Answered step by step

Verified Expert Solution

Question

1 Approved Answer

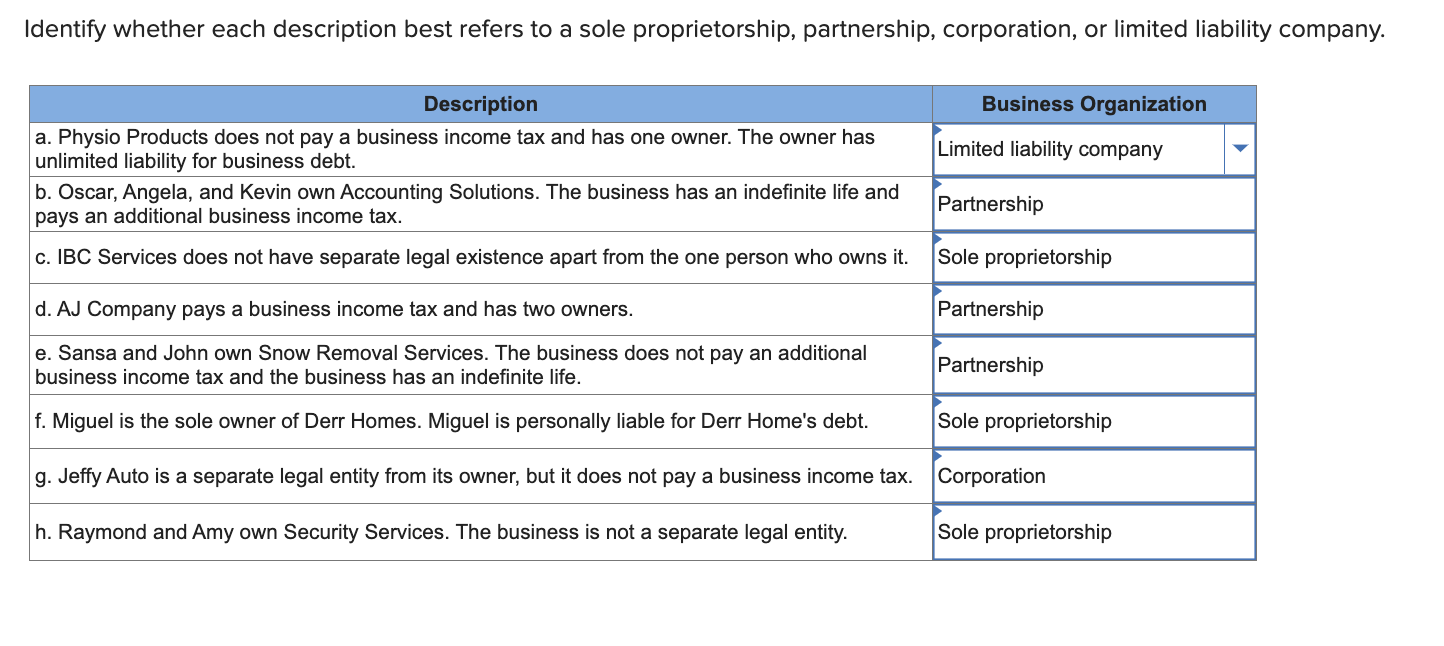

Identify whether each description best refers to a sole proprietorship, partnership, corporation, or limited liability company. begin{tabular}{|l|l|l|} hline multicolumn{1}{|c|}{ Description } & multicolumn{1}{|c|}{ Business Organization

Identify whether each description best refers to a sole proprietorship, partnership, corporation, or limited liability company. \begin{tabular}{|l|l|l|} \hline \multicolumn{1}{|c|}{ Description } & \multicolumn{1}{|c|}{ Business Organization } \\ \hline a.PhysioProductsdoesnotpayabusinessincometaxandhasoneowner.Theownerhasunlimitedliabilityforbusinessdebt. & Limited liability company \\ \hline b.Oscar,Angela,andKevinownAccountingSolutions.Thebusinesshasanindefinitelifeandpaysanadditionalbusinessincometax. & Partnership \\ \hline c. IBC Services does not have separate legal existence apart from the one person who owns it. & Sole proprietorship \\ \hline d. AJ Company pays a business income tax and has two owners. & Partnership \\ \hline e.SansaandJohnownSnowRemovalServices.Thebusinessdoesnotpayanadditionalbusinessincometaxandthebusinesshasanindefinitelife. & Partnership \\ \hline f. Miguel is the sole owner of Derr Homes. Miguel is personally liable for Derr Home's debt. & Sole proprietorship \\ \hline g. Jeffy Auto is a separate legal entity from its owner, but it does not pay a business income tax. & Corporation \\ \hline h. Raymond and Amy own Security Services. The business is not a separate legal entity. & Sole proprietorship \\ \hline \end{tabular}

Identify whether each description best refers to a sole proprietorship, partnership, corporation, or limited liability company. \begin{tabular}{|l|l|l|} \hline \multicolumn{1}{|c|}{ Description } & \multicolumn{1}{|c|}{ Business Organization } \\ \hline a.PhysioProductsdoesnotpayabusinessincometaxandhasoneowner.Theownerhasunlimitedliabilityforbusinessdebt. & Limited liability company \\ \hline b.Oscar,Angela,andKevinownAccountingSolutions.Thebusinesshasanindefinitelifeandpaysanadditionalbusinessincometax. & Partnership \\ \hline c. IBC Services does not have separate legal existence apart from the one person who owns it. & Sole proprietorship \\ \hline d. AJ Company pays a business income tax and has two owners. & Partnership \\ \hline e.SansaandJohnownSnowRemovalServices.Thebusinessdoesnotpayanadditionalbusinessincometaxandthebusinesshasanindefinitelife. & Partnership \\ \hline f. Miguel is the sole owner of Derr Homes. Miguel is personally liable for Derr Home's debt. & Sole proprietorship \\ \hline g. Jeffy Auto is a separate legal entity from its owner, but it does not pay a business income tax. & Corporation \\ \hline h. Raymond and Amy own Security Services. The business is not a separate legal entity. & Sole proprietorship \\ \hline \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started