Answered step by step

Verified Expert Solution

Question

1 Approved Answer

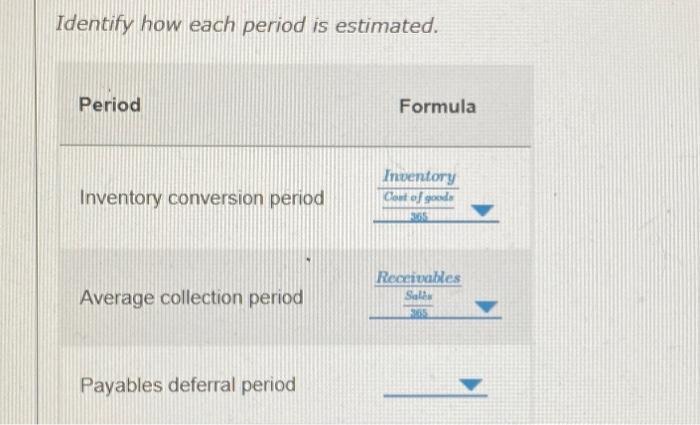

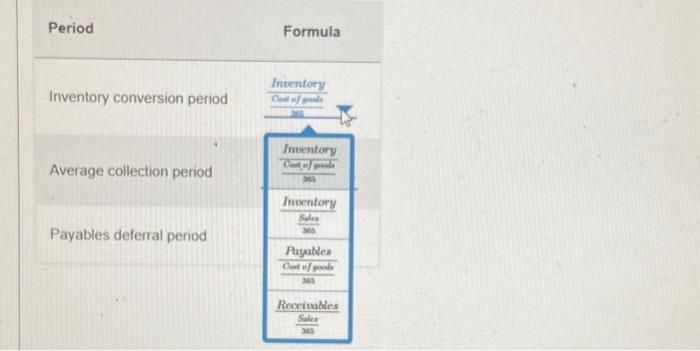

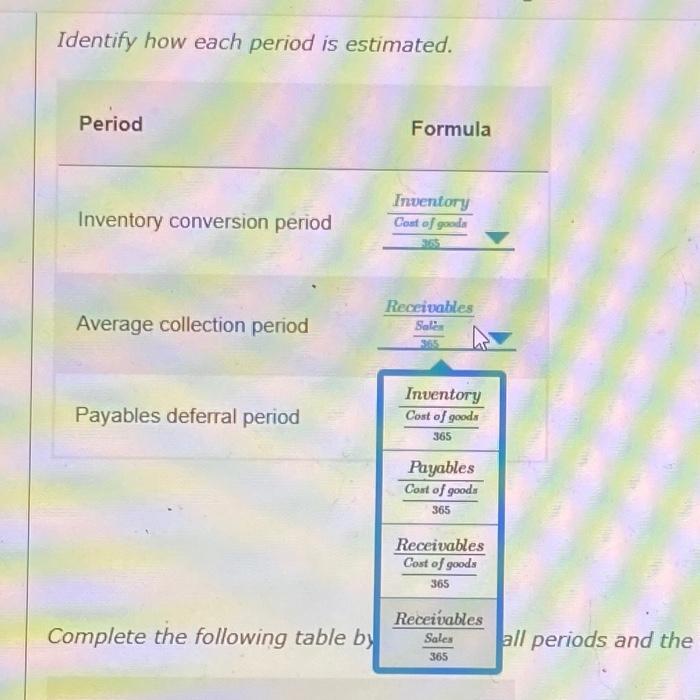

