Question: identify and explain five examples where executives or directors faced moral hazards and did not deal with them ethically globa ow ied on lendin to

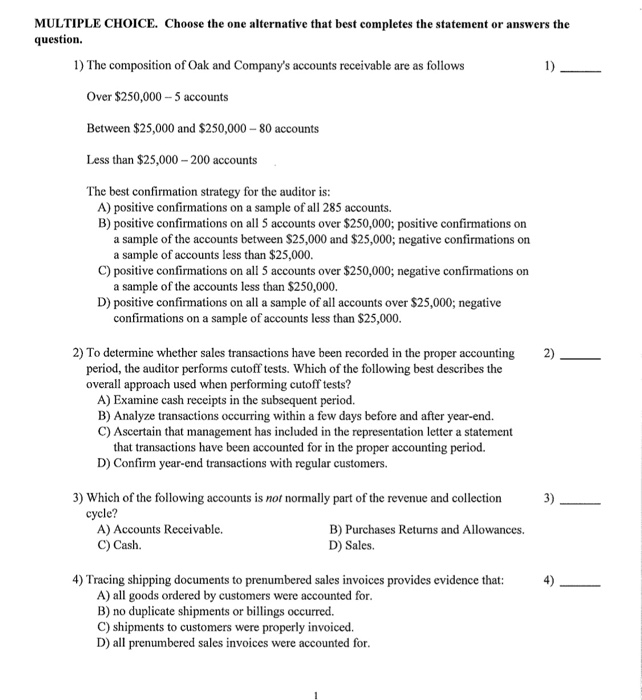

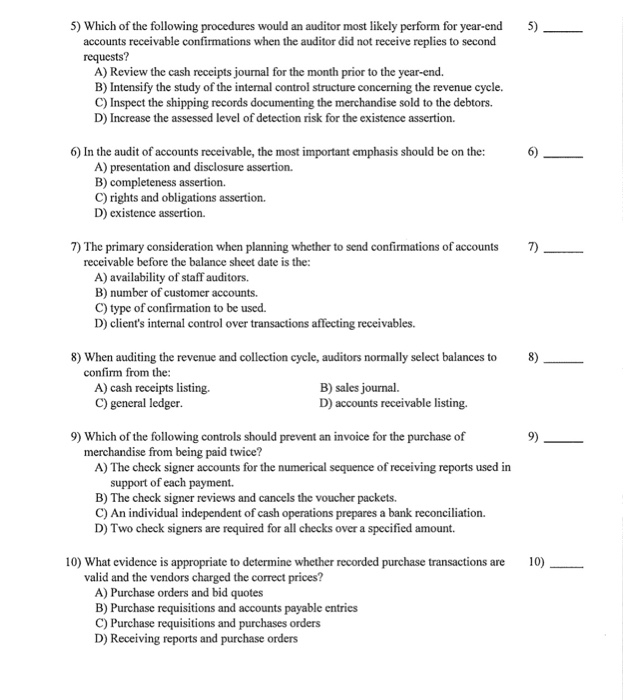

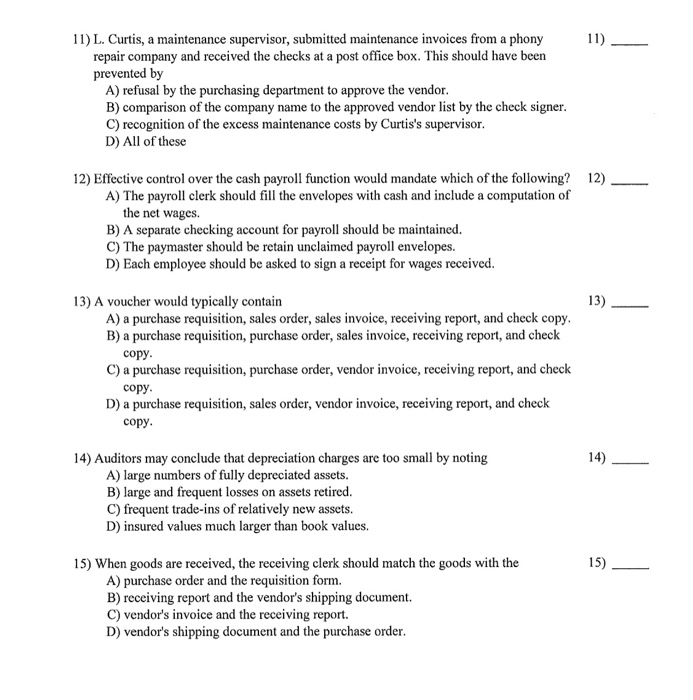

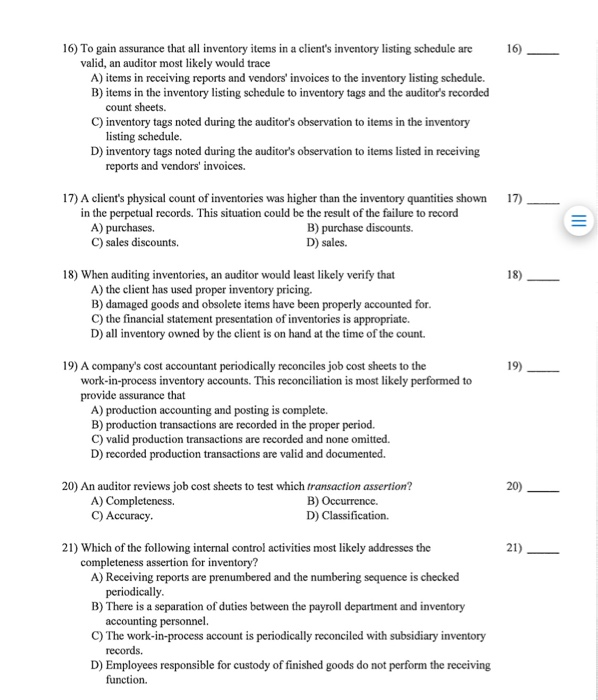

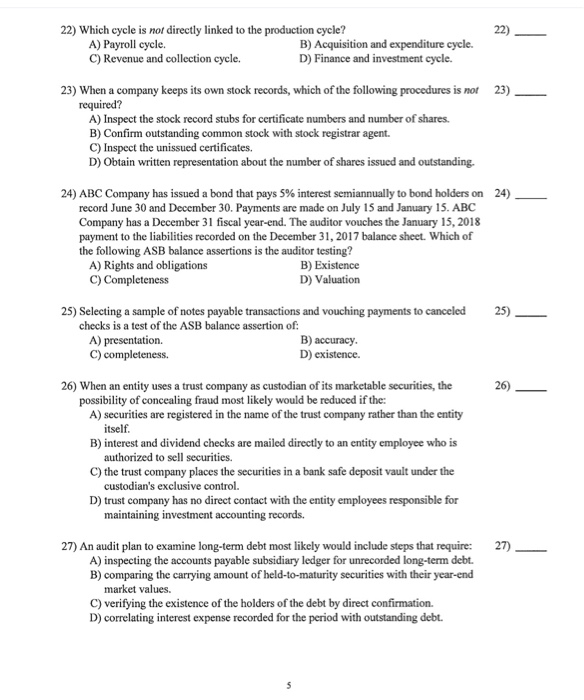

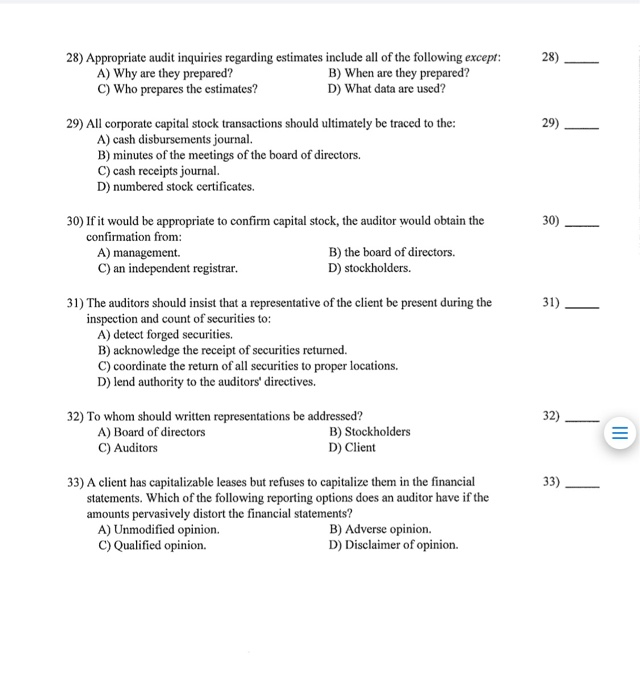

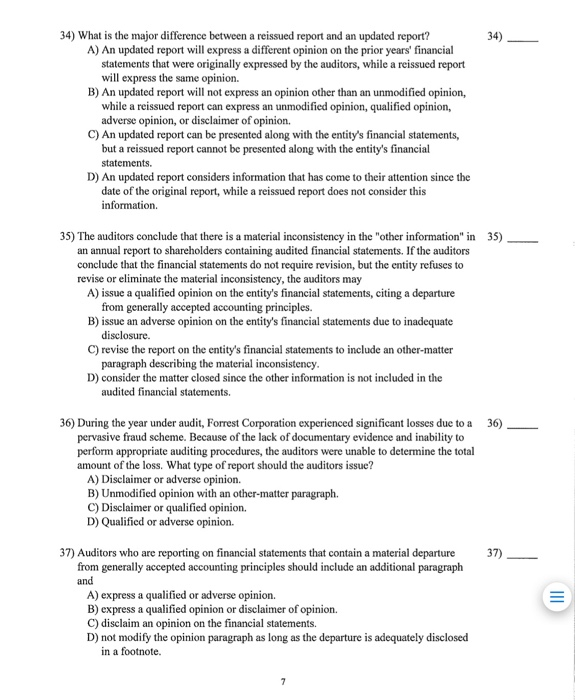

globa ow ied on lendin to be applied on a gh ns nd ie asis The accounting profession has led the scandal, eake on&ewting and disckosure standards globally, an ding scandal, investment is to and headway is evident. Corpo. are slower to change. Forta anticorruption laws on a worldwide d the huge fines levied and lost profits improved, but these are and ef LIBOR scandal banks, and the i cheat ar its cheating on air quality tests have the rjeus entoncement of antib ea or is il spill and VW for the future of business and professional ethics ) a aw ehial dacisin making af imany multinational Questions 1 Hoe much and in which ways did unbridled self-i nterest to the subprime contribute lending crisis? improve the exercise of unbridled self-interest in How could increased regulation decision making? How could ethical considerations improve unbridled self interest in ethical decision making? Kdentify and explain five examples where executives or directors faced moral hazards and did not deal with them ethically s Hoer mach should hexiting CEOs of Fannie Mae and Freddie Mac have receisl The government bailout of the financial community included taking an equity interest m poblidly traded companies such as AIG. Is it right for the government to become a investor in publicly traded companies? 7. Shold CEOs who made large bonuses by having their firms invest in sdial scoutis n the carly years have to repay those bonuses in when the firm records losses on those same securities? in mo &. Should the CEOs who refused to have their firms invest in mortgage Os who refused to have their firms invest in mortgage- b early years because the risks were too great receive bonuses ih atr Hotw Dcause their firms did not incur any mortgage-backed security you determine the size of these bonuses? d organizations that have a risk-taking culture, such as the ohout rn eil at MerrilI gvermnent baloutsnch, enjoy the gains and suffer the loss wi The global er the losses, without recourseto cricsms that M2M accounting rules contibuted to the ccs housing vonomic crisis was caused by the meltdown ieil the miesof . government bear some of the responsibility al countries that were harmed by this crisis? out the MULTIPLE CHOICE. Choose the one alternative that best completes the statement or answers the question. 1) The composition of Oak and Company's accounts receivable are as follows 1) Over $250,000 5 accounts Between $25,000 and $250,000-80 accounts Less than $25,000-200 accounts The best confirmation strategy for the auditor is: A) positive confirmations on a sample of all 285 accounts. B) positive confirmations on all 5 accounts over $250,000; positive confirmations on a sample of the accounts between $25,000 and $25,000; negative confirmations on a sample of accounts less than $25,000 a sample of the accounts less than $250,000. confirmations on a sample of accounts less than $25,000 C) positive confirmations on all 5 accounts over $250,000; negative confirmations on