Answered step by step

Verified Expert Solution

Question

1 Approved Answer

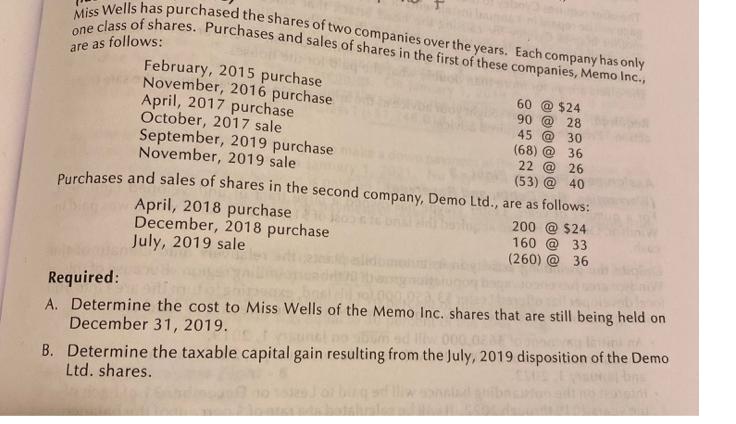

Miss Wells has purchased the shares of two companies over the years. Each company has only one class of shares. Purchases and sales of

Miss Wells has purchased the shares of two companies over the years. Each company has only one class of shares. Purchases and sales of shares in the first of these companies, Memo Inc., are as follows: February, 2015 purchase November, 2016 purchase April, 2017 purchase October, 2017 sale September, 2019 purchase November, 2019 sale 60 @ $24 90 @ 28 45 @ 30 (68) @ 36 22 @ 26 (53) @ 40 Purchases and sales of shares in the second company, Demo Ltd., are as follows: April, 2018 purchase December, 2018 purchase July, 2019 sale $24 160 @ (260) @ 36 200 33 Required: A. Determine the cost to Miss Wells of the Memo Inc. shares that are still being held on December 31, 2019. B. Determine the taxable capital gain resulting from the July, 2019 disposition of the Demo Ltd. shares.

Step by Step Solution

★★★★★

3.47 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

A answers Note calculating the cost on the basis of average cost basis Formula a...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started