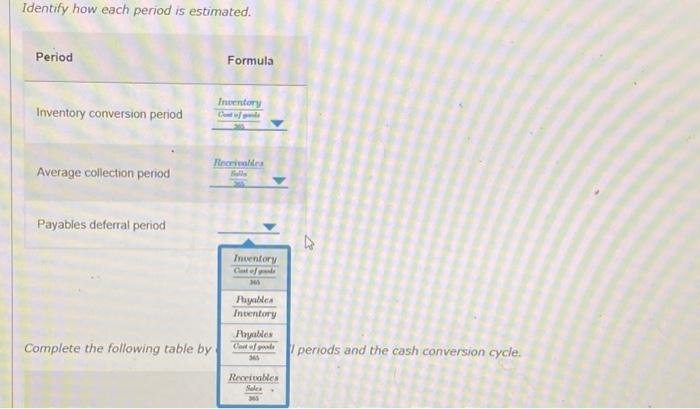

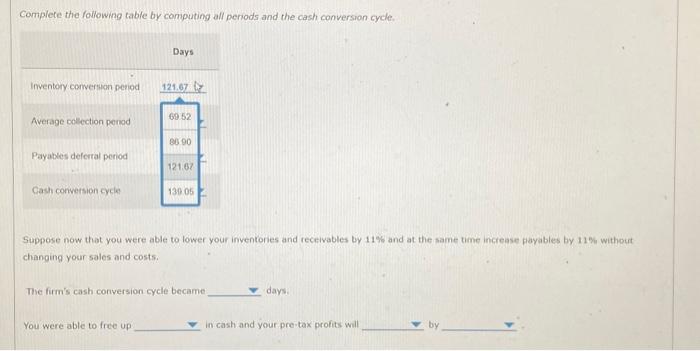

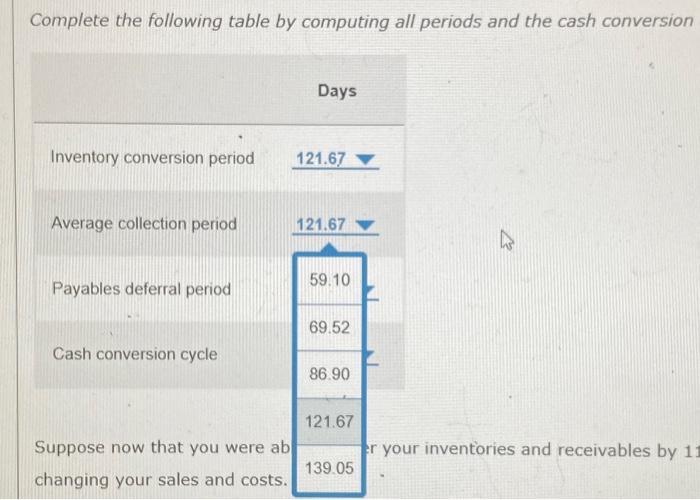

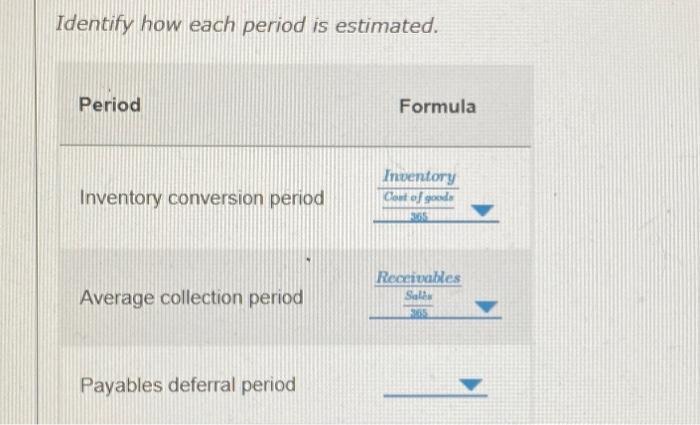

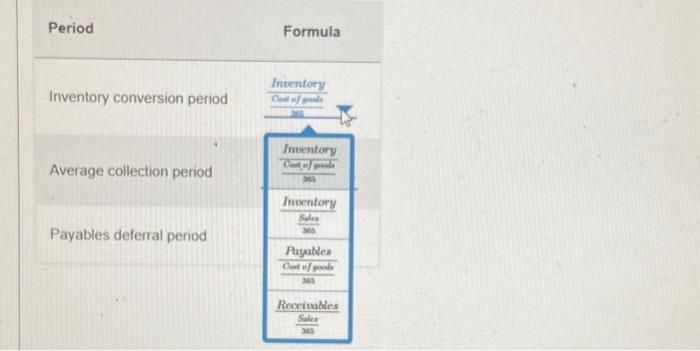

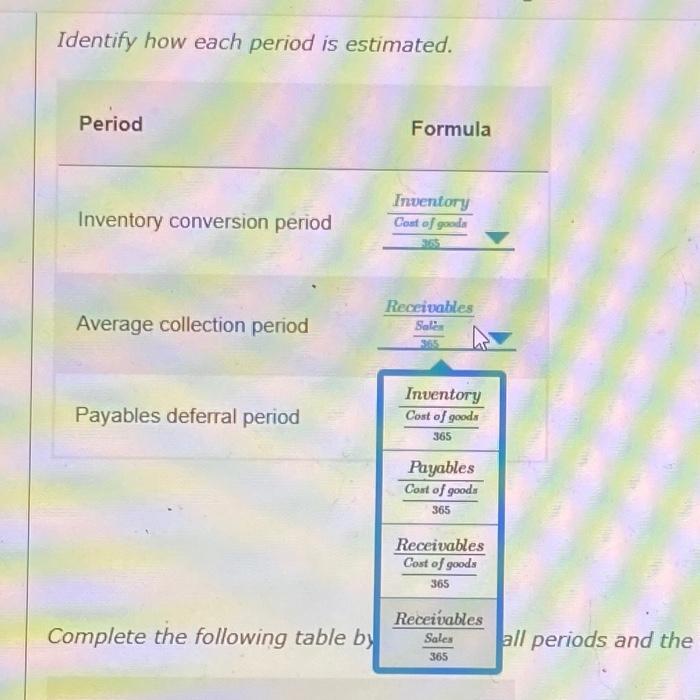

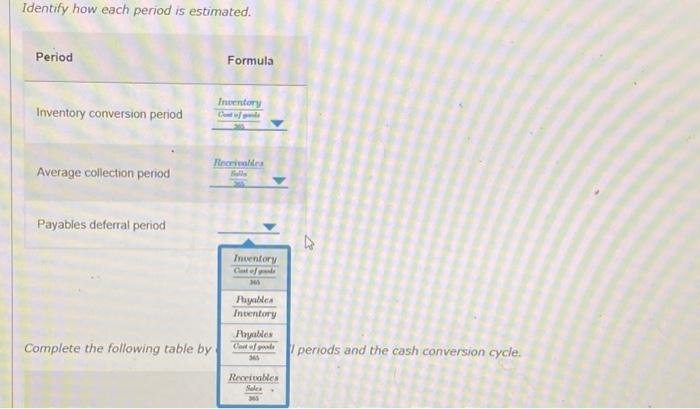

Identify how each period is estimated. iods and the cash conversion cycle. Identify how each period is estimated. Complete the following table by computing all