D) positive confirmations on all a sample of all accounts over $25,000; negative 2) To determine whether sales transactions have been recorded in the proper accounting 2) period, the auditor performs cutoff tests. Which of the following best describes the overall approach used when performing cutoff tests? A) Examine cash receipts in the subsequent period. B) Analyze transactions occurring within a few days before and after year-end. C) Ascertain that management has included in the representation letter a statement that transactions have been accounted for in the proper accounting period. D) Confirm year-end transactions with regular customers. 3) Which of the following accounts is not normally part of the revenue and collection 3) cycle? A) Accounts Receivable. C) Cash. B) Purchases Returns and Allowances. D) Sales. 4) Tracing shipping documents to prenumbered sales invoices provides evidence that:4) A) all goods ordered by customers were accounted for B) no duplicate shipments or billings occurred. C) shipments to customers were properly invoiced. D) all prenumbered sales invoices were accounted for 5) Which of the following procedures would an auditor most likely perform for year-end 5) accounts receivable confirmations when the auditor did not receive replies to second requests? A) Review the cash receipts journal for the month prior to the year-end. B) Intensify the study of the intermal control structure concerning the revenue cycle. C) Inspect the shipping records documenting the merchandise sold to the debtors. D) Increase the assessed level of detection risk for the existence assertion. 6) In the audit of accounts receivable, the most important emphasis should be on the: 6) A) presentation and disclosure assertion. B) completeness assertion. C) rights and obligations assertion. D) existence assertion. 7) The primary consideration when planning whether to send confirmations of accounts 7) receivable before the balance sheet date is the: A) availability of staff auditors. B) number of customer accounts. C) type of confirmation to be used. D) client's internal control over transactions affecting receivables. 8) When auditing the revenue and collection cycle, auditors normally select balances to 8) confirm from the: A) cash receipts listing. C) general ledger B) sales journal. D) accounts receivable listing. 9) Which of the following controls should prevent an invoice for the purchase of 9) merchandise from being paid twice? A) The check signer accounts for the numerical sequence of receiving reports used in support of each payment. B) The check signer reviews and cancels the voucher packets. C) An individual independent of cash operations prepares a bank reconciliation. D) Two check signers are required for all checks over a specified amount. 10) What evidence is appropriate to determine whether recorded purchase transactions are 10) valid and the vendors charged the correct prices? A) Purchase orders and bid quotes B) Purchase C) Purchase requisitions and purchases orders D) Receiving reports and purchase orders requisitions and accounts payable entries 11) L. Curtis, a maintenance supervisor, submitted maintenance invoices from a phony repair company and received the checks at a post office box. This should have been prevented by A) refusal by the purchasing department to approve the vendor B) comparison of the company name to the approved vendor list by the check signer C) recognition