Answered step by step

Verified Expert Solution

Question

1 Approved Answer

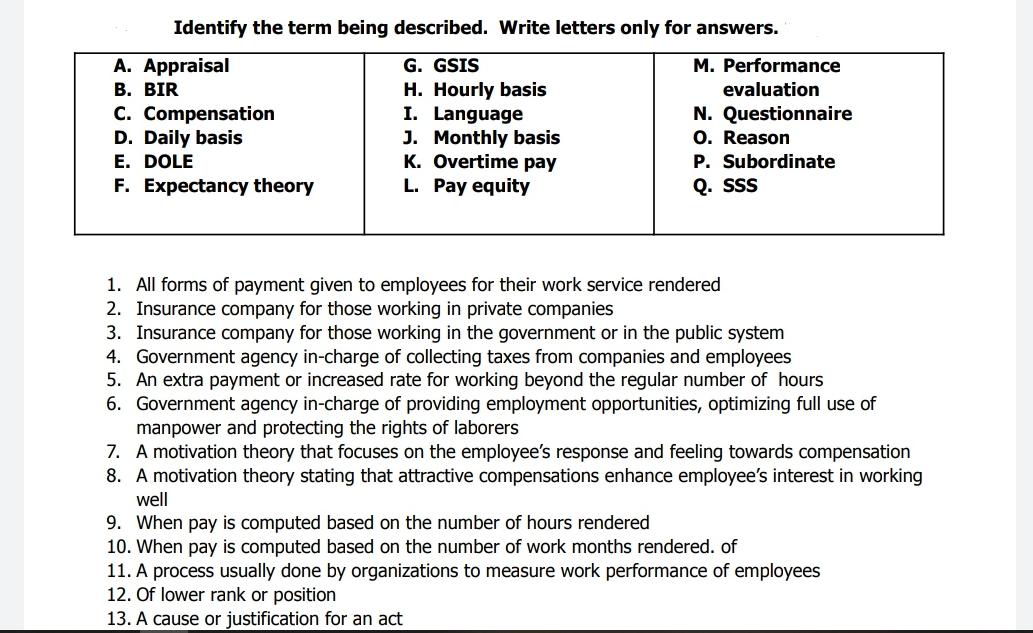

Identify the term being described. Write letters only for answers. G. GSIS H. Hourly basis I. Language J. Monthly basis K. Overtime pay L.

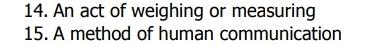

Identify the term being described. Write letters only for answers. G. GSIS H. Hourly basis I. Language J. Monthly basis K. Overtime pay L. Pay equity A. Appraisal B. BIR C. Compensation D. Daily basis E. DOLE F. Expectancy theory M. Performance evaluation N. Questionnaire O. Reason P. Subordinate Q. SSS 1. All forms of payment given to employees for their work service rendered 2. Insurance company for those working in private companies 3. Insurance company for those working in the government or in the public system 4. Government agency in-charge of collecting taxes from companies and employees 5. An extra payment or increased rate for working beyond the regular number of hours 6. Government agency in-charge of providing employment opportunities, optimizing full use of manpower and protecting the rights of laborers 7. A motivation theory that focuses on the employee's response and feeling towards compensation 8. A motivation theory stating that attractive compensations enhance employee's interest in working well 9. When pay is computed based on the number of hours rendered 10. When pay is computed based on the number of work months rendered. of 11. A process usually done by organizations to measure work performance of employees 12. Of lower rank or position 13. A cause or justification for an act 14. An act of weighing or measuring 15. A method of human communication

Step by Step Solution

★★★★★

3.31 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Based on the descriptions provided and the corresponding terms in the list here are the answers 1 Al...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started