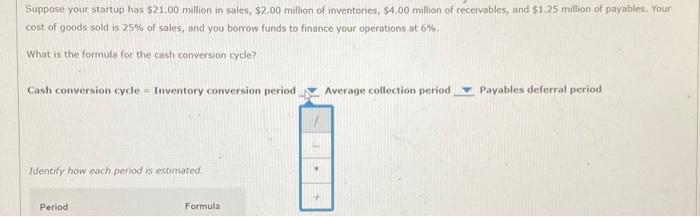

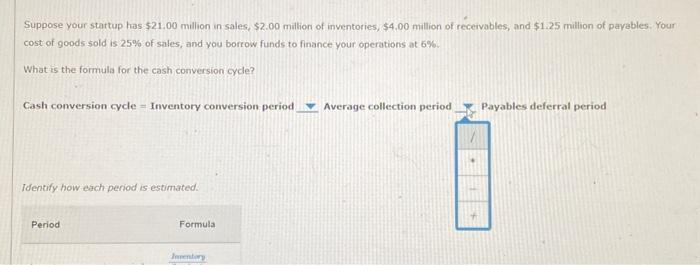

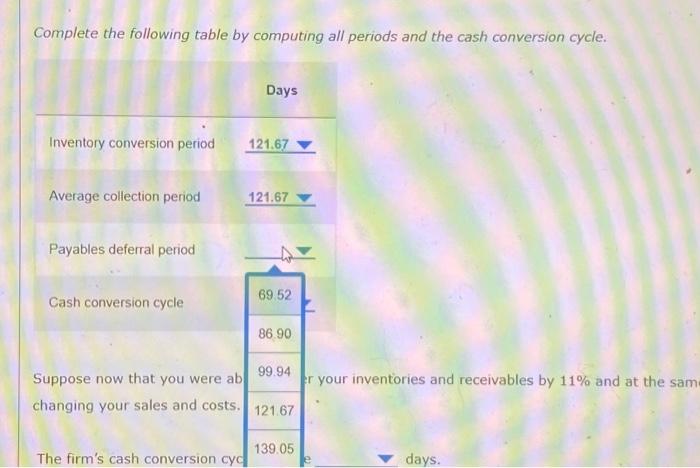

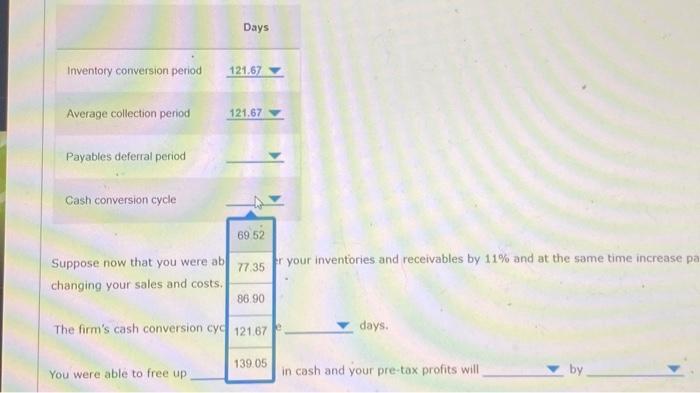

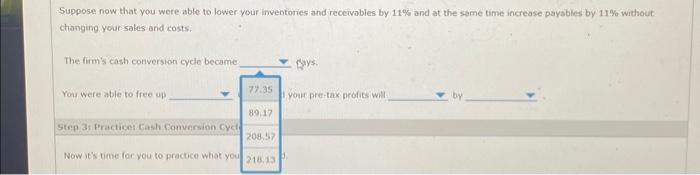

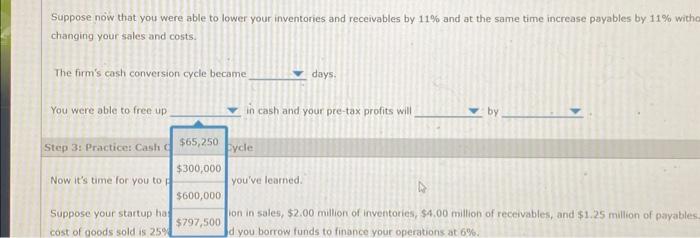

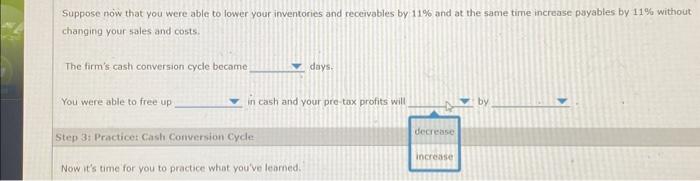

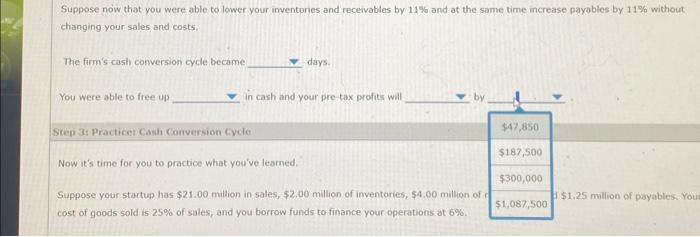

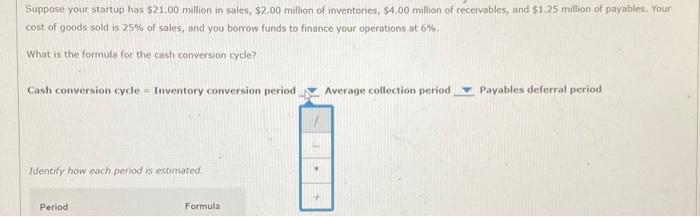

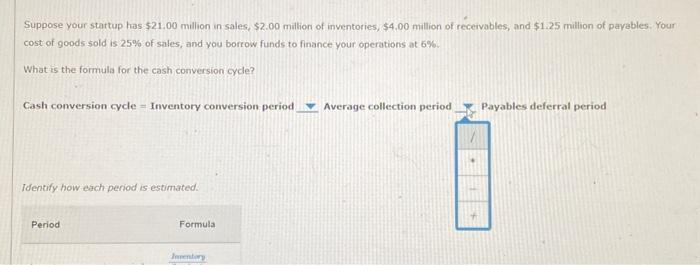

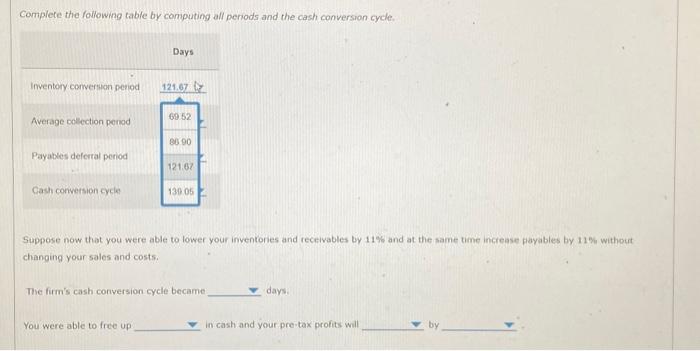

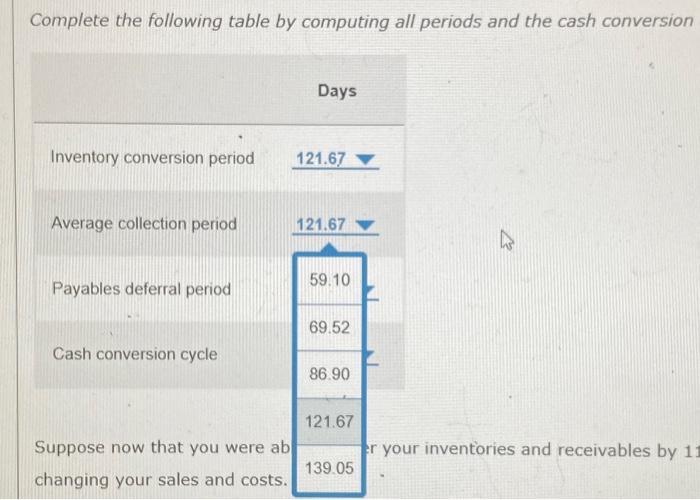

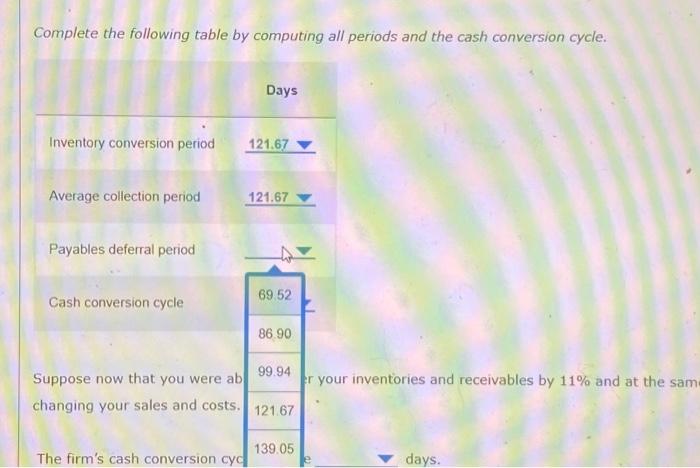

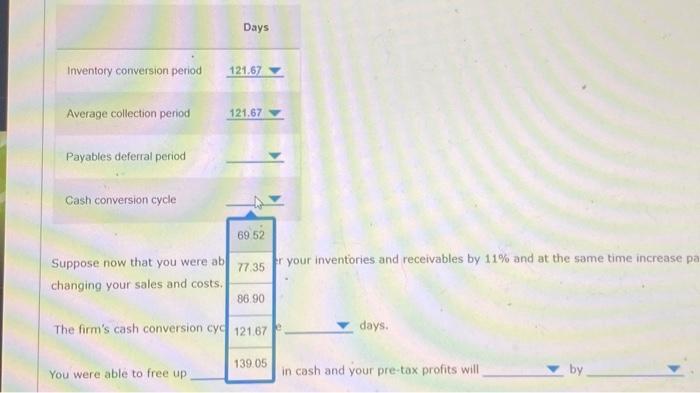

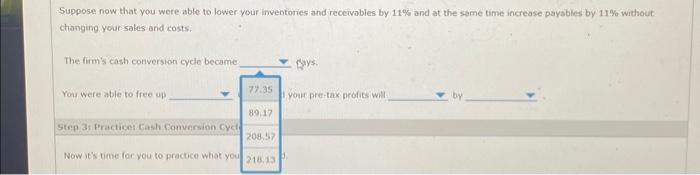

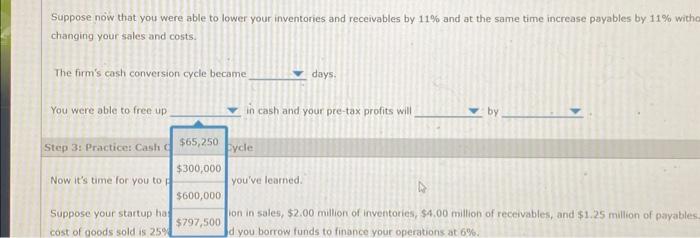

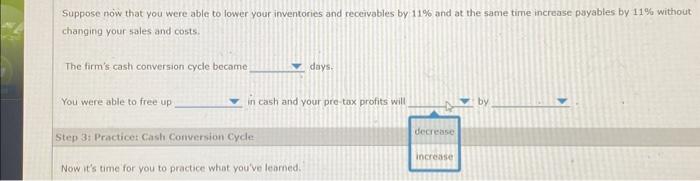

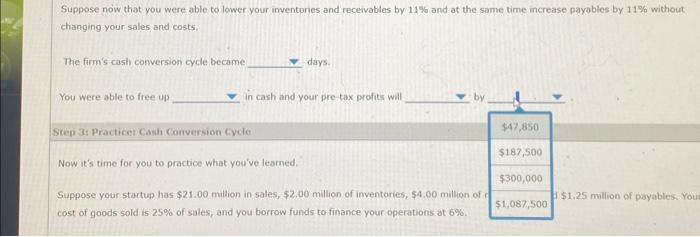

Identify how each period is estimated. iods and the cash conversion cycle. Identify how each period is estimated. Complete the following table by computing all penods and the cash conversion cycle. Suppose now that you were able to lower your inventones and receivables by 11% and at the same time increase payables by 11% without chanoing your sales and costs. The firm's cash conversion cycle became dars. You were able to free up in cash and your pre tax profits will by Complete the following table by computing all periods and the cash conversion Period Formula Days Inventory conversion period 121.67 Average collection period 121,67 Payables deferral period Cash conversion cycle Suppose now that you were ab changing your sales and costs. The firm's cash conversion cyc 121.67 days. You were able to free up 139.05 in cash and your pre-tax profits will by Suppose your startup has $21.00 million in sales, $2.00 million of inventories, $4.00 million of receivables, and $1.25 million of pavables, Your cost of goods sotd is 25% of sates, and you borrow funds to finance your operations at 5%. What is the formula for the cash conversion cycle? Cash conversion cycle = Inventory conversion period Identify how each period is estimated. riods and the Suppose now that you were able to lower your inventories and receivables by 11% and at the same time increase payables by 11% without changing your sales and costs. The firm's cash conversion cycle became days. You were able to free up in cash and your pre-tax profits will by Step 3: Practices Cash Conversion Cycle Now it's time for you to practice what you've learned. Suppose now that you were able to lower your inventories and receivables by 11% and at the same time increase payables by 11% without changing your sales and costs. The firm's cash conversion cycie became You were able to free up your pre-tax profies will Step 3r Practices Casti Comversion Cye Now it's time for vou to practice what you Suppose your startup has $21.00 million in sales, $2.00 miltion of inventories, $4.00 million of receivables, and $1.25 million of payables. Your cost of goods sold is 25% of sales, and you borrow funds to finance your operations at 6%. What is the formula for the cash conversion cycle? Cash conversion cycle = Inventory conversion period. Average collection period_ > Payables deferral period Suppose now that you were able to lower your inventones and receivables by 11% and at the same time increase payables by 11% without changing your sales and costs. The firm's cash conversion cycle became days. You were able to free up in cash and your pre-tax profits will by Complete the following table by computing all periods and the cash