of the excess maintenance costs by Curtis's supervisor D) All of these 12) Effective control over the cash payroll function would mandate which of the following? A) The payroll clerk should fill the envelopes with cash and include a computation of 12) the net wages. B) A separate checking account for payroll should be maintained. C) The paymaster should be retain unclaimed payroll envelopes. D) Each employee should be asked to sign a receipt for wages received 13) A voucher would typically contain A) a purchase requisition, sales order, sales invoice, receiving report, and check copy B) a purchase requisition, purchase order, sales invoice, receiving report, and check copy copy copy C) a purchase requisition, purchase order, vendor invoice, receiving report, and checlk D) a purchase requisition, sales order, vendor invoice, receiving report, and check 14) Auditors may conclude that depreciation charges are too small by noting 14 A) large numbers of fully depreciated assets. B) large and frequent losses on assets retired C) frequent trade-ins of relatively new assets. D) insured values much larger than book values. 15 15) When goods are received, the receiving clerk should match the goods with the A) purchase order and the requisition form. B) receiving report and the vendor's shipping document C) vendor's invoice and the receiving report. D) vendor's shipping document and the purchase order 16) To gain assurance that all inventory items in a client's inventory listing schedule are 16 valid, an auditor most likely would trace A) items in receiving reports and vendors' invoices to the inventory listing schedule. B) items in the inventory listing schedule to inventory tags and the auditor's recorded C) inventory tags noted during the auditor's observation to items in the inventory D) inventory tags noted during the auditor's observation to items listed in receiving count sheets. listing schedule. reports and vendors' invoices. 17) A client's physical count of inventories was higher than the inventory quantities shown in the perpetual records. This situation could be the result of the failure to record 17) A) purchases C) sales discounts. B) purchase discounts. D) sales. 18) When auditing inventories, an auditor would least likely verify that A) the client has used proper inventory pricing. B) damaged goods and obsolete items have been properly accounted for C) the financial statement presentation of inventories is appropriate. D) all inventory owned by the client is on hand at the time of the count. 19) A company's cost accountant periodically reconciles job cost sheets to the work-in-process inventory accounts. This reconciliation is most likely performed to provide assurance that A) production accounting and posting is complete. B) production transactions are recorded in the proper period. C) valid production transactions are recorded and none omitted. D) recorded production transactions are valid and documented. 20) An auditor reviews job cost sheets to test which transaction assertion? 20) A) Completeness. C) Accuracy B) Occurrence. D) Classification. 21) Which of the following internal control activities most likely addresses the completeness assertion for inventory? A) Receiving reports are prenumbered and the numbering sequence is checked B) There is a separation of duties between the payroll department and inventory accounting personnel. records. function. C) The work-in-process account is periodically reconciled with subsidiary inventory D) Employees responsible for custody of finished goods do not perform the receiving 22) Which cycle is not directly linked to the production cycle? 