Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Identify two potential provisions of the Tax Act that could apply to effect the overall amount of tax payable on the income of LizEng Pty

Identify two potential provisions of the Tax Act that could apply to effect the overall amount of tax payable on the income of LizEng Pty Ltd and explain how these provisions would apply.

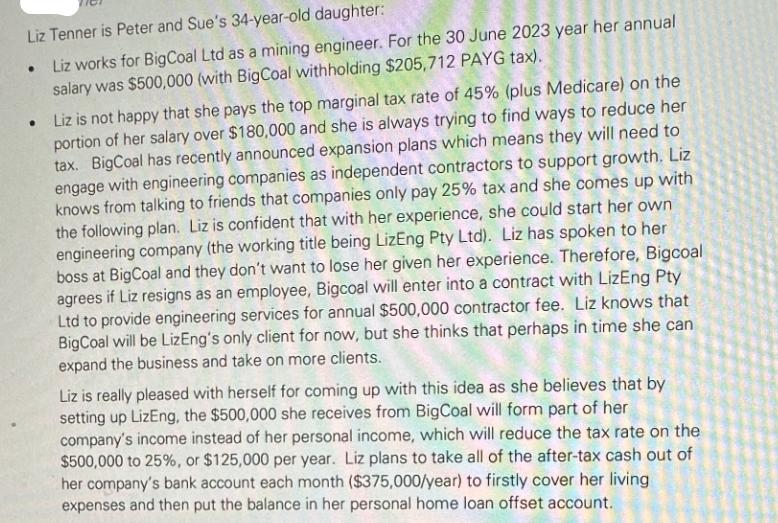

Identify two potential provisions of the Tax Act that could apply to effect the overall amount of tax payable on the income of LizEng Pty Ltd and explain how these provisions would apply. Liz Tenner is Peter and Sue's 34-year-old daughter: Liz works for BigCoal Ltd as a mining engineer. For the 30 June 2023 year her annual salary was $500,000 (with BigCoal withholding $205,712 PAYG tax). Liz is not happy that she pays the top marginal tax rate of 45% (plus Medicare) on the portion of her salary over $180,000 and she is always trying to find ways to reduce her tax. BigCoal has recently announced expansion plans which means they will need to engage with engineering companies as independent contractors to support growth. Liz knows from talking to friends that companies only pay 25% tax and she comes up with the following plan. Liz is confident that with her experience, she could start her own engineering company (the working title being LizEng Pty Ltd). Liz has spoken to her boss at BigCoal and they don't want to lose her given her experience. Therefore, Bigcoal agrees if Liz resigns as an employee, Bigcoal will enter into a contract with LizEng Pty Ltd to provide engineering services for annual $500,000 contractor fee. Liz knows that BigCoal will be LizEng's only client for now, but she thinks that perhaps in time she can expand the business and take on more clients. Liz is really pleased with herself for coming up with this idea as she believes that by setting up LizEng, the $500,000 she receives from BigCoal will form part of her company's income instead of her personal income, which will reduce the tax rate on the $500,000 to 25%, or $125,000 per year. Liz plans to take all of the after-tax cash out of her company's bank account each month ($375,000/year) to firstly cover her living expenses and then put the balance in her personal home loan offset account.

Step by Step Solution

★★★★★

3.42 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

1 Personal Services Income PSI Rules The PSI rules in the Tax Act are designed to prevent individuals from diverting their income through a company to take advantage of lower corporate tax rates LizEng Pty Ltds income from BigCoal could be subject to PSI rules if Liz is the main person providing the services and if LizEng Pty Ltd does not pass certain tests demonstrating genuine independence If the PSI rules apply LizEng Pty Ltd may be required to attribute the income back to Liz personally resulting in her being taxed at the individual ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started