Question

Identify each fringe benefit provided to Maggie and determine whether an exemption applies. (6 marks) Question 2: Explain the impact the fringe benefits will

Identify each fringe benefit provided to Maggie and determine whether an exemption applies. (6 marks)

Question 2:

Explain the impact the fringe benefits will have on Maggie's taxable income and/or net tax payable (refundable). (2 mark)

Question 3:

Once you have completed Maggie's tax return, it comes to your attention that Maggie may hold cryptoassets. With reference to the TASA Code of Professional Conduct, reflect upon both your duty as a tax agent and Maggie's duties as your client. (4 marks)

Question 4:

Explain how you approached completing this task including details of any resources you viewed or utilised and provide a complete reference list. (2 marks)

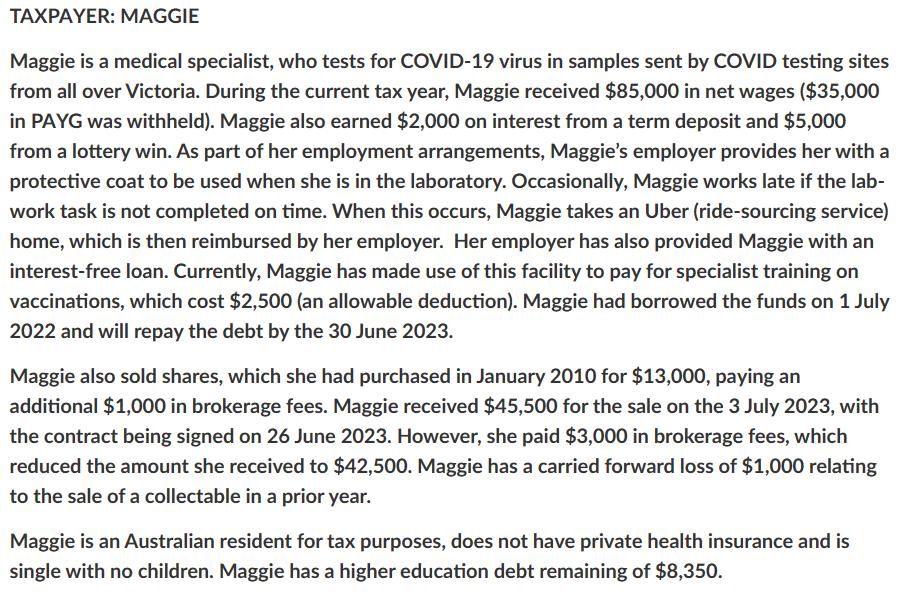

TAXPAYER: MAGGIE Maggie is a medical specialist, who tests for COVID-19 virus in samples sent by COVID testing sites from all over Victoria. During the current tax year, Maggie received $85,000 in net wages ($35,000 in PAYG was withheld). Maggie also earned $2,000 on interest from a term deposit and $5,000 from a lottery win. As part of her employment arrangements, Maggie's employer provides her with a protective coat to be used when she is in the laboratory. Occasionally, Maggie works late if the lab- work task is not completed on time. When this occurs, Maggie takes an Uber (ride-sourcing service) home, which is then reimbursed by her employer. Her employer has also provided Maggie with an interest-free loan. Currently, Maggie has made use of this facility to pay for specialist training on vaccinations, which cost $2,500 (an allowable deduction). Maggie had borrowed the funds on 1 July 2022 and will repay the debt by the 30 June 2023. Maggie also sold shares, which she had purchased in January 2010 for $13,000, paying an additional $1,000 in brokerage fees. Maggie received $45,500 for the sale on the 3 July 2023, with the contract being signed on 26 June 2023. However, she paid $3,000 in brokerage fees, which reduced the amount she received to $42,500. Maggie has a carried forward loss of $1,000 relating to the sale of a collectable in a prior year. Maggie is an Australian resident for tax purposes, does not have private health insurance and is single with no children. Maggie has a higher education debt remaining of $8,350.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Q 1 Identify each fringe benefit provided to Maggie and determine whether an exemption applies a Defensive Coat Periphery Advantage The defensive coat given by Maggies employer Exception This is a wor...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started