22) A) Payroll cycle. C) Revenue and collection cycle. B) Acquisition and expenditure cycle D) Finance and investment cycle 23) When a company keeps its own stock records, which of the following procedures is not 23) required? A) Inspect the stock record stubs for certificate numbers and number of shares B) Confirm outstanding common stock with stock registrar agent. C) Inspect the unissued certificates. D) Obtain written representation about the number of shares issued and outstanding. 24) ABC Company has issued a bond that pays 5% interest semiannually to bond holders on 24) record June 30 and December 30. Payments are made on July 15 and January 15. ABC Company has a December 31 fiscal year-end. The auditor vouches the January 15, 2018 payment to the liabilities recorded on the December 31, 2017 balance sheet. Which of the following ASB balance assertions is the auditor testing? A) Rights and obligations C) Completeness B) Existence D) Valuation 25) Selecting a sample of notes payable transactions and vouching payments to canceled 25) checks is a test of the ASB balance assertion of B) accuracy D) existence. A) presentation. 26) When an entity uses a trust company as custodian of its marketable securities, the 26) possibility of concealing fraud most likely would be reduced if the: A) securities are registered in the name of the trust company rather than the entity B) interest and dividend checks are mailed directly to an entity employee who is C) the trust company places the securities in a bank safe deposit vault under the D) trust company has no direct contact with the entity employees responsible for itself authorized to sell securities. custodian's exclusive control. maintaining investment accounting records. 27) An audit plan to examine long-term debt most likely would include steps that require: A) inspecting the accounts payable subsidiary ledger for unrecorded long-term debt. B) comparing the carrying amount of held-to-maturity securities with their year-end 27) market values. C) verifying the existence of the holders of the debt by direct confirmation. D) correlating interest expense recorded for the period with outstanding debt. 28) Appropriate audit inquiries regarding estimates include all of the following except: A) Why are they prepared? C) Who prepares the estimates? B) When are they prepared? D) What data are used? 29) All corporate capital stock transactions should ultimately be traced to the: A) cash disbursements journal. B) minutes of the meetings of the board of directors. C) cash receipts journal D) numbered stock certificates. 30) If it would be appropriate to confirm capital stock, the auditor would obtain the confirmation from B) the board of directors. C) an independent registrar. 31) The auditors should insist that a representative of the client be present during the inspection and count of securities to: A) detect forged securities. B) acknowledge the receipt of securities returned. C) coordinate the return of all securities to proper locations. D) lend authority to the auditors' directives. 