Question

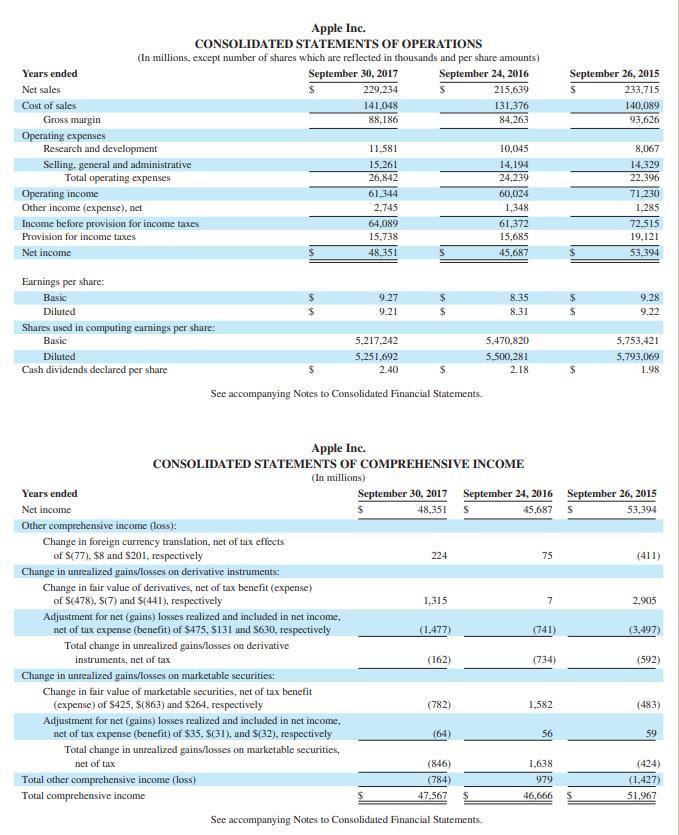

Manufacturers and merchandisers can apply just-in-time (JIT) to their inventory management. Apple wants to know the impact of a JIT inventory system on operating cash

