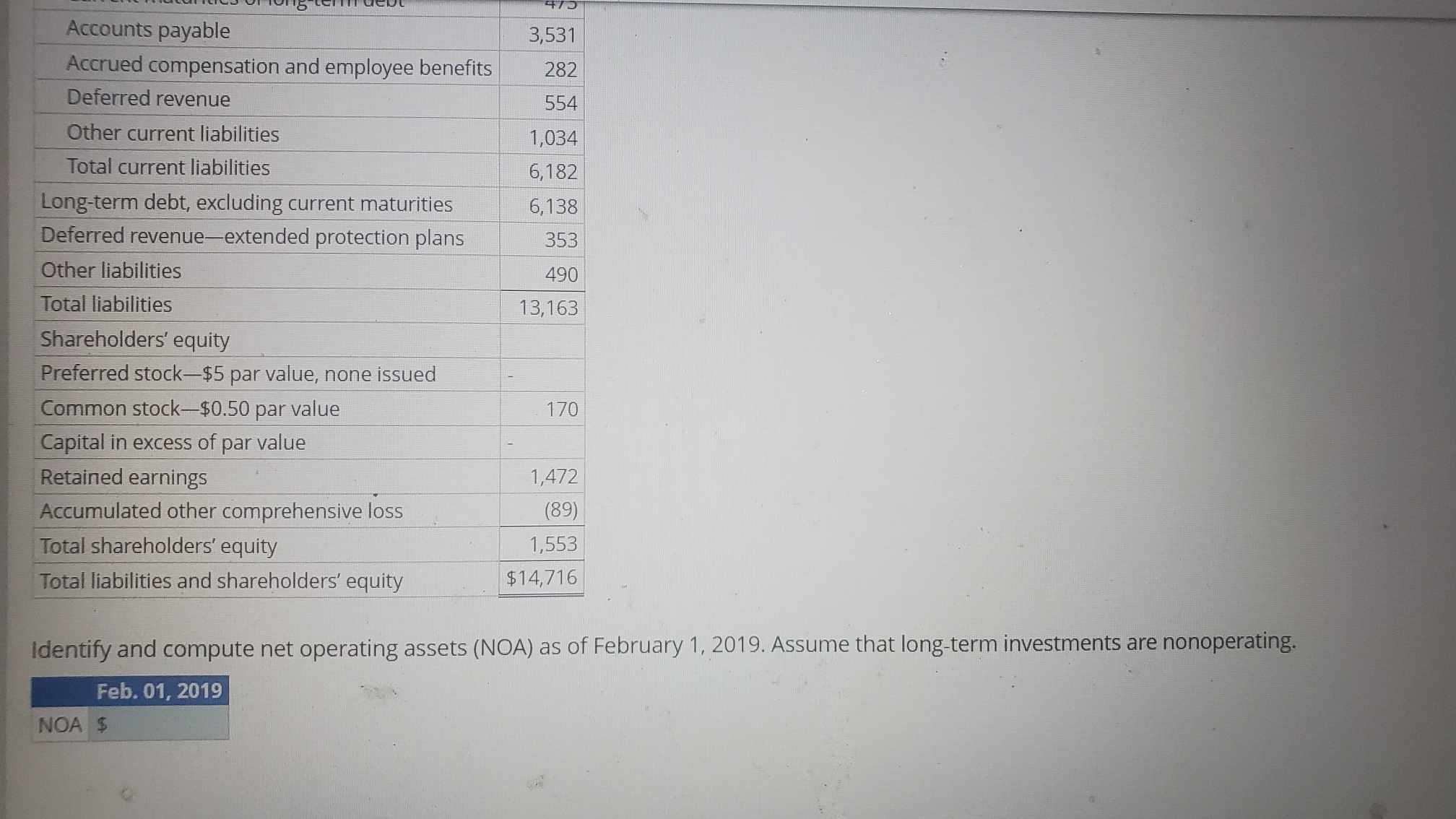

Identify and Compute Net Operating Assets Following is the balance sheet for Lowe's Companies Inc. LOWE'S COMPANIES INC. Consolidated Balance Sheet $ millions, except par value Feb. 1, 2019 Current assets Cash and cash equivalents Short-term investments Merchandise inventory-net Other current assets Total current assets Property, less accumulated depreciation Long-term investments Deferred income taxes-net Goodwill Other assets Total assets Current liabilities Short-term borrowings Current maturities of long-term debt $218 93 5,357 400 6,068 7,861 109 125 129 424 $14,716 $308 473 3,531 Accounts payable Accrued compensation and employee benefits Deferred revenue Other current liabilities Total current liabilities Long-term debt, excluding current maturities Deferred revenue-extended protection plans Other liabilities Total liabilities Shareholders' equity Preferred stock-$5 par value, none issued Common stock-$0.50 par value Capital in excess of par value Retained earnings Accumulated other comprehensive loss Total shareholders' equity Total liabilities and shareholders' equity 47 NOA $ 3,531 282 554 1,034 6,182 6,138 353 490 13,163 170 1,472 (89) 1,553 $14,716 Identify and compute net operating assets (NOA) as of February 1, 2019. Assume that long-term investments are nonoperating. Feb. 01, 2019

Step by Step Solution

★★★★★

3.34 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

The task here is to identify and compute the Net Operating Assets NOA for Lowes Companies Inc as of February 1 2019 NOA is a measure of a companys ope...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started