32) To whom should written representations be addressed? A) Board of directors C) Auditors B) Stockholders D) Client 33) A client has capitalizable leases but refuses to capitalize them in the financial statements. Which of the following reporting options does an auditor have if the amounts pervasively distort the financial statements? B) Adverse opinion. D) Disclaimer of opinion. A) Unmodified opinion. C) Qualified opinion. 4) What is the major difference between a reissued report and an updated report? 34) A) An updated report will express a different opinion on the prior years' financial statements that were originally expressed by the auditors, while a reissued report will express the same opinion. B) An updated report will not express an opinion other than an unmodified opinion, while a reissued report can express an unmodified opinion, qualified opinion, adverse opinion, or disclaimer of opinion. C) An updated report can be presented along with the entity's financial statements, but a reissued report cannot be presented along with the entity's financial D) An updated report considers information that has come to their attention since the date of the original report, while a reissued report does not consider this 35) The auditors conclude that there is a material inconsistency in the "other information" in an annual report to shareholders containing audited financial statements. If the auditors conclude that the financial statements do not require revision, but the entity refuses to 35) revise or eliminate the material inconsistency, the auditors may A) issue a qualified opinion on the entity's financial statements, citing a departure B) issue an adverse opinion on the entity's financial statements due to inadequate C) revise the report on the entity's financial statements to include an other-matter from generally accepted accounting principles. paragraph describing the material inconsistency D) consider the matter closed since the other information is not included in the audited financial statements. 36) During the year under audit, Forrest Corporation experienced significant losses due to a 36) pervasive fraud scheme. Because of the lack of documentary evidence and inability to perform appropriate auditing procedures, the auditors were unable to determine the total amount of the loss. What type of report should the auditors issue? A) Disclaimer or adverse opinion. B) Unmodified opinion with an other-matter paragraph. C) Disclaimer or qualified opinion. D) Qualificd or adverse opinion. 37) Auditors who are reporting on financial statements that contain a material departure 37) from generally accepted accounting principles should include an additional paragraph and A) express a qualified or adverse opinion. B) express a qualified opinion or disclaimer of opinion. C) disclaim an opinion on the financial statements. D) not modify the opinion paragraph as long as the departure is adequately disclosed in a footnote. 42) Which of the following events occurring after the audit report release date most likely would cause auditors to make further inquiries about the previously-issued financial 42) A) An uninsured natural disaster occurs that may affect the entity's ability to continue as a going concern B) A subsidiary is sold that accounts for 25% of the entity's consolidated net income. C) New information is discovered concerning undisclosed lease transactions during the period under audit. D) A contingency is resolved that had been disclosed in the audited financial 43) Following the audit report release date, auditors became aware