Question

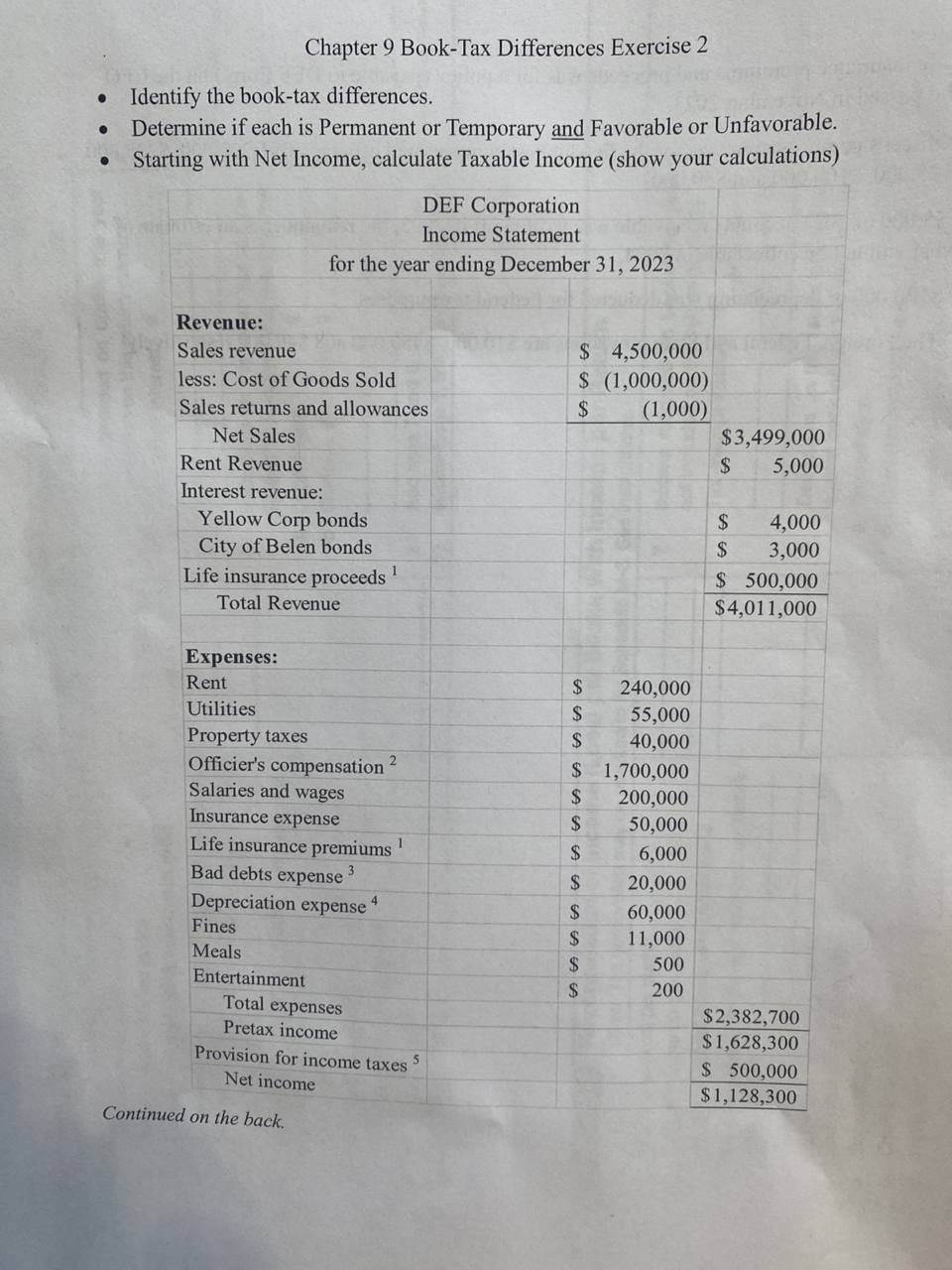

Identify the book-tax differences. Determine if each is permanent or temporary and favorable or unfavorable. Starting with net income, calculate taxable income (show your calculations)

Identify the book-tax differences.

Determine if each is permanent or temporary and favorable or unfavorable.

Starting with net income, calculate taxable income (show your calculations)

DEF Corporation

Income Statement

For the year ending December 31, 2023

Revenue:

Sales revenue $ 4,500,000

Less: Cost of Goods Sold $ (1,000,000)

Sales returns and allowances $ (1000)

Net Sales $ 3,499,000

Rent Revenue $ 5,000

Interest revenue:

Yellow Corp bonds $ 4,000

City of Belen bonds $ 3,000

Life insurance proceeds $ 500,000

Total Revenue $ 4,011,000

Expenses:

Rent $ 240,000

Utilities $ 55,000

Property taxes $ 40,000

Officers compensation $ 1,700,000

Salaries and wages $ 200,000

Insurance expense $ 50,000

Life insurance premiums $ 6,000

Bad debts expense $ 20,000

Depreciation expense $ 60,000

Fines $ 11,000

Meals $ 500

Entertainment $ 200

Total expenses $ 2,382,700

Pretax income $ 1,628,300

Provision for income taxes $ 500,000

Net income $ 1,128,300

1-Life insurance premiums and proceeds were for a policy (payable to DEF Corp) on the CFO who passed in November 2023

2-Officers compensation was for the five highest compensated officers of $1,200,000, $225,000, $125,000, $100,000, and $50,000. 3-$5,000 of 2023 accounts receivable was written off in 2023, the remainder is an estimate of what will not be collectible in 2024. 4-$100,000 of depreciation was deducted for federal tax purposes. 5-the foreign, federal and state provisions are $10,000, $450,000 and $40,000 respectively

Chapter 9 Book-Tax Differences Exercise 2 - Identify the book-tax differences. - Determine if each is Permanent or Temporary and Favorable or Unfavorable. - Starting with Net Income, calculate Taxable Income (show your calculations)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started