conversion cycle. r inventories and receivables by 11% and at the sam Suppose now that you were able to lower your inventories and receivables by 11% and at the same time increase payables by 11% witho changing your sales and costs. The firm's cash conversion cycle became days. You were able to free up in cash and your pre-tax profits will by

Identify how each period is estimated. iods and the cash conversion cycle. Identify how each period is estimated. Complete the following table by computing all penods and the cash conversion cycle. Suppose now that you were able to lower your inventones and receivables by 11% and at the same time increase payables by 11% without chanoing your sales and costs. The firm's cash conversion cycle became dars. You were able to free up in cash and your pre tax profits will by Complete the following table by computing all periods and the cash conversion Period Formula Days Inventory conversion period 121.67 Average collection period 121,67 Payables deferral period Cash conversion cycle Suppose now that you were ab changing your sales and costs. The firm's cash conversion cyc 121.67 days. You were able to free up 139.05 in cash and your pre-tax profits will by Suppose your startup has $21.00 million in sales, $2.00 million of inventories, $4.00 million of receivables, and $1.25 million of pavables, Your cost of goods sotd is 25% of sates, and you borrow funds to finance your operations at 5%. What is the formula for the cash conversion cycle? Cash conversion cycle = Inventory conversion period Identify how each period is estimated. riods and the Suppose now that you were able to lower your inventories and receivables by 11% and at the same time increase payables by 