of facts existing at the report date that would have affected the reports had auditors then been aware of such facts. What is the most appropriate initial course of action that auditors should take? 43) A) Determine whether there are persons relying or likely to rely on the financial statements who would attach importance to the information. B) Issue revised pro forma financial statements taking into consideration the newly discovered information. C) Give public notice that auditors are no longer associated with financial statements. D) Request that management disclose the newly-discovered information by issuing revised financial statements. 44) Auditors must complete various phases of an audit after the date of the financial 44) statements. The auditors' responsibility for matters affecting the client extends from the date of the financial statements to the A) audit report release date. B) date of the auditors' report. C) delivery of the auditors' reports to the client D) final review of the audit documentation. 45) Which of the following procedures would auditors most likely perform in obtaining 45) evidence about subsequent events? A) Determine that changes in employee pay rates after year end were properly B) Investigate changes in long-term debt occurring after year end. C) Recompute depreciation charges for plant assets sold after year end D) Inquire about payroll checks that were recorded before year end but cashed after year end. 46) Which of the following substantive procedures would not ordinarily be used by auditors 46) in evaluating the potential existence of subsequent events? A) Obtaining written representations B) Inquiring of officers and other client executives C) Performing cut-off testing near year end D) Reviewing the latest interim financial statements 47) Which of the following items would appear in written representations in the audit of a 47) public entity but not a nonpublic entity? A) An indication that all subsequent events have been disclosed to the auditors B) Management's opinion as to the effectiveness of its internal control over financial reporting C) Statements related to management's responsibility for the entity's financial D) Statements related to management's responsibility for designing internal control to prevent and detect fraud 48) Which of the following is typically not included in the inquiry letter sent to the client's 48) attorneys? A) A disclaimer regarding the likelihood of settlement of pending litigation B) An evaluation of the likelihood of an unfavorable outcome C) A listing of pending or threatened litigation, claims, or assessments D) An estimate of the range of potential loss 49) Auditors who are reporting on financial statements that contain a material departure 49) from generally accepted accounting principles should include an additional paragraph and A) disclaim an opinion on the financial statements. B) express a qualified opinion or disclaimer of opinion. C) express a qualified or adverse opinion. D) not modify the opinion paragraph as long as the departure is adequately disclosed in a footnote. 50) If financial statements contain a material but non-pervasive departure from generally 50) accepted accounting principles, the auditors should render a(n) A) adverse opinion with reference to departure. B) adverse C) disclaimer of opinion. D) Qualified opinion with reference to departure. opinion with scope limitation reference