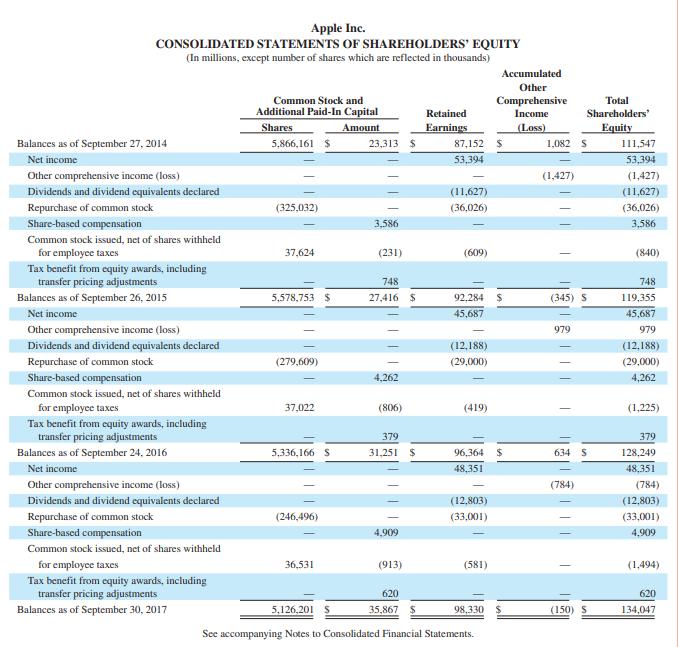

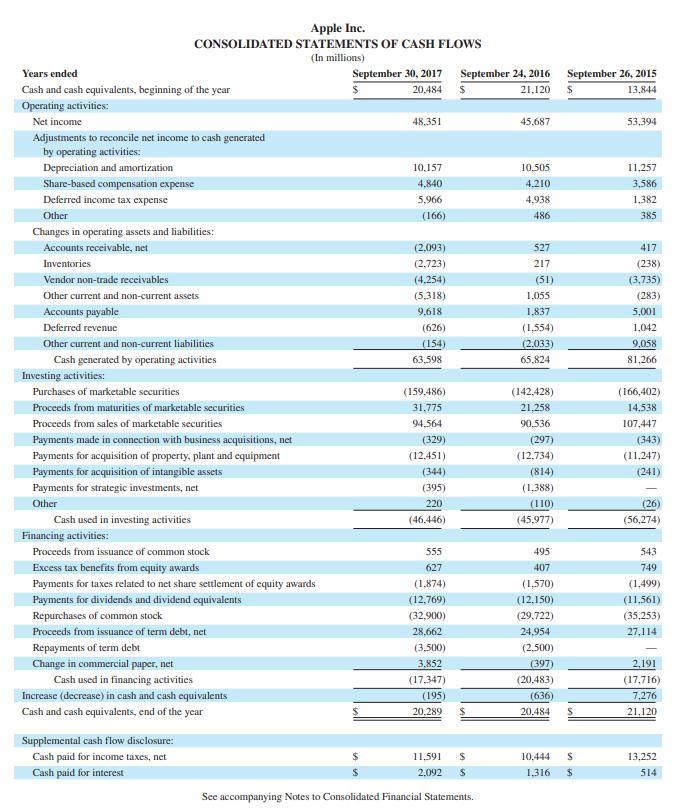

Manufacturers and merchandisers can apply just-in-time (JIT) to their inventory management. Apple wants to know the impact of a JIT inventory system on operating cash flows. Review Apple’s statement of cash flows in Appendix A to answer the following.

Required

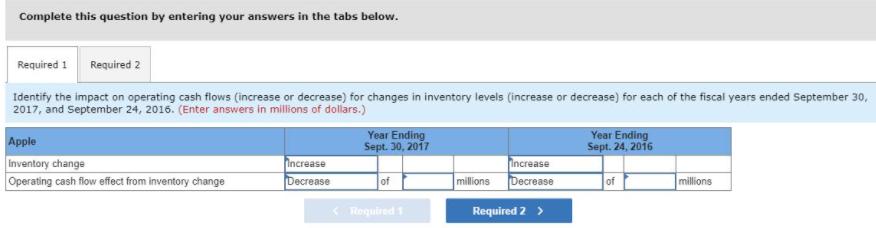

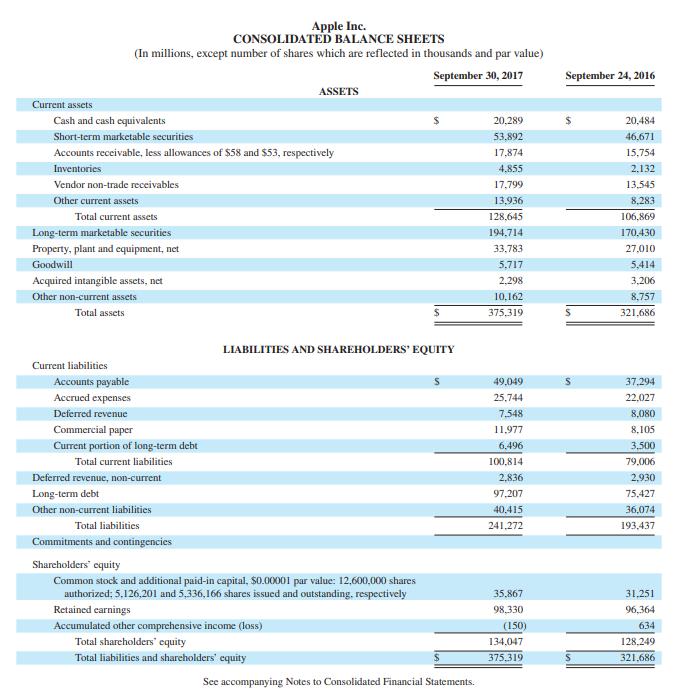

1. Identify the impact on operating cash flows (increase or decrease) for changes in inventory levels (increase or decrease) for each of the fiscal years ended September 30, 2017, and September 24, 2016.

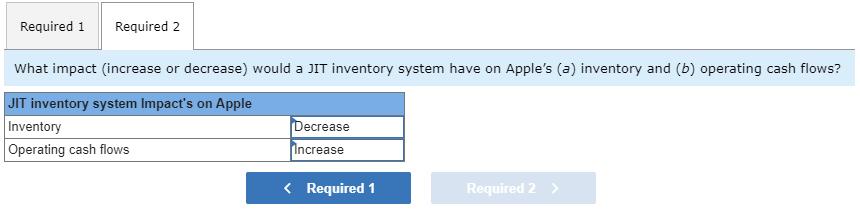

2. What impact (increase or decrease) would a JIT inventory system have on Apple’s (a) inventory and (b) operating cash flows?

Complete this question by entering your answers in the tabs below. Required 1 Required 2 Identify the impact on operating cash flows (increase or decrease) for changes in inventory levels (increase or decrease) for each of the fiscal years ended September 30, 2017, and September 24, 2016. (Enter answers in millions of dollars.) Year Ending Sept. 30, 2017 Year Ending Sept. 24, 2016 Apple inventory change Operating cash flow effect from inventory change increase Decrease Increase Decrease of millions of millions Roquired1 Required 2 >

Step by Step Solution

3.43 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Answer to Question no1 Impact on Operating Cash flow with t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started