11% without changing your sales and costs. The firm's cash conversion cycle became days. You were able to free up in cash and your pre-tax profits will by Step 3: Practices Cash Conversion Cycle Now it's time for you to practice what you've learned. Suppose now that you were able to lower your inventories and receivables by 11% and at the same time increase payables by 11% without changing your sales and costs. The firm's cash conversion cycie became You were able to free up your pre-tax profies will Step 3r Practices Casti Comversion Cye Now it's time for vou to practice what you Suppose your startup has $21.00 million in sales, $2.00 miltion of inventories, $4.00 million of receivables, and $1.25 million of payables. Your cost of goods sold is 25% of sales, and you borrow funds to finance your operations at 6%. What is the formula for the cash conversion cycle? Cash conversion cycle = Inventory conversion period. Average collection period_ > Payables deferral period Suppose now that you were able to lower your inventones and receivables by 11% and at the same time increase payables by 11% without changing your sales and costs. The firm's cash conversion cycle became days. You were able to free up in cash and your pre-tax profits will by Complete the following table by computing all periods and the cash conversion cycle. r inventories and receivables by 11% and at the sam Suppose now that you were able to lower your inventories and receivables by 11% and at the same time increase payables by 11% witho changing your sales and costs. The firm's cash conversion cycle became days. You were able to free up in cash and your pre-tax profits will by

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started