Step by Step Solution

There are 3 Steps involved in it

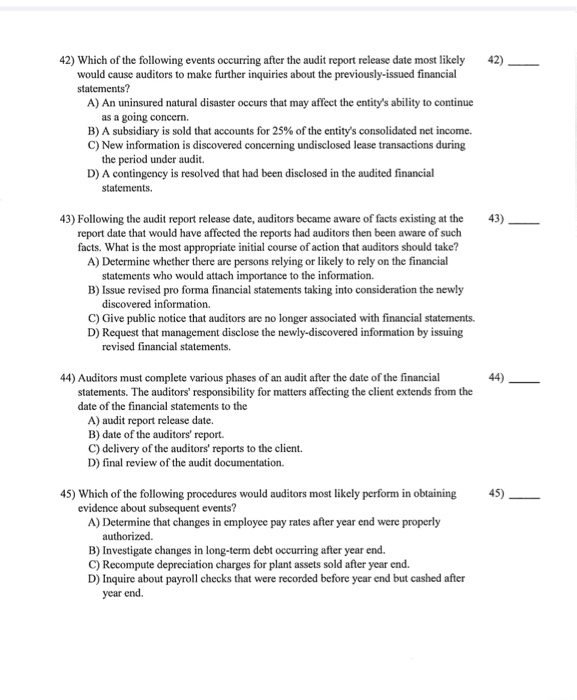

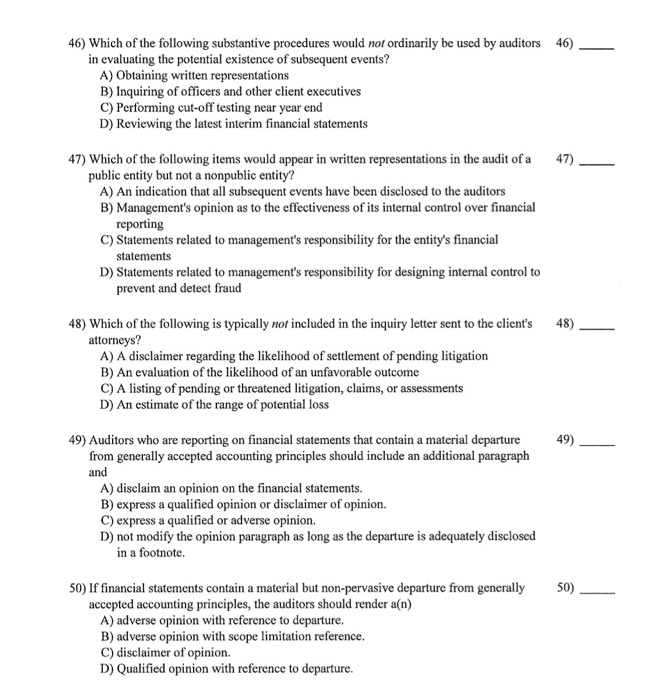

Get step-by-step solutions